[ad_1]

Hyperliquid didn’t rely on hype cycles or marketing blitzes to break into the spotlight—it engineered its way into relevance, forcing the crypto industry to reassess how far onchain trading infrastructure had come.

What Hyperliquid Is

At its core, Hyperliquid is a decentralized exchange ( DEX) built specifically for perpetual futures trading. Unlike earlier DEX platforms that relied on automated market makers or offchain order matching, Hyperliquid operates a fully onchain central limit order book, with trades, liquidations, and funding payments recorded directly on its blockchain.

The design goal was straightforward but ambitious: deliver the execution quality, market depth, and responsiveness traders expect from centralized exchanges while maintaining non-custodial settlement. In practice, that meant replicating professional trading mechanics onchain rather than compromising on speed or price discovery.

Who Built It

Hyperliquid was developed by Hyperliquid Labs and is led by Jeff Yan, a former high-frequency trader with experience at Hudson River Trading. Yan later ran a crypto market-making operation before turning his attention to exchange infrastructure following the collapse of FTX, which exposed the risks of centralized custody in derivatives trading.

The project took an unconventional path from the outset. Hyperliquid did not raise venture capital, opting instead to self-fund development. That decision shaped the platform’s governance structure, incentives, and long-term priorities, keeping control concentrated among builders rather than outside investors.

Where Hyperliquid Operates

Hyperliquid runs on its own standalone layer one (L1) blockchain rather than Ethereum or an existing rollup. Users must bridge assets—most commonly stablecoins like USDC—onto the network before trading. Once funds are deposited, trading actions are effectively gas-free from the user’s perspective, with fees abstracted at the protocol level.

There is no central headquarters and no identity verification requirement. Validators are limited in number compared with older blockchains, reflecting a deliberate tradeoff favoring throughput and low latency over maximal decentralization.

Why Traders Took Notice

Hyperliquid’s rise coincided with renewed demand for derivatives trading in the aftermath of multiple centralized exchange ( CEX) failures. Traders wanted leverage without custodial exposure, and Hyperliquid arrived offering fast execution, low fees, and onchain settlement.

The platform’s interface and mechanics felt familiar to experienced traders, lowering the learning curve that had historically slowed adoption of decentralized exchanges. For many, it was the first onchain venue that functioned like a professional trading platform rather than an experimental alternative.

