[ad_1]

The following is a guest post from Vincent Maliepaard, Marketing Director at IntoTheBlock.

DeFi has emerged as one of the most successful niches in the cryptocurrency industry, pioneering innovative economic tools and significantly driving value across the crypto ecosystem. In this article, we’ll provide a comprehensive overview of DeFi’s historical development, current market landscape, and key future trends.

DeFi’s Historical Development

Between 2015 and 2018, Ethereum’s smart contract capabilities laid the foundational framework for modern DeFi. Early innovators like MakerDAO introduced decentralized stablecoins (DAI), while protocols such as EtherDelta and 0x pioneered decentralized trading. The introduction of the ERC-20 token standard simplified the issuance of new assets, sparking an influx of creative projects.

By 2018, essential DeFi primitives—decentralized exchanges (DEXs), lending platforms, and stablecoins—had become well-established, laying the groundwork for rapid growth. This period also popularized Total Value Locked (TVL) as a primary measure of DeFi’s liquidity and adoption, becoming a key indicator for tracking ecosystem health.

From 2019 onward, “DeFi Summer” catapulted decentralized finance into mainstream attention with exponential TVL growth, lucrative liquidity mining incentives, and innovative governance structures. Challenges such as high Ethereum gas fees and scalability issues led to the adoption of alternative blockchains and Layer 2 scaling solutions.

Simultaneously, NFT-driven markets, increased regulatory scrutiny, and high-profile exploits underscored both DeFi’s immense potential and its inherent risks. Despite these hurdles, DeFi has steadily matured, increasingly drawing institutional interest and fostering advanced risk management frameworks. Pioneers like Aave have solidified their positions as market leaders, while innovations such as Ethena’s stablecoin products and real-world asset tokenization have continued to push the boundaries of financial technology.

Leaders in DeFi

While the DeFi industry is still extremely competitive, several DeFi protocols have already established significant dominant positions in their respective niches, particularly in DeFi primitives that are already more established.

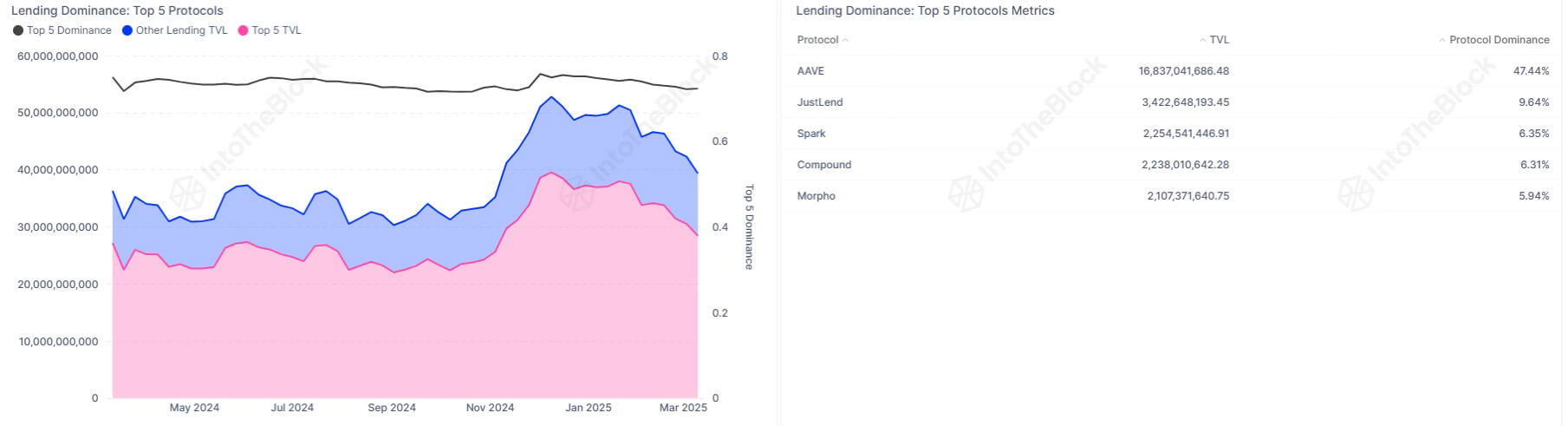

Lending Protocols

Lending protocols enable users to earn interest by lending digital assets or borrowing against their holdings in a decentralized manner.

