The Bitcoin mining industry has faced a harsher operating environment since the 2024 halving, a core feature of Bitcoin’s monetary design that cuts block rewards roughly every four years to enforce long-term scarcity. While the halving strengthens Bitcoin’s economic hardness, it also places immediate pressure on miners by slashing revenue overnight.

In 2025, this resulted in the “harshest margin environment of all time,” according to TheMinerMag, which cited collapsing revenue and surging debt as major obstacles.

Even publicly listed Bitcoin (BTC) miners with sizable cash reserves and access to capital have struggled to remain profitable solely through mining. To make do, many have accelerated their push into alternative, title=”https://cointelegraph.com/news/bitcoin-miners-corporate-adoption-treasury-buying-slowdown”>Bitcoin miners could boost corporate adoption as crypto treasury buys slow

Average Bitcoin mining costs across 14 publicly listed mining companies in Q3 2025. Source: TheMinerMag

By 2026, Bitcoin will still be operating in its fourth mining epoch, which began after the April 2024 halving and is expected to run until about 2028. With block subsidies fixed at 3.125 BTC, competition is intensifying, reinforcing the industry’s shift toward efficiency and revenue diversification.

Below are three key themes that are expected to drive the Bitcoin mining industry in 2026.

Mining profitability hinges on energy strategy and fee markets

Hashrate measures the computing power securing the Bitcoin network, while hashprice reflects the revenue that this computing power earns. The distinction remains central to mining economics, but as block subsidies continue to shrink, profitability is increasingly shaped by factors beyond sheer scale.

Access to low-cost energy, along with exposure to Bitcoin’s transaction fee market, has become critical to whether miners can sustain margins through the cycle.

Bitcoin’s price still plays a disproportionately large role. However, 2025 did not produce the kind of blow-off top that many in the industry had expected, or that typically follows in the year following the halving.

Instead, Bitcoin moved higher in a more measured fashion, stair-stepping upward before peaking above $126,000 in October. Whether that marked the cycle high remains an open question.

Volatility, however, has had a clear impact on miner revenue. Data from TheMinerMag shows that the hash price has fallen from an average of about $55 per petahash per second (PH/s) in the third quarter to what the publication describes as a “structural low” of near $35 PH/s.

Adding to the strain, average Bitcoin mining costs rose steadily throughout 2025, reaching about $70,000 in the second quarter, further compressing margins for operators already grappling with lower hash prices.

The decline closely tracked a sharp correction in Bitcoin’s price, which fell from its highs to below $80,000 in November. Pressure on miners could persist into 2026 if Bitcoin enters a broader downturn, a pattern seen in previous post-halving cycles, though not guaranteed to repeat.

