[ad_1]

Donald Trump clinched the presidential nomination in November, creating a frenzy of bitcoin price predictions that range from a modest $130,000 to a mind-bending $49 million per coin.

Top Minds Predict Bitcoin’s Price Trajectory

A black swan event is an occurrence so rare and unpredictable that no one sees it coming, yet its impact is far-reaching and profound.

The election of a pro-bitcoin U.S. president – a man who just three years ago called the dominant cryptocurrency a “scam” – would fit neatly into the black swan category.

Add to that scene the historic January spot bitcoin exchange-traded fund (ETF) approvals and the April halving event, and the result is a perfect storm that gives rise to one of the strongest crypto bull markets, with bitcoin (BTC) topping $108,135 on December 17, according to data from Coingecko.

Donald Trump’s landslide victory on November 5 in particular, has spawned all manner of bitcoin (BTC) price predictions for various reasons, resulting in 2025 price forecasts as low as $130,000 all the way to $49 million per bitcoin by 2045.

The Pragmatists

Bitcoin peaked at approximately $44,000 in 2023 before skyrocketing to just over $108,000 earlier this month – a 145% increase in price.

If 2025 produces similar returns, we should expect a price of roughly $265,000. Thus, predictions lower than that benchmark could be seen as more conservative estimates.

Bitwise: Digital asset manager Bitwise, predicted that BTC will trade “above $200,000” in 2025, and four years later in 2029, it “will overtake the $18 trillion gold market and trade above $1 million per bitcoin.”

However, the firm added a caveat that could push the 2025 prediction all the way past half a million.

“If the U.S. government follows through on proposals to establish a one million bitcoin strategic reserve, $200,000 becomes $500,000 or more,” Bitwise stated.

The company explained that record ETF inflows, the bitcoin halving (which reduced supply), and increased institutional and government demand were the primary factors behind its predictions.

Vaneck: Fellow asset manager Vaneck provided a more modest prediction, capping its estimate at $180,000 within the first quarter of 2025, coupled with a $54,000 dip afterward.

“At the cycle’s apex, we project bitcoin to be valued at around $180,000,” the firm said. “Following this first peak, we anticipate a 30% retracement in BTC,” the company added.

Much like Bitwise, Matthew Sigel, Vaneck’s head of digital assets research, pointed out that his team has a model that incorporates a strategic bitcoin reserve scenario and generates a much higher price as a result – $3 million by 2050.

“We have a model that assumes that by 2050…bitcoin becomes a reserve asset that’s used in global trade and held by global central banks at a very modest 2% weight,” Sigel said. “In that model, we arrive at a $3 million price target for bitcoin.”

Bernstein: Gautam Chhugani, a senior analyst at brokerage firm Bernstein, predicted a $200,000 bitcoin price in June, and doubled down on that prediction in November.

“We are entering a stage, where we expect intrigue will turn to pain for the bitcoin bears,” Chhugani and his team wrote in a note to clients. “Bitcoin to $100,000 seems around the corner and our $200,000 bitcoin target [by the end of] 2025 now looks not as delusional,” the team said.

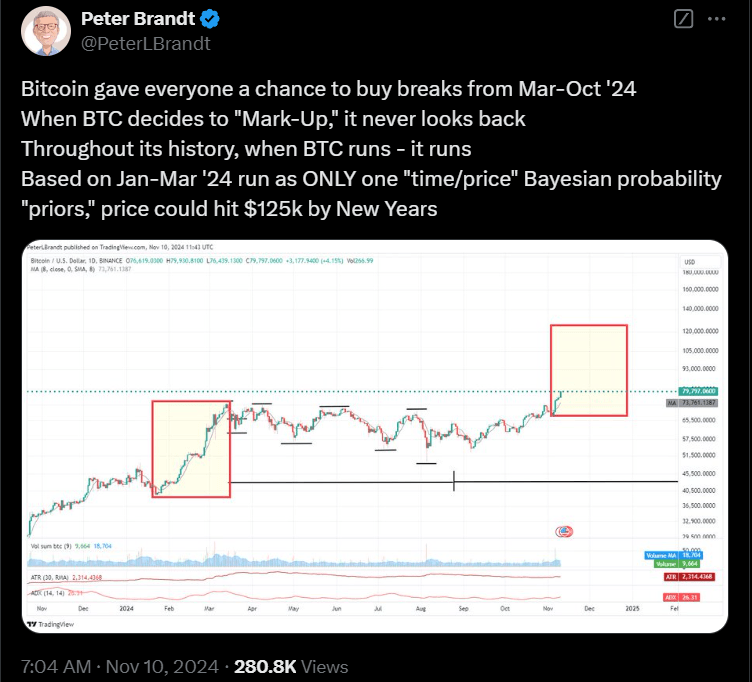

Peter Brandt: Back in February, ever-popular chart trader Peter Brandt, whose X account has well over 750,000 followers, predicted a $200,000 bitcoin price by August or September 2025.