Aave dominates this segment with an impressive TVL of approximately $16.8 billion, commanding nearly half of the entire lending market with around 47% market share. Competitors like JustLend and Compound also show significant engagement but collectively represent much smaller portions of the market, each accounting for approximately 5% of total lending TVL.

Liquid Staking

Liquid staking allows users to stake their crypto assets to secure a blockchain network while simultaneously receiving tokens that represent their staked assets, maintaining liquidity and enabling participation in other DeFi activities.

Lido leads this market decisively, holding a substantial majority of liquid staking TVL. With approximately 75% of the liquid staking market share and over $15 billion in TVL, Lido’s dominance underscores its central role within the Ethereum staking ecosystem.

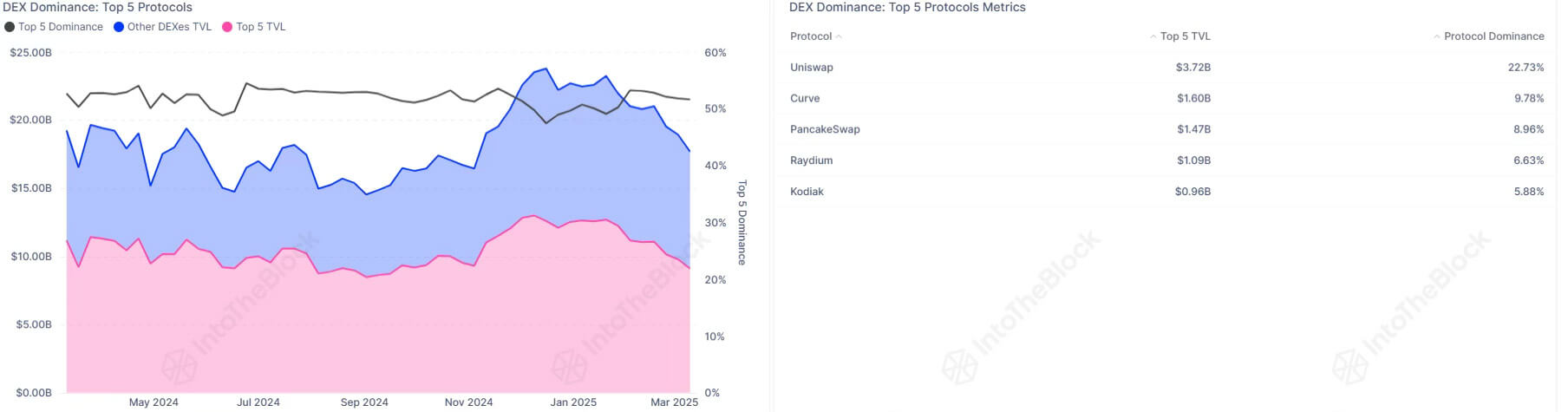

Decentralized Exchanges (DEXs)

DEXs facilitate peer-to-peer cryptocurrency trading directly from users’ wallets, without intermediaries. They remain highly competitive due to diverse user preferences across various blockchain ecosystems.

Uniswap leads with around $3.7 billion in TVL, accounting for roughly 22% of total DEX market share. However, unlike other categories, its dominance is moderate, reflecting traders’ preferences for multiple platforms tailored to specific use cases and asset availability.

DeFi Trends to Watch

DeFi never sleeps, and while there are market leaders in certain established DeFi segments, other segments are still very much in flux. DEX perps, lending markets, and yield markets are among these newer primities that promise to shape DeFi in the coming years.

1. Decentralized Perpetual Exchanges (DEX Perps)

DEXs offering perpetual contracts have witnessed a remarkable surge in popularity. Platforms like Hyperliquid, dydx, and Jupiter have captured substantial market share, with Hyperliquid alone processing over $340 billion in trading volume in December 2024. These platforms provide benefits like no-KYC trading, low latency execution, and extensive asset availability, becoming essential components of DeFi infrastructure.