Liquidity and Market Share

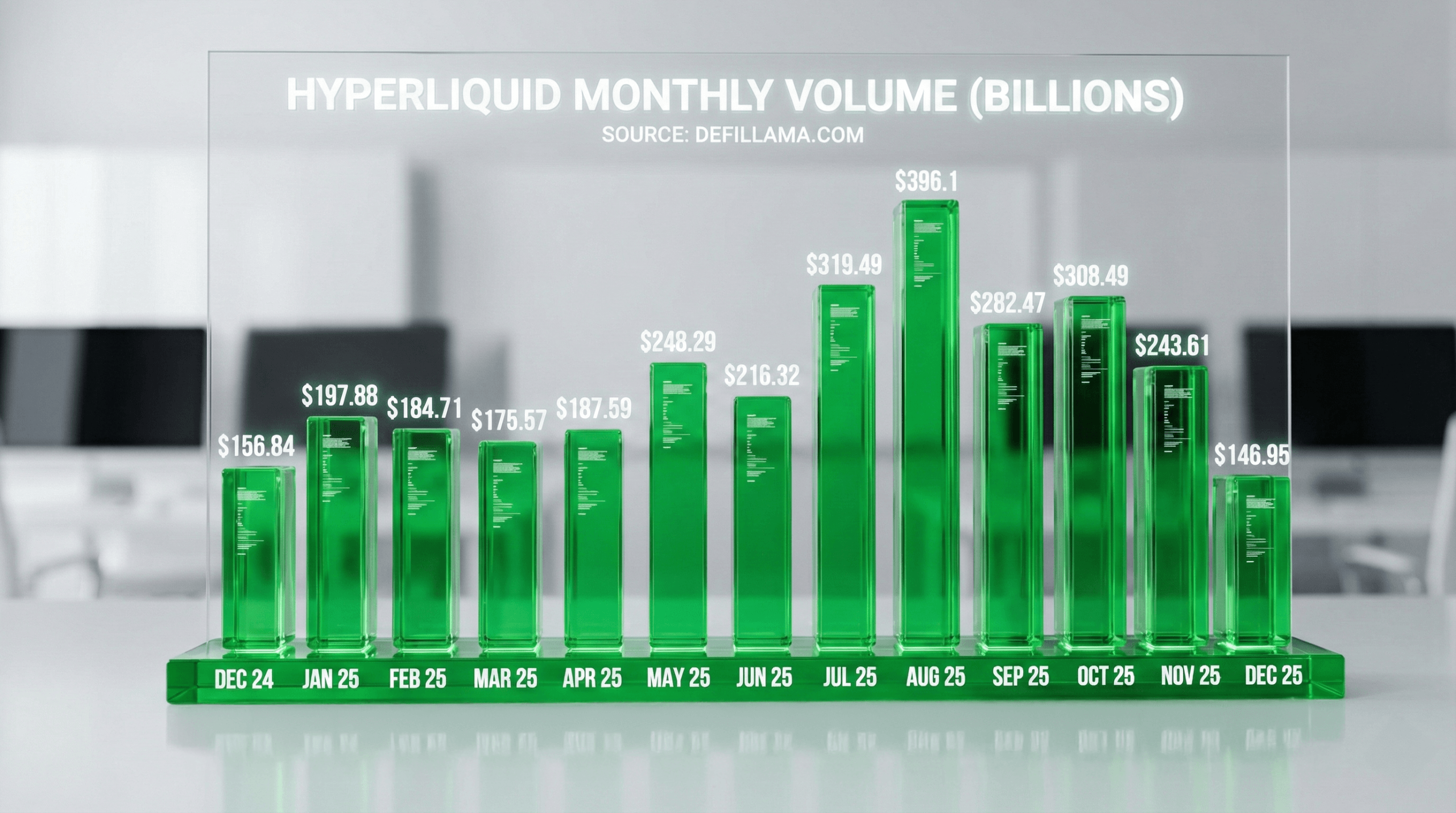

Liquidity followed activity. Market makers entered, order books deepened, and spreads narrowed. By 2025, Hyperliquid consistently accounted for the largest share of decentralized perpetuals trading volume, often handling billions of dollars in daily activity.

While volumes fluctuated with broader market conditions, Hyperliquid maintained a leading position within decentralized perpetuals throughout much of the year. At several points, its futures volume reached double-digit percentages of Binance’s, a comparison that underscored how much ground decentralized infrastructure had gained.