Brandt primarily relies on charting and technical analysis for his predictions – scouring market data to suss out trends and patterns.

Soon after the U.S. presidential election, Brandt downgraded that estimate to “between $130,000 and $150,000” for the August to September 2025 period, but also projected a $125,000 bitcoin by January 1, 2025.

(Bitcoin price technical analysis/Peter Brandt)

“Based on January to March 2024 run, as only one ‘time/price’ Bayesian probability ‘priors,’ price could hit $125,000 by New Year’s,” Brandt posted on Twitter.

In other words, he based his 2025 New Year’s projection on bitcoin’s prior rally in the spring.

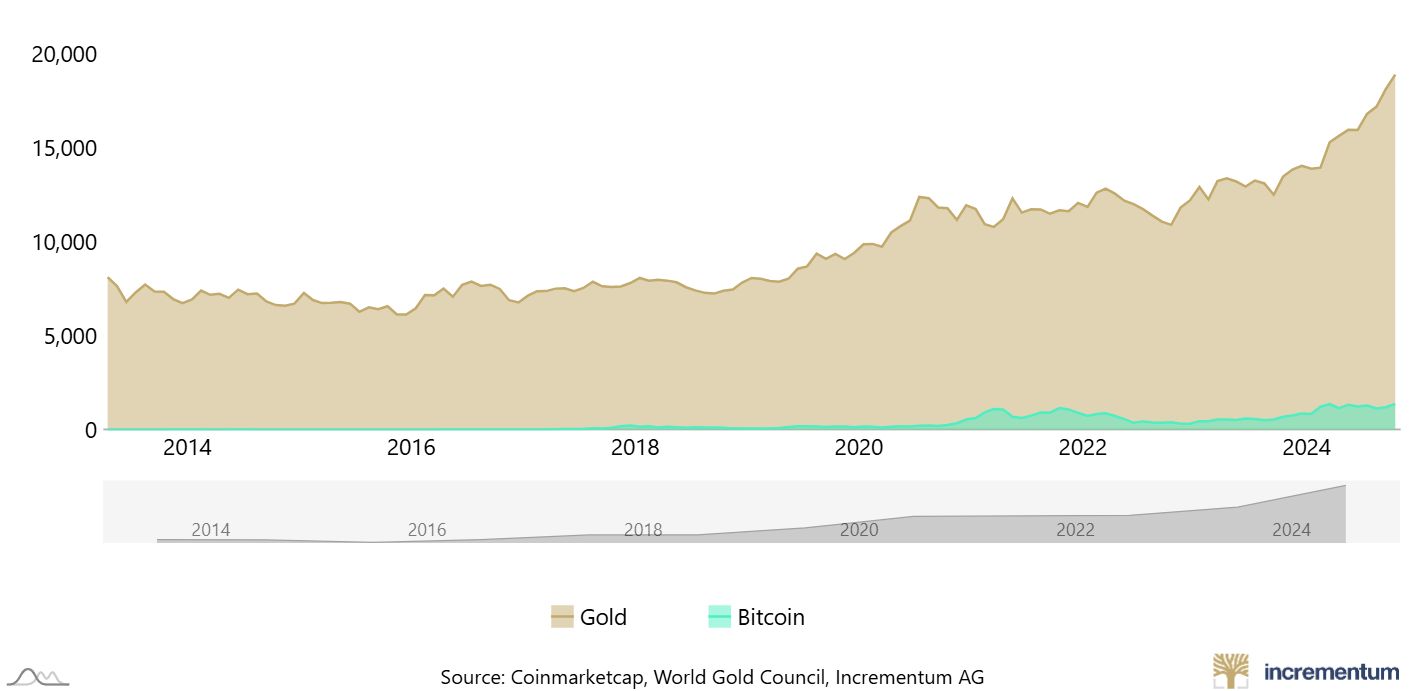

Nic Carter: During a Bloomberg Crypto interview, Castle Island Ventures General Partner Nic Carter declined to give a short-term BTC price target but projected a long-term price of $900,000 assuming bitcoin matches the market capitalization of gold.