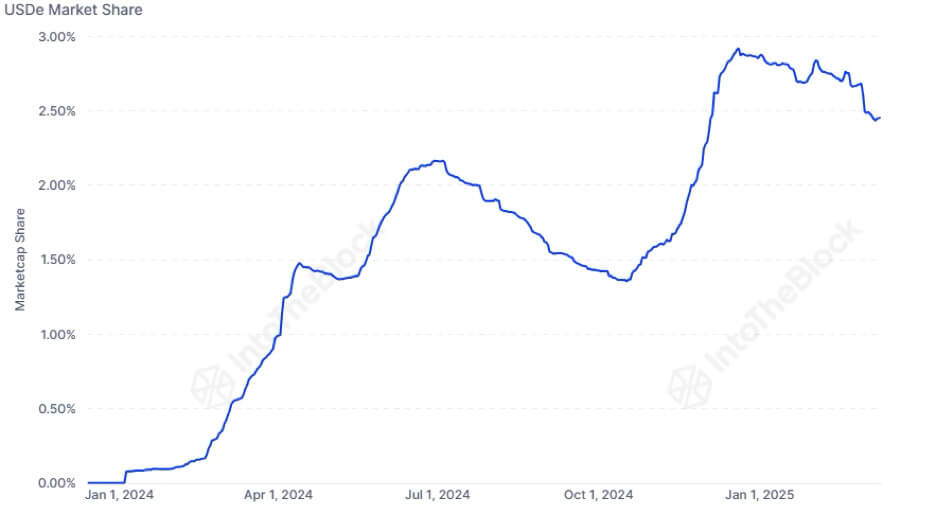

2. Basis Trading with Yield-Bearing Stablecoins

Basis trading, which profits from the spread between spot and futures prices, has been a newer and popular mechanism for providing stablecoin stability and yield. While reduced funding rates are currently contributing to a minor downturn in this niche, protocols like Ethena have successfully integrated yield-bearing synthetic dollars (USDe) into DeFi ecosystems, offering innovative financial instruments. Ethena’s success with USDe is noteworthy, quickly climbing to become the fourth-largest stablecoin by market cap.

Basis trading, which profits from the spread between spot and futures prices, has been a newer and popular mechanism for providing stablecoin stability and yield. Up to a few months ago, yields could reach as high as 20% APR, yet have deteriorated somewhat more recently due in part to reduced funding rates.

Even so, protocols like Ethena have successfully integrated yield-bearing synthetic dollars (USDe) into DeFi ecosystems, offering innovative financial instruments. Ethena’s success with USDe is noteworthy, quickly climbing to become the fourth-largest stablecoin by market cap.

3. Isolated Lending Markets

Isolated lending platforms, such as Morpho and Euler, have been quite successful this year and are set for significant growth in 2025. These platforms provide specialized vaults tailored to unique risk profiles and individual needs, enhancing efficiency and safety in DeFi lending.

4. Yield Markets

Yield markets, pioneered by protocols such as Pendle, separate yield-bearing tokens into principal and interest components. This model allows users to lock in fixed yields, speculate on yield fluctuations, and contribute liquidity, greatly expanding DeFi’s yield-generation opportunities.

For institutional investors, yield markets offer a new way to earn more predictable returns by holding the principal side of the asset. Because many DeFi participants have a higher risk-return tolerance and are willing to buy Yield Tokens (YT) for potentially higher variable returns, demand for YT can be strong.

5. Real-World Asset (RWA) Tokenization

Tokenizing tangible assets, including real estate and commodities, is increasingly prominent. Protocols like Ondo’s USDY, Sky’s USDS, and WUSDM by Mountain are leading examples, enabling stablecoins backed by yield-generating real-world assets, bridging traditional finance and blockchain technology effectively.

These developments highlight DeFi’s adaptability and continuous innovation in response to user demands, market dynamics, and technological progress, solidifying its position as a cornerstone of the future digital financial landscape.

[ad_2]