[ad_1]

The Aave DAO has reached a consensus. According to Aave Labs’ CEO, the DAO is not currently looking to invest in tokens other than AAVE.

The unanimous decision came via a consensus among members of the DAO. A decentralized autonomous organization (DAO) runs on “decentralized” authority, such that decisions are usually never made by one person.

More details about the consensus

Aave Labs’ CEO, Stani Kulechov announced that the consensus will be respected, as Aave DAO operates a DAO not just in name only. According to Stani, this means the team won’t try to push any agenda other than the DAO’s decision.

Aave Labs’ CEO, Stani Kulechov shares a message with the AAVE DAO after they reached a consensus about token investment. Source: Stani Kulechov (X/Twitter)

As for its pledge to take RWA exploration more seriously, Stanis’ post assures it will continue, but only once they find the right approach.

“There is only $AAVE,” he wrote as he ended his post.

The DAO’s decision to circle back and return to the whiteboard regarding RWA exploration is not only a smart one but also proof of Aave DAO’s strategic (or cautious) interest in the budding crypto sector.

Focusing on AAVE alone also means the Aave DAO doesn’t have to manage the risks that come with portfolio diversification.

Under the comment section of Stani’s post announcing the consensus and the team’s plan to honor it, interested parties weighed in with their opinions.

While many praised the DAO’s decision to focus on only Aave, there was a smattering of more critical comments. One of them wondered why the RWA exploration was being put on a back burner and also pointed out that adding value to the AAVEe token should not be something they are just agreeing on.

Another user stated that it made no sense to create another token and implied that “extracting value from Aave” would be the ultimate accomplishment.

Overall, the community agrees with the consensus and is glad RWA exploration is still on the table, even if it is not a priority right now.

The news comes shortly after Aave Labs announced the launch of Horizon

One reason many may have been surprised that RWA exploration is currently not the priority of the DAO is that only days before, Aave Labs launched a new initiative named Horizon, and its purpose is to enhance the integration of institutional real-world assets (RWAs) into DeFi.

Aave made the announcement on March 13, and according to reports, the project aims to bridge DeFi’s open financial ecosystem with the structured needs of institutional asset issuers, thereby creating infrastructure that encourages broader participation in on-chain finance.

Project Horizon will align with institutional compliance requirements while staying true to DeFi’s efficiency and transparency. It essentially introduces a structured pathway for institutions and tokenization platforms to leverage decentralized finance without concern.

One of Horizon’s core features is that it will allow institutions to use tokenized money market funds (MMFs) as collateral when borrowing stablecoins. It also has future plans to expand to other forms of RWAs and enhance institutional access to DeFi liquidity.

Aave Labs’ CEO, Stani Kulechov, in the past, has pointed out that DeFi lacks the necessary infrastructure to handle large-scale institutional participation even though that is the end game.