(Gold vs bitcoin market capitalization/Incrementum)

Bitcoin and gold had market capitalizations of roughly $2 trillion and $18 trillion respectively at the time of reporting.

“Long-term, I’m looking for bitcoin to match the market cap for gold, which would price bitcoin at $900,000 a coin,” Carter said.

Fidelity Investments: Like Carter, Jurrien Timmer, Fidelity Investments’ global head of macro, didn’t publicly share a price prediction, but posted an interesting chart on X, showing a bitcoin power law curve that appears to suggest a $1 million BTC price by 2035. A power law is a specific type of relationship between two variables.

(Bitcoin power law curve/Jurrien Timmer)

“If the power law of bitcoin’s expanding network (amplified by real rates and the money supply) is the best way to value this most intriguing asset, then bitcoin sits squarely in its fair value range,” Timmer said.

Timmer was once mistakenly quoted as having predicted a $1 billion bitcoin price by 2038.

Tommy Lee: Co-founder of investment research firm Fundstrat, Tommy Lee, had previously predicted a $150,000 BTC price for 2025. Lee recently upped that projection to $250,000 during a podcast episode with Anthony Scaramucci, founder of asset management firm Skybridge Capital.

“Over the next 12 months, I believe something in the range of $250,000 is possible, perhaps even highly probable, based on the current price cycle,” Lee said.

He explained that his estimate was based on the Bitcoin halving in April, but now with a pro-crypto administration waiting in the wings, that number could go even higher.

“Because the new administration has run on a pro-bitcoin platform, I think that the possibility of the U.S. not only legitimizing bitcoin but making it a strategic reserve asset raises…the possible price scenarios for bitcoin,” Lee explained.

The Moonshots

Futurist Peter Diamandis – who ironically just predicted a $300,000 BTC price – defines a moonshot as “going 10x bigger or better when everyone else is pursuing incremental change.”

Moonshot predictions are more bullish estimates that exceed the previously referenced $265,000 threshold.

Michael Saylor: Beloved Bitcoin proponent Michael Saylor, chairman of Microstrategy, the world’s largest corporate holder of bitcoin, predicted a $13 million BTC price by 2045 during his keynote speech at the July Bitcoin Conference in Nashville, Tennessee.

Saylor recently explained his rationale for that long-term estimate on the popular Impact Theory podcast.

“I gave that forecast in Nashville in July of this year and it’s based upon the Bitcoin 24 model,” Saylor said. “The Bitcoin 24 model is an open-source macro model of Bitcoin adoption and macroeconomic development over the next 21 years.”

In a nutshell, the model assumes a 60% growth rate in price with a 20% deceleration across 21 years, yielding an average annual rate of return (ARR) of 29%, which over 21 years results in a price of roughly $13 million per coin.

To be clear, the $13 million price tag is a base case scenario. A more conservative bear market scenario results in a much lower $3 million estimate, while a bull market scenario would project a staggering $49 million BTC price.

(Bitcoin 24 Model/Michael Saylor)

The 59-year-old billionaire said the model is available on Github and can be downloaded and manipulated by anyone.

Robert Kiyosaki: Rich Dad Poor Dad author and businessman Robert Kiyosaki endorsed Saylor’s $13 million projection and has thrown out predictions of his own, citing the possibility of AI to decimate fiat currency systems, as signaled by lawyer Jim Rickard in his book “Money GPT.”

“It’s frightening because AI is going to shake up the world of money,” Kiyosaki posted on X in September. “The good news is, Jim Rickard’s prediction means bitcoin may soon top $500,000 in 2025 and $1 Million by 2030.”

He repeated that same prediction in late November after Trump’s election.

Samson Mow: CEO of JAN3, Samson Mow, is no stranger to seven-figure bitcoin price predictions. His firm focuses on nation-state bitcoin adoption, an activity that likely shapes his grander estimates.

Mow predicted a $1 million bitcoin price target before and after the U.S. presidential election, most recently during a November podcast episode.

“This is the premise behind the $1 million bitcoin call,” Mow said. “It’s not going to be a gradual slow increase to $1 million a coin, but rather, a very short and violent upheaval that sends us there in a matter of weeks to months.”

Like Kiyosaki, Mow cites the eventual failure of fiat systems as the final catalyst for a meteoric rise in the price of bitcoin.

“If you look at the failure of fiat currencies, they don’t gradually fail, they fail spectacularly,” Mow said.