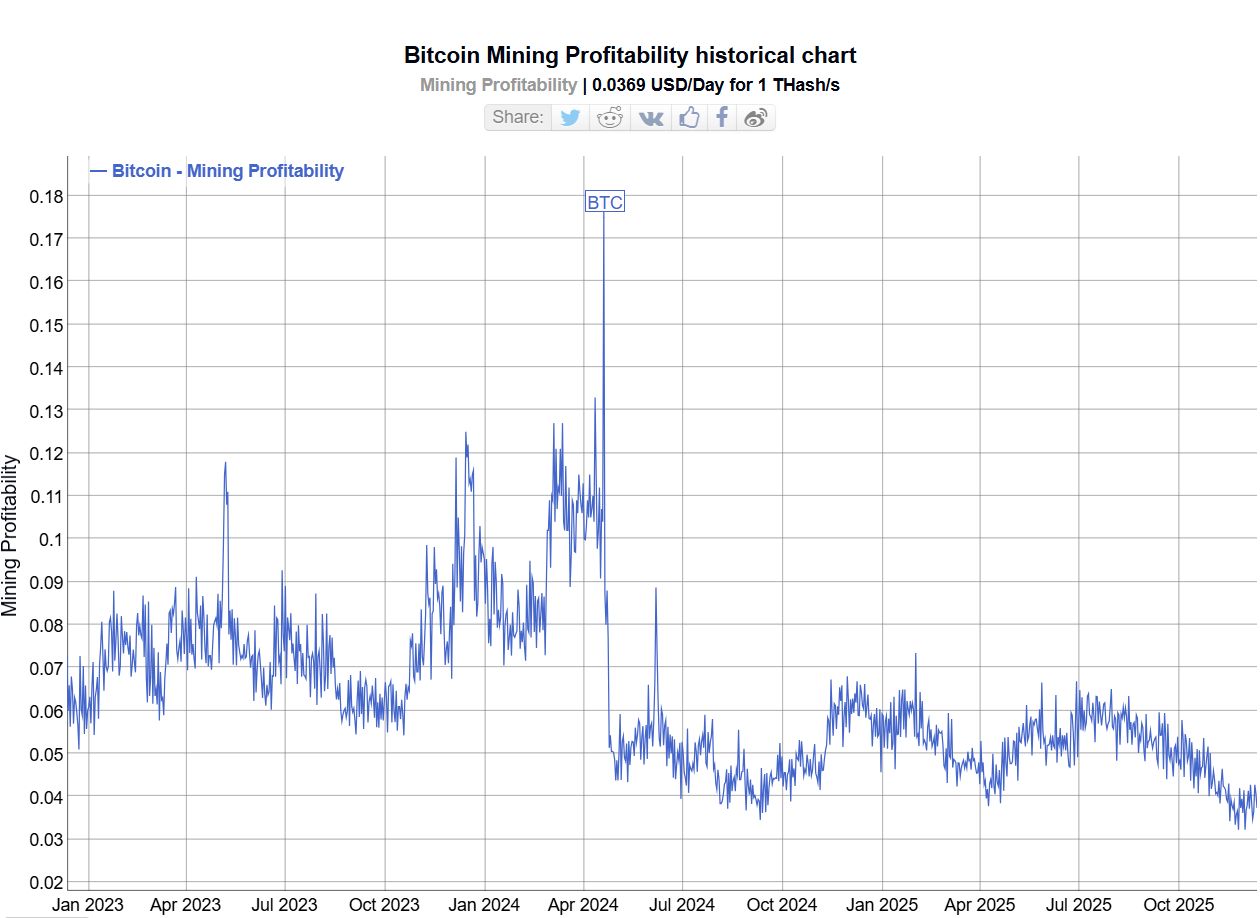

Over the past three years, Bitcoin mining profitability, measured in US dollars earned per unit of hashpower, has trended lower, reflecting post-halving revenue compression and difficulty increases. Source: BitInfoCharts

AI, HPC and consolidation reshape the mining landscape

Publicly traded Bitcoin miners are no longer positioning themselves solely as Bitcoin companies. Increasingly, they describe their businesses as digital infrastructure providers, reflecting a broader strategy to monetize power, real estate and data center capabilities beyond block rewards.

