[ad_1]

Aave liquidity is suffering an unexpected setback, as a giant whale identified as HTX removed 93% of available USDT from one of the top lending pools. This locks other whales in a position where they cannot remove their stake, as most USDT is already claimed by borrowers.

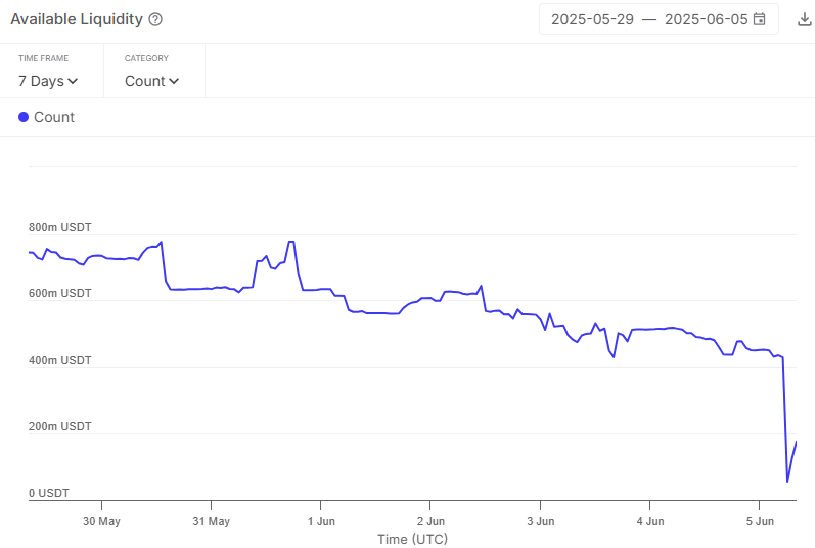

A giant whale removed up to 93% of available USDT liquidity on Aave, meaning all other lender whales were stuck in their positions. USDT has a high utilization rate on Aave, as it is one of the preferred assets to borrow.

An address identified as HTX, formerly Huobi, withdrew $400M USDT in a single transaction.

Liquidity in Aave USDT pools crashed in the short term, before new depositors appeared to tap the growing yields. | Source: DeFi Risk

HTX has moved some of its USDT in the past week, as observed by on-chain analysts, with the potential to allocate the liquidity to other tasks.

The Huobi Recovery wallet and the HTX 52 wallet were involved in a series of USDT operations. In the past, wallets linked to Justin Sun have also removed USDT from Aave for a series of swaps between chains, also involving Binance to move between the TRON and Ethereum versions of USDT.

Available liquidity on Aave V3 fell by over $307M in the past 24 hours, immediately leading to an outsized spike in USDT interest rates. The removal of liquidity led to an immediate spike in the pool’s APY, with spikes as high as 40% annualized. All remaining lenders are making outsized gains, although they are unable to remove their liquidity.

The exact purpose of the recent liquidity operation remains uncertain. Top DeFi apps continue to attract whales for their passive income opportunities, but are also vulnerable to similar large-scale liquidity operations. HTX remains one of the top depositors in Aave, still supplying significant liquidity to lending pools.

HTX withdrawal caused a short-term spike in borrowing, deposit rates on Aave V3

Immediately after the large liquidity withdrawal, borrowing retained a rate of 28.6%, while deposits gained 24.65% in annualized yield. The rates continued to normalize within an hour of the large-scale withdrawal, sinking back to 8%, still an unusually high level.

更新:不要小瞧搬砖人的力量啊!😆

短短半小时,USDT 存款 APY 已经降回 8.07% 了,太有实力了朋友们

不过 HTX 目前仍是 Aave USDT 存款金库的榜一大哥,尽管撤走了 4 亿枚 USDT 也还有 12 亿枚,占总存款数量的 32.6% pic.twitter.com/HkLWcOyDhU

— Ai 姨 (@ai_9684xtpa) June 5, 2025

Following the large withdrawal, Aave started to draw in deposits from other whales, trying to make the best of the situation and grab the niche opened by the HTX deposit.

Aave is not under-capitalized, and according to analysts, still has $1.2B in available USDT, among other stablecoins. However, the recent withdrawal demonstrated that DeFi is still unpredictable when it comes to available liquidity and rates.

HTX sent back the funds to a known address belonging to Huobi Recovery with no previous warning.

USDT withdrawal proved a stress test for Aave

The recent withdrawal affected only a single USDT pool, with sufficient liquidity remaining in other assets, as well as USDT. Following the news, AAVE tokens only suffered a small setback, losing 2.7% to $262.90.

The ability to withdraw $400M without affecting the protocol revealed the resilience of Aave and the self-correcting nature of pools.

Aave V3 currently holds over $24B in value locked, with over $16.6B borrowed. The protocol’s health is also linked to the significant supply of native stablecoins GHO, with over 238M in circulation. Aave remains the leading lending protocol, with versions on over 23 chains.

[ad_2]