He has previously described a concept called “dollar-sat parity” where one satoshi or “sat” – one hundred millionth of a bitcoin and the smallest unit of the cryptocurrency – will be worth one dollar, meaning a single bitcoin will be worth $100 million.

“Let’s just say we have dollar-sat parity,” Mow said on another podcast. “Then the market cap of Bitcoin will be $2.1 quadrillion dollars.”

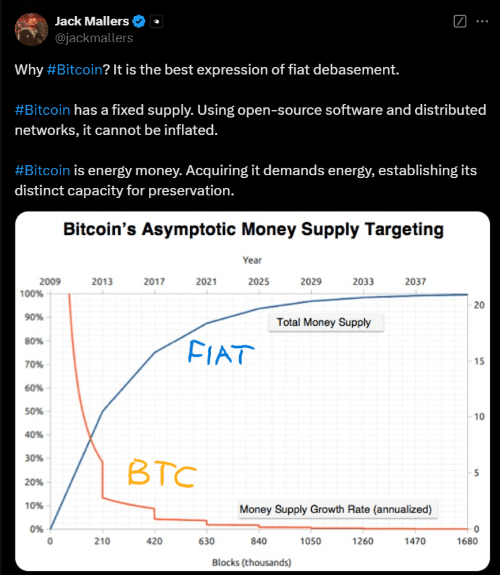

Jack Mallers: Strike CEO Jack Mallers reiterated his “$250,000 to $1 million” 2026 bitcoin price prediction during a podcast interview with Anthony Scaramucci.

“I think we’re going to see one of the greatest asset bubbles in human history,” Mallers said. “Domestic debt-to-GDP close to 130%, global debt-to-GDP well over 300%, and so there’s a loss that has to be realized and the question is where are we going to realize that loss.”

Ultimately, Mallers believes governments will simply print more money to pay off their debts, triggering inflation and currency debasement. Bitcoin unlike fiat will be the only global currency that will retain its value.

(BTC vs fiat debasement/Jack Mallers)

“If America comes out and buys four million bitcoin, I think bitcoin ticks a million easily,” Mallers said. “If not…well then $250,000 seems decently reasonable.”

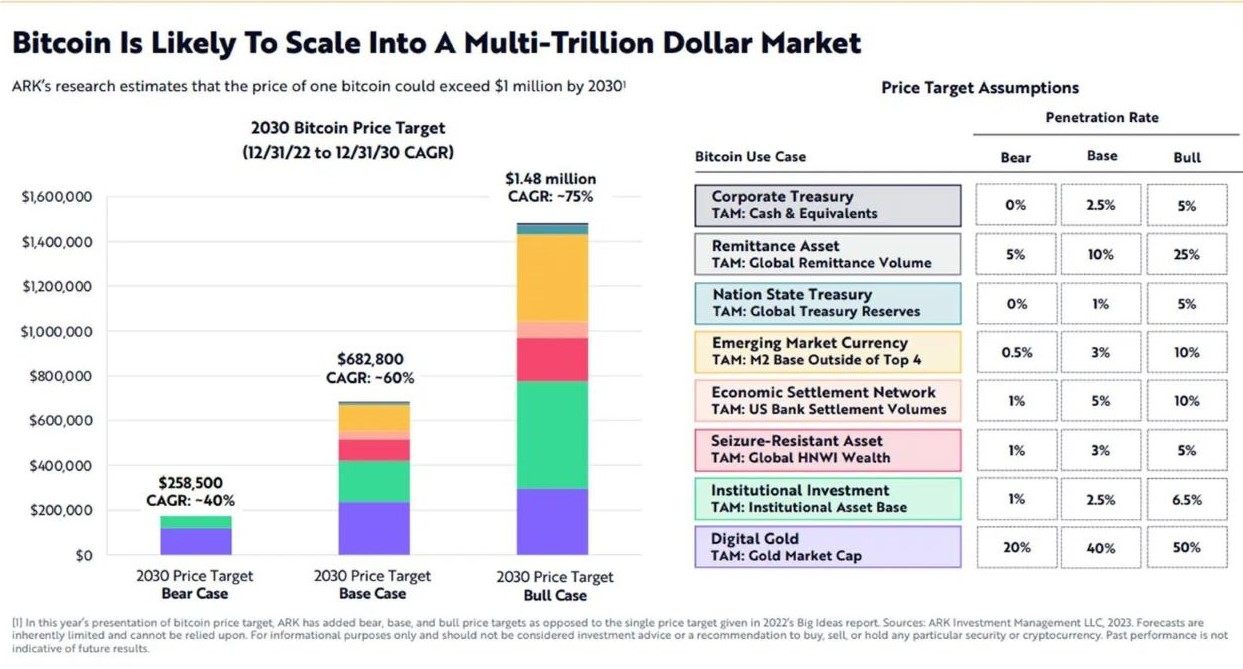

Cathy Wood: The CEO of tech investment firm Ark Investment Management, Catherine Wood, recently gave CNBC a base and bull case for the firm’s price predictions.

