[ad_1]

From its early days on Ethereum to its expansive reach across layer-2s and alternative chains, Aave has solidified itself as a leader in decentralized finance.

Aave (AAVE) metrics skyrocketing: Overview

AAVE tokens have had a massive surge of over 21% this week, vastly outperforming the broader crypto market. This rally follows a significant governance proposal from Aave DAO, which seeks to enhance the token’s value accrual mechanisms.

Key elements of the proposal include:

- A profit-sharing model for AAVE stakers.

- A “buy and distribute” program to support price stability and long-term value.

- A novel “Anti-GHO” mechanism to burn or convert GHO debt for additional rewards.

- A self-protection system dubbed “Umbrella” to shield users from bad debt

These proposed changes reflect a growing commitment to incentivizing AAVE holders and reinforcing the protocol’s financial resilience. While the price has almost made a round trip by now, it shows the market is excited about this new proposal and how it will affect the AAVE token.

AAVE is key asset for major DeFi

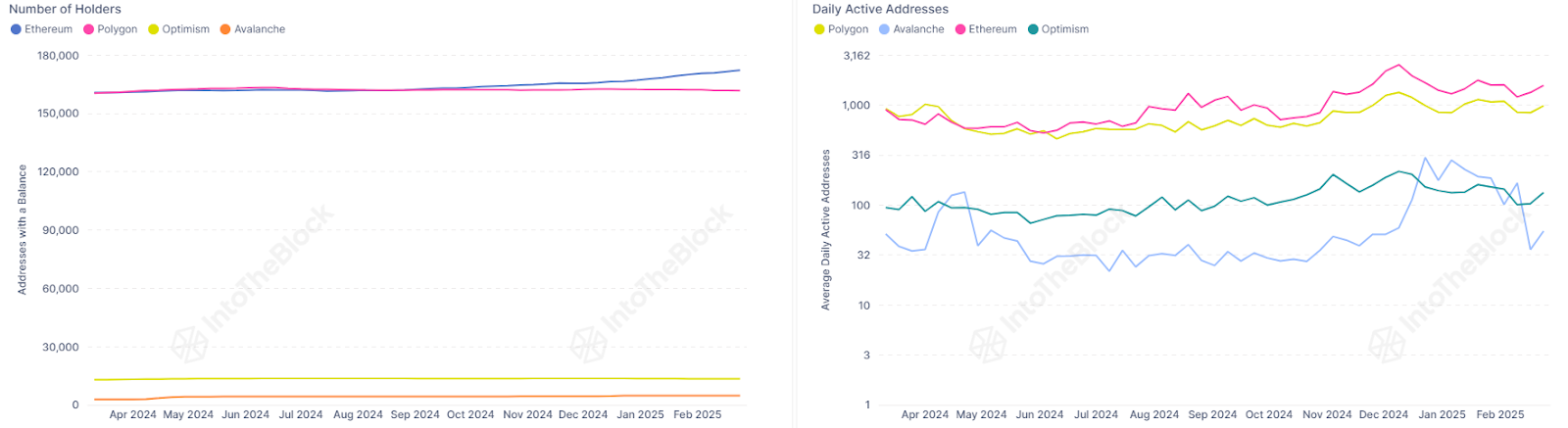

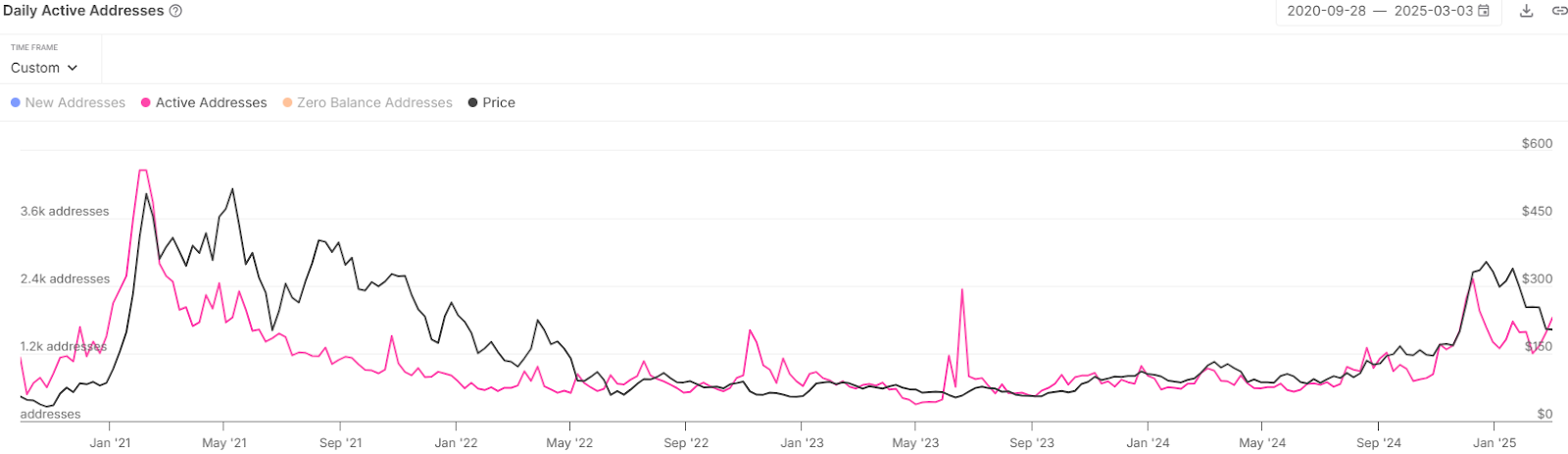

This recent surge in AAVE also reinforces its role as the beating heart of the protocol, enabling governance decisions and, in the future, potentially earning rewards from the protocol itself. The token currently boasts over 170,000 AAVE holders on Ethereum alone, with nearly the same number on Polygon.

However, despite the broad distribution, the AAVE token only sees around 3,000 daily active addresses across blockchains. This signals that many users are choosing to hold rather than transact frequently, likely in anticipation of further price appreciation.

However, on-chain metrics for AAVE look promising, as evidenced by a notable increase in activity since the end of 2024.

Early days of AAVE

Aave’s journey began in 2017 when Finnish law student Stani Kulechov launched ETHLend, a pioneering peer-to-peer lending platform on Ethereum.

However, the model faced liquidity and scalability issues, prompting a major shift. In 2018, ETHLend rebranded to Aave, meaning “ghost” in Finnish, and transitioned to a liquidity pool model. This innovation significantly improved efficiency, allowing users to deposit assets into shared pools from which borrowers could draw, eliminating the inefficiencies of direct lender-borrower matching.