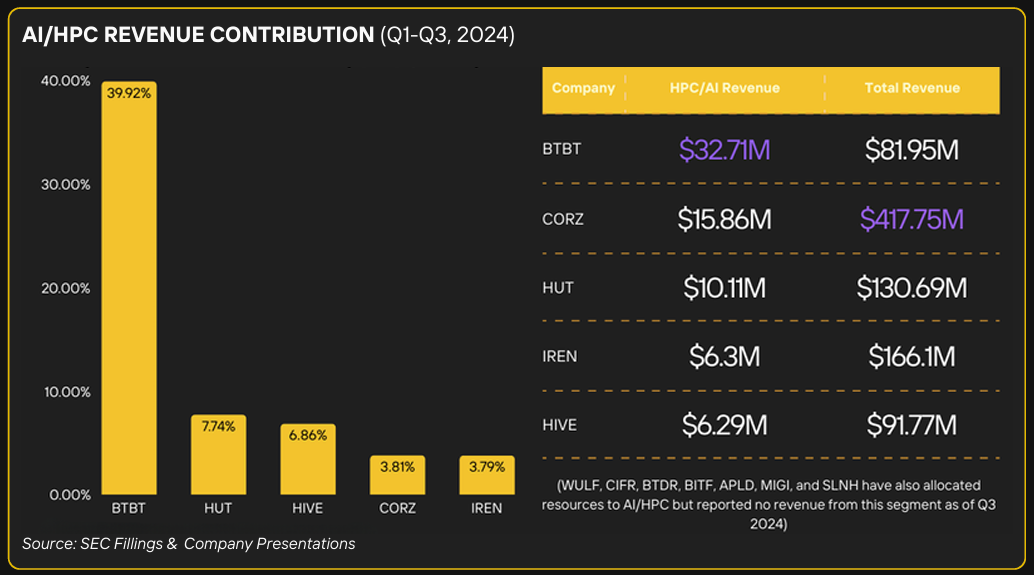

One of the earliest movers was HIVE Digital Technologies, which began pivoting part of its business toward high-performance computing in 2022 and reported HPC-related revenue the following year. At the time, the strategy stood out in an industry still largely focused on expanding hashrate.

Since then, a growing number of public miners have followed suit, repurposing portions of their infrastructure, or signaling plans to do so, for GPU-based workloads tied to artificial intelligence and HPC. These include Core Scientific, MARA Holdings, Hut 8, Riot Platforms, TeraWulf and IREN.

The scale and execution of these initiatives vary widely, but collectively they indicate a broader shift across the mining sector. With margins under pressure and competition rising, many miners now view AI and compute services as a means to stabilize cash flow, rather than relying solely on block rewards.

By 2024, AI and HPC were already contributing meaningful revenue for some miners. Source: Digital Mining Solutions

That shift is expected to continue into 2026. It builds on a consolidation trend flagged in 2024 by Galaxy, a digital asset investment and advisory company, which pointed to a growing wave of mergers and acquisitions among mining companies.