The Token, Without the Hype

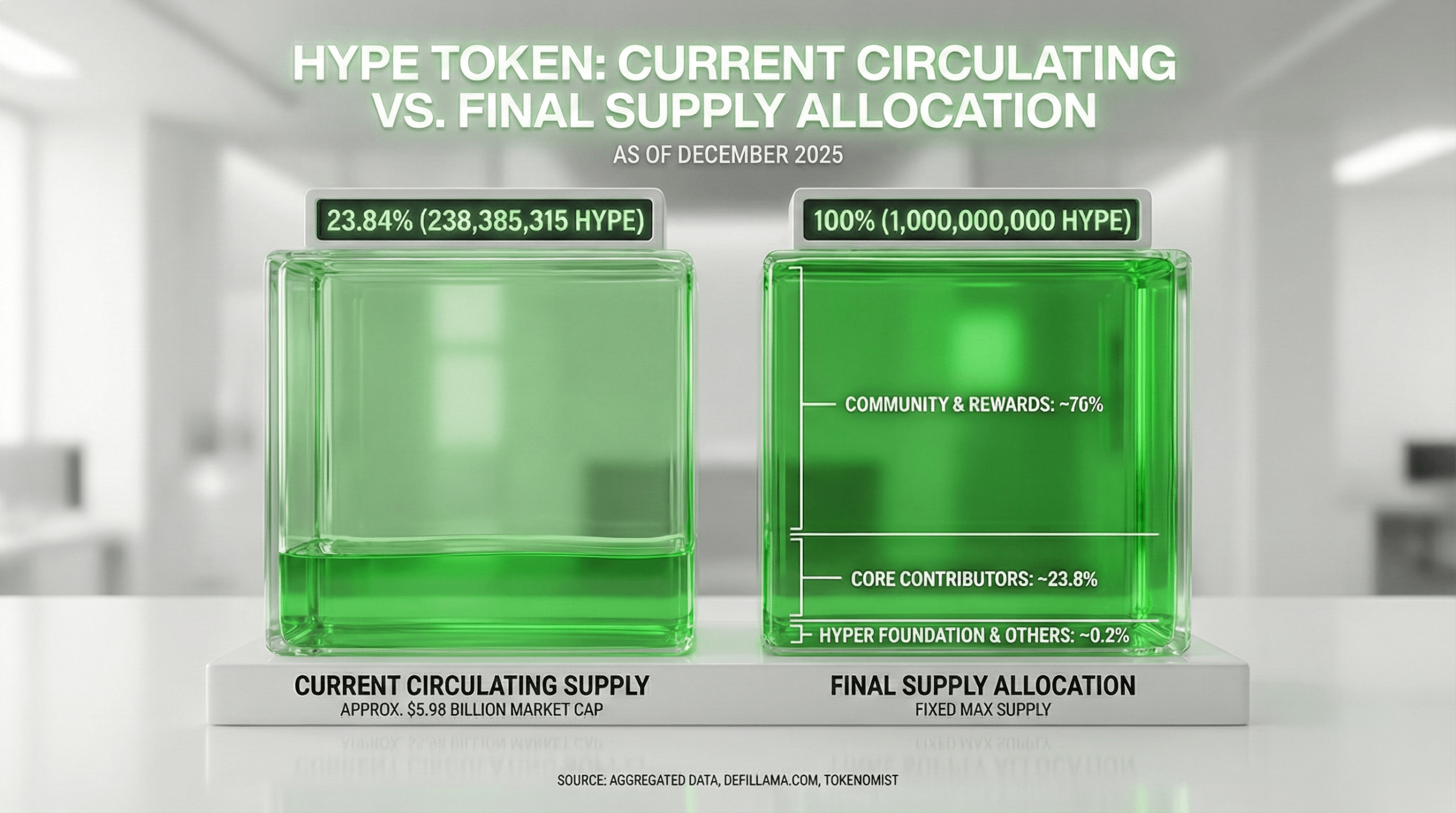

Hyperliquid introduced its native token, HYPE, in late 2024 through a large airdrop that primarily favored users rather than outside investors. The token is used for governance and network-level functions, with protocol revenue largely directed toward buybacks rather than inflationary trading rewards.

While HYPE’s market performance drew attention in 2025, the exchange’s growth was driven more by trading activity and liquidity than by incentive farming or emissions-based programs.

Stress Tests and Technical Scrutiny

The platform faced its first major stress test in late 2024 when rumors of a potential exploit triggered a rapid wave of withdrawals. No breach occurred, and trading continued uninterrupted, reinforcing confidence in the system’s design.

In 2025, Hyperliquid experienced occasional technical issues, including brief outages and API disruptions. These incidents did not result in lasting trading interruptions but highlighted the operational challenges of running high-performance infrastructure entirely onchain.

Competitors Enter the Arena

Hyperliquid’s success attracted aggressive competition. Established decentralized derivatives platforms such as DYdX and GMX remained active, while a new generation of perp DEXs launched with incentive-heavy strategies designed to capture volume.