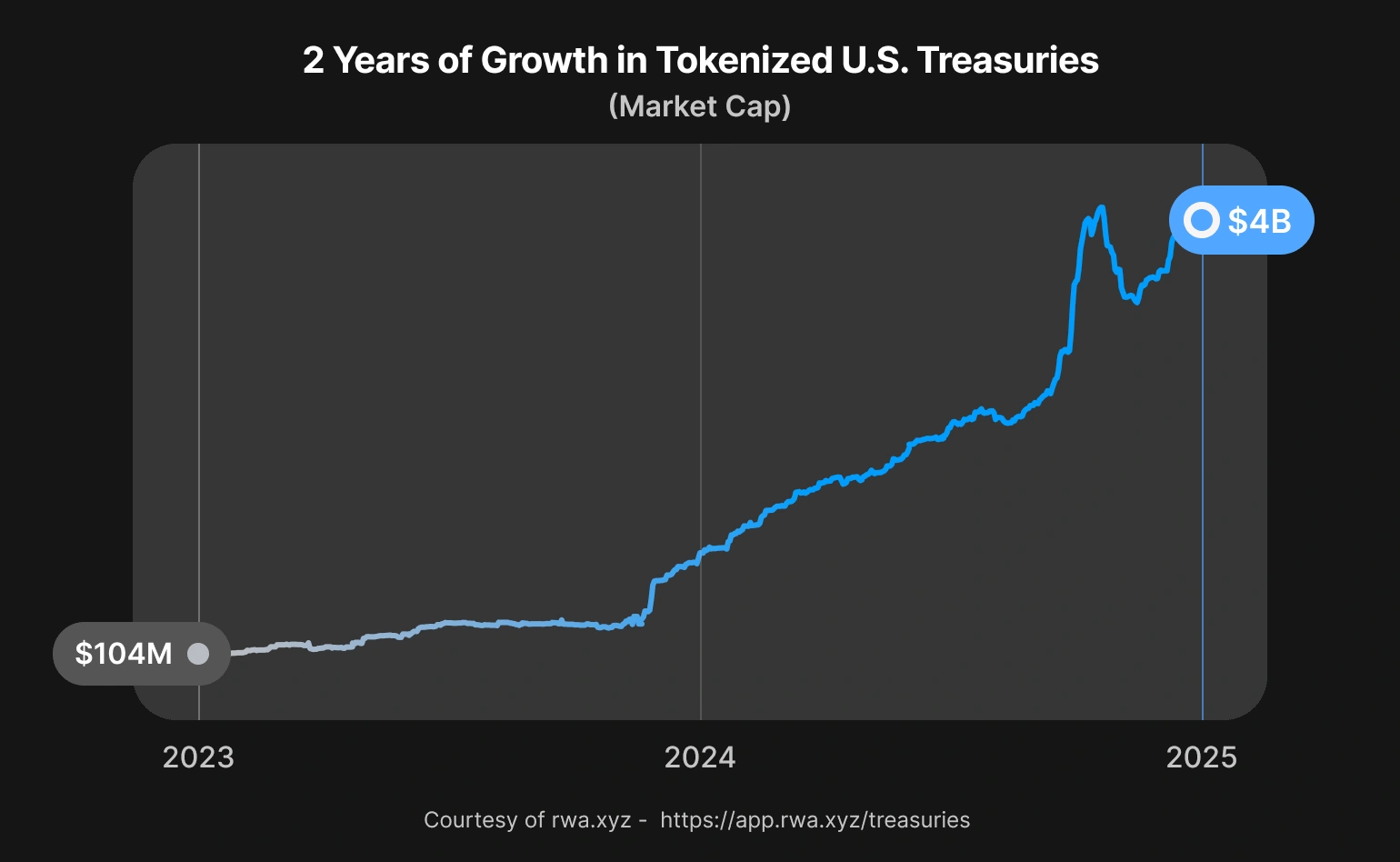

Two-year chart of tokenized US Treasuries. Source: RWA.xyz

According to him, Project Horizon, wise from lessons from Aave Arc, is capable of improving institutional access to permissionless stablecoin liquidity.

To back the initiative, Aave has proposed launching a licensed instance of the Aave Protocol via the Aave DAO and it will be the foundation for all projects under the Horizon initiative.

Horizon’s RWA solution will start out as an operation under Aave V3 as a licensed instance but will eventually transition to a custom Aave V4 deployment when available.

Horizon will also implement a profit-sharing mechanism for long-term sustainability, allocating 50% of its first-year revenue to the Aave DAO. Additional incentives will also be introduced to encourage broader ecosystem adoption.

Aave Labs’ interest in RWAs is happening amid significant growth in the sector. According to RWA.xyz, the total value of on-chain RWAs has increased by more than 17% over the past month, reaching $18.13 billion.

The number of unique asset holders has also surged by 5%, surpassing 89,818. One critical expansion area has been on-chain treasuries, which now account for a TVL of $4.22 billion, reflecting a 400% year-over-year increase.

Despite all that growth, experts still see a lot of potential in RWAs. Many predict the RWA sector could scale to $16 trillion over the next decade, which highlights its growing presence in global finance. The trend has been spotted by major institutions like BlackRock, who have already issued substantial tokenized assets through its BUIDL product.

Other institutions like BlackRock that have shown significant interest in the RWA sector include JPMorgan, Citigroup, UBS, Franklin Templeton and Goldman Sachs.

These organizations are doing it for their own respective reasons. JPMorgan, for instance, has pioneered RWA tokenization through its Onyx platform and has processed over $900 billion in tokenized assets, while Franklin Templeton is embracing RWAs by launching tokenized money market funds and exploring blockchain-based asset management.

[ad_2]