Related: Texas grid is heating up again, this time from AI, not Bitcoin miners

Bitcoin mining stocks: Volatility and dilution risks

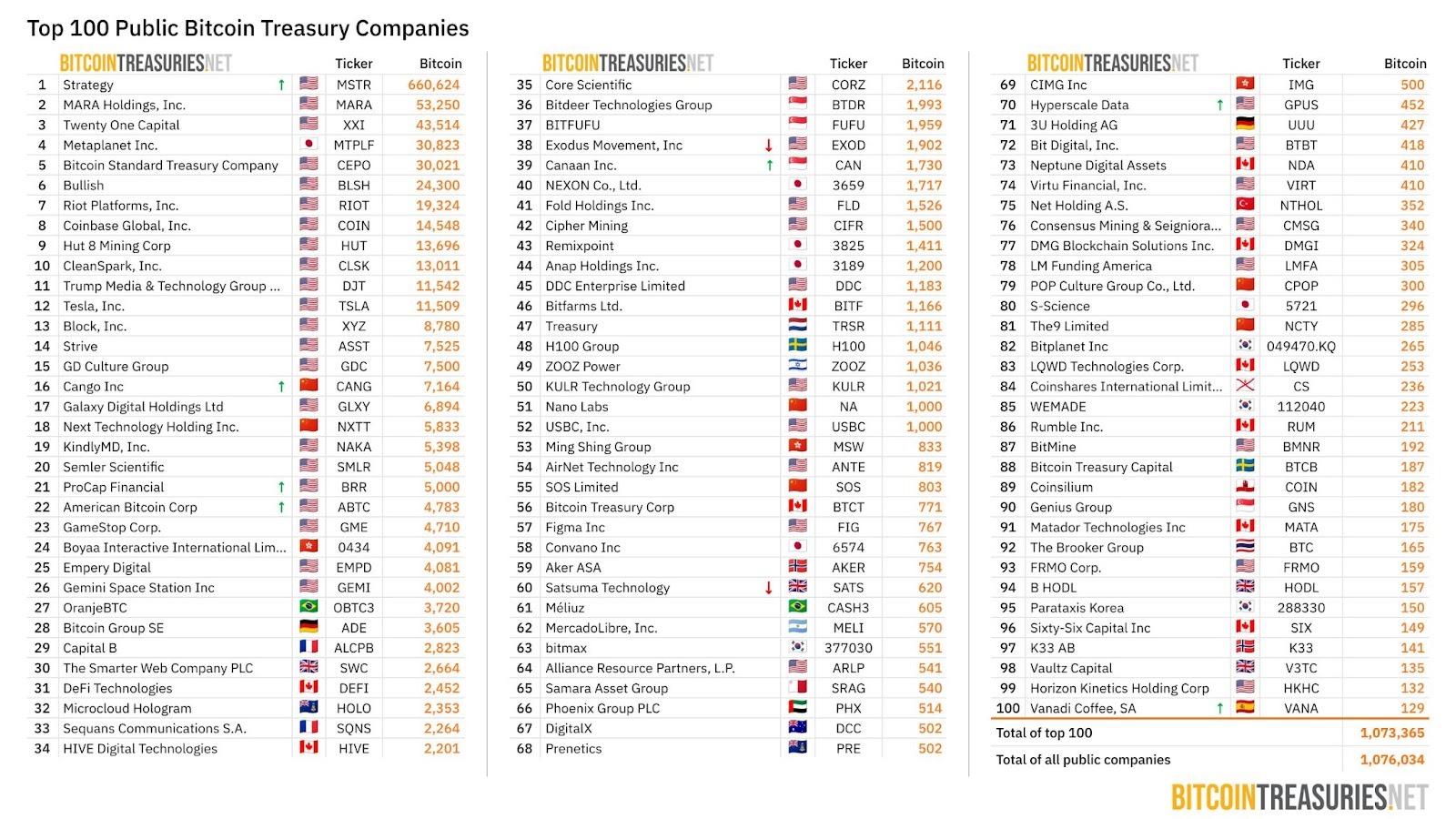

Public Bitcoin miners play an outsized role in the market, not only by securing the network, but also by emerging as some of the largest corporate holders of Bitcoin. Over the past several years, many listed miners have moved beyond a pure operating model and begun treating Bitcoin as a strategic balance-sheet asset.

As Cointelegraph reported in January, a growing number of miners had taken cues from Michael Saylor’s playbook at Strategy, adopting more deliberate Bitcoin treasury strategies by retaining a portion of their mined BTC. By year-end, miners ranked among the largest public Bitcoin holders, with MARA Holdings, Riot Platforms, Hut 8 and CleanSpark all landing in the top 10 by total BTC held.

The largest public Bitcoin treasury companies. Source: BitcoinTreasuries.NET

That exposure, however, has increased volatility risks. As Bitcoin’s price swings, miners with large BTC treasuries experience amplified balance-sheet fluctuations, similar to other digital asset treasury companies that have come under strain during market drawdowns.

Mining stocks also face persistent dilution risk. The business remains capital-intensive, requiring ongoing investment in ASIC hardware, data center expansion and, during downturns, debt servicing.

When operating cash flow tightens, miners have frequently turned to equity-linked financing to maintain liquidity, including at-the-market (ATM) programs and secondary share offerings.

Recent fundraising activity underscores that trend. Several miners, including TeraWulf and IREN, have tapped debt and convertible markets to shore up balance sheets and fund various growth initiatives.

Industry-wide, Bitcoin mining companies raised billions of dollars through debt and convertible note offerings in the third quarter alone, extending a financing pattern that gained momentum in 2024.

Looking ahead to 2026, dilution risk is likely to remain a key concern for investors, particularly if mining margins stay compressed and Bitcoin enters a bear market.

Operators with higher breakeven costs or aggressive expansion plans may continue to rely on equity-linked capital, while those with lower breakeven costs and stronger balance sheets will be better positioned to limit shareholder dilution as the cycle matures.

Related: Google takes 14% stake in Bitcoin miner TeraWulf, becoming top shareholder