“We have a 2030 target, in our base case it’s around $650,000, in our bull case, it’s between $1 million and $1.5 million,” Wood explained. Like many others, she attributed the projections to heightened interest from Wall Street and a more favorable regulatory environment once Trump takes office.

A 2022 chart by Ark shows figures similar to Wood’s recent projections, but with a breakdown of bitcoin penetration rates across eight specific use cases that Ark used to arrive at its estimates. Some of those use cases include BTC’s role as digital gold, a strategic reserve asset, and an emerging market currency.

(Bitcoin price target 2022/ARK Investment Management)

Max Keiser: Colorful bitcoin proponent Max Keiser, who also serves as an advisor to El Salvador President Nayib Bukele, recently upped his price projection from $220,000 to $2.2 million per coin, citing increased uptake of the cryptocurrency by nation-states and noting like Mallers, inevitable fiat currency debasement.

“With bitcoin, you’re guaranteed an increase of purchasing power over time whereas with fiat money like the U.S. dollar for example, you’re guaranteed a loss of purchasing power over time,” Keiser said in an interview, explaining how central banks cause inflation by increasing the money supply.

“The supply of fiat money is increasing [annually] by 15% on average globally,” he added.

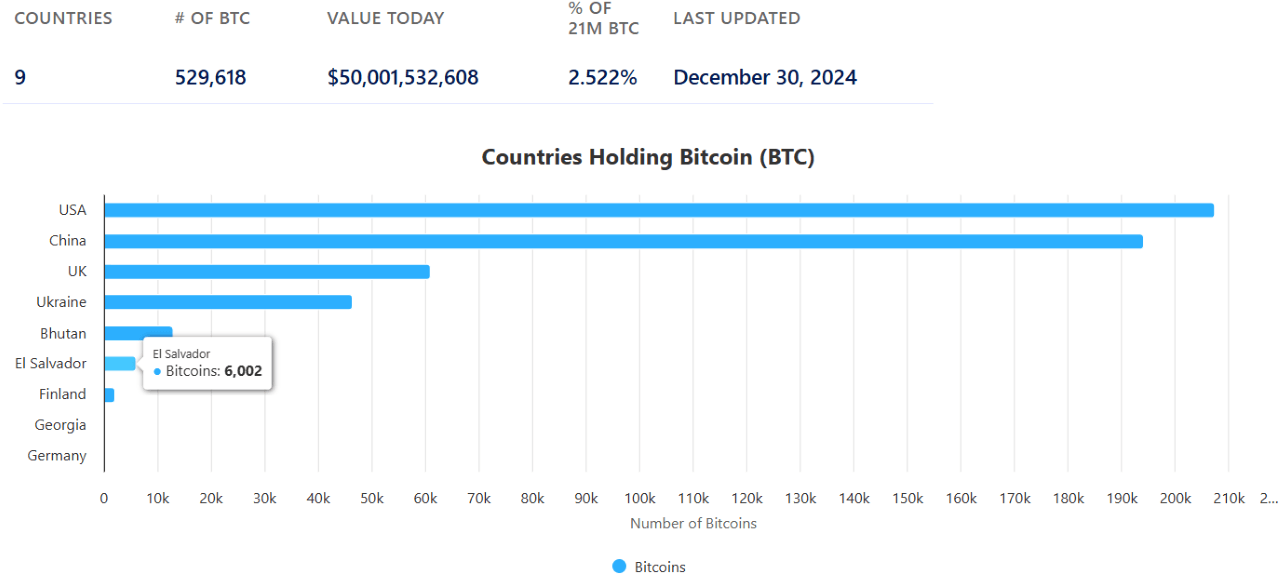

El Salvador, where Keiser now resides, has amassed 6,002 BTC worth nearly $600,000,000 at current prices.

(El Salvador’s BTC treasury as of 12-30-2024/Bitcoin Treasuries by BitBo)

[ad_2]