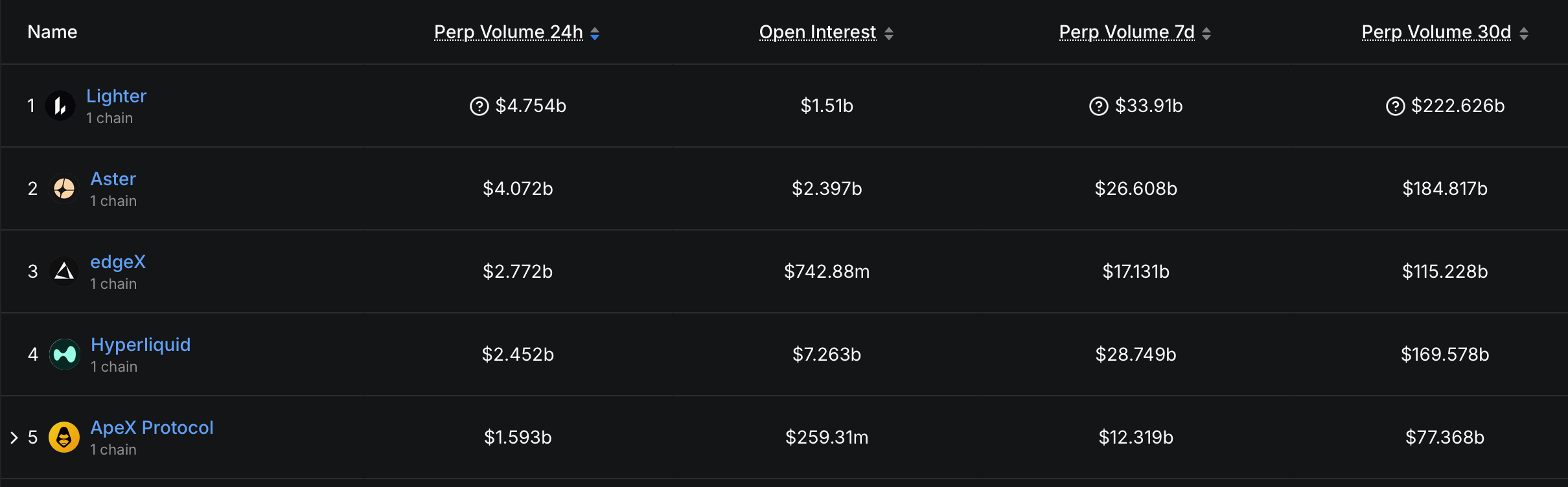

December perp DEX volume according to defillama.com stats. 30-day volume shows Lighter and Aster moving ahead of Hyperliquid.

Newer entrants leaned on trading rewards, zero-fee promotions, and airdrop speculation, igniting what became known as the 2025 “perp DEX wars.” As competition intensified, Hyperliquid’s market share narrowed, though it remained one of the largest decentralized perps venue by liquidity and open interest.

Why Hyperliquid Became a 2025 Theme

Hyperliquid became a focal point not because it eliminated competition, but because it changed expectations. It demonstrated that decentralized exchanges could support institutional-scale derivatives trading without relying on offchain shortcuts or custodial risk.

The platform’s self-funded model, restrained token emissions, and emphasis on infrastructure over incentives made it a frequent reference point in industry research and commentary throughout the year.

What Comes Next

By the end of 2025, Hyperliquid had evolved beyond a single trading venue. With an expanding EVM-compatible environment and a growing ecosystem of third-party applications, it positioned itself as trading infrastructure rather than a standalone exchange.

Whether it maintains its lead as competitors mature remains uncertain. But in 2025, Hyperliquid forced the industry to recalibrate its assumptions—and in crypto, shifting the baseline often matters more than winning the moment.

FAQ ❓

- What is Hyperliquid?Hyperliquid is a decentralized exchange focused on perpetual futures trading on its own Layer-1 blockchain.

- Who founded Hyperliquid?The platform is led by Jeff Yan, a former high-frequency trader who built Hyperliquid after centralized exchange failures exposed custodial risks.

- Why did Hyperliquid gain traction in 2025?It combined centralized-style execution with onchain settlement and self-custody.

- Does Hyperliquid require identity verification?No, users can trade without KYC by depositing assets and connecting a wallet.

[ad_2]