Aave across blockchains

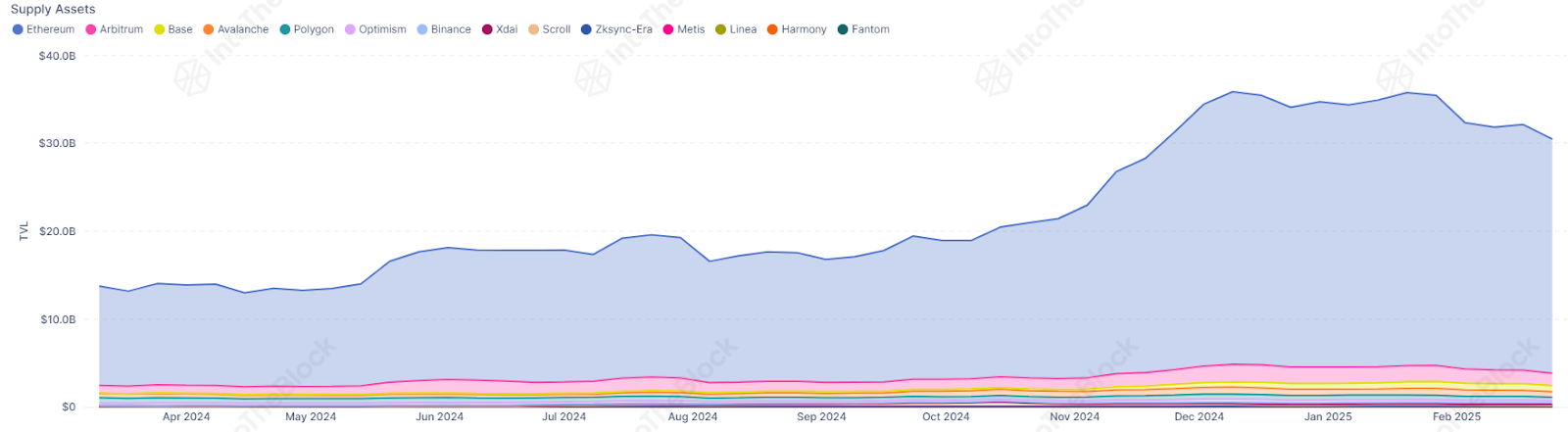

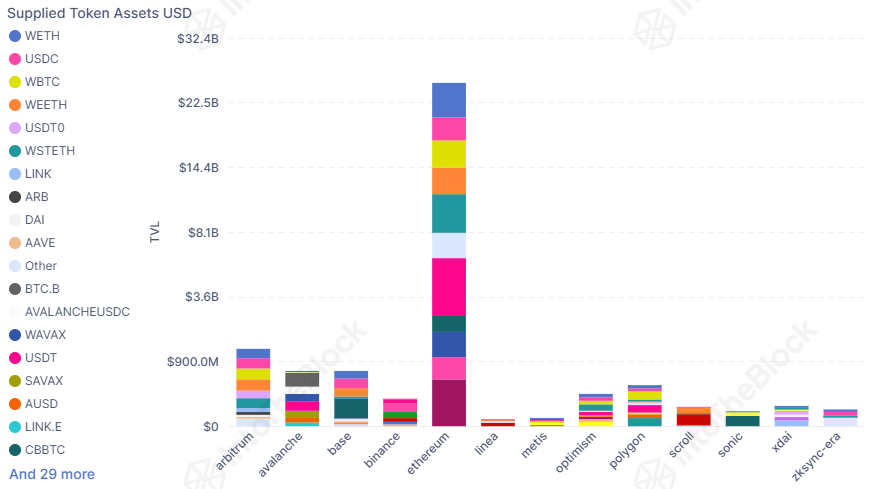

While Aave has clearly gone cross-chain and is now available on 13 different chains, the main Aave hub remains Ethereum. Here, Aave commands:

- $26.6 billion in supplied assets across 49 markets, primarily in WETH and wstETH.

- Over $11 billion in borrowed assets, heavily focused on WETH and USDT.

These numbers account for nearly 90% of Aave’s total supplied and borrowed assets, showing that, unsurprisingly, Ethereum still remains the main hub for Aave.

Aave’s multi-chain domination

Why settle for one blockchain when you can conquer several? Aave’s expansion strategy looks like a series of well-planned chess moves across multiple networks:

- Arbitrum: A whopping $1.4 billion in supplied assets, thanks to high throughput and low fees.

- Base: Already hosting $699 million in supplied assets, indicative of strong early adoption.

- Avalanche: About $630 million in assets, appealing to those who value speed and eco-friendly consensus.

- Polygon: Over $393 million, drawing in users who crave efficiency and near-instant finality.

Wrapping up: What’s next for Aave (AAVE)?

With an ever-growing user base, multi-chain deployments and active governance, Aave is showing no signs of slowing. In fact, Aave’s plans include expanding to other blockchains in the near future.

If the past few years are any indication, Aave’s trajectory will continue to push the boundaries of what is possible in DeFi.

[ad_2]