According to the World Bank, 1.4 billion adults around the world remain unbanked. The global financial system, despite its unbelievably vast infrastructure, falls short of serving the global population equitably on many counts.

For many, the glittering promise of financial freedom is not merely a matter of surviving the rat race but also a tale of inflation and documentation.

Bitcoin-Backed Credit: A Lifeline for the Unbanked Globally

Millions of people remain underbanked or entirely unbanked due to strict credit requirements, high fees, and limited accessibility. From Palestinian refugees with no proof of citizenship, single women with no employment contract in Egypt, or the countless people facing exorbitant inflation rates of over 120% in Argentina.

During the 2008 financial crisis, countless individuals in the US lost their homes due to predatory lending practices, showcasing the system’s inherent vulnerabilities. Even today, high inflation erodes savings in fiat currencies, leaving consumers with fewer options to preserve their wealth.

Meanwhile, small businesses worldwide face rejection from banks due to rigid creditworthiness standards. One may even argue that money is perhaps the most violent political tool in the weaponry bag of the powers that be.

This gap in accessibility and fairness reveals the need for alternative financial systems. Bitcoin-backed credit offers a viable solution, overcoming both the political agendas and the economic limitations that keep poor people poor.

What Are Bitcoin-Backed Credit Systems?

Bitcoin-backed credit systems allow borrowers to use their BTC holdings as collateral to secure loans without selling their assets. These systems function similarly to secured loans, where a borrower pledges an asset to access liquidity.

If the borrower fails to repay, the lender liquidates the collateral to recover the funds. Unlike traditional loans, these systems do not require credit scores or extensive documentation, making them more accessible to crypto holders.

“High inflation, currency devaluation, and low trust in centralized banks could drive demand for Bitcoin-backed loans. Bitcoin’s stability and decentralized nature make it attractive in volatile economies, and DeFi platforms offer lower barriers and better terms compared to traditional lending,” Kevin Charles, co-founder of The Open Bitcoin Credit Protocol told BeInCrypto in an interview.

The market for Bitcoin-backed credit has grown, with key players like BlockFi, Ledn, Celsius, and Nexo leading the way. These platforms allow users to retain exposure to BTC while accessing fiat or stablecoin liquidity. The simplicity and appeal of these systems have fueled their adoption in recent years, one reason why they have faired peacefully throughout bear markets.

One major advantage of BTC-backed credit is the ability to retain exposure to Bitcoin’s price appreciation. Borrowers can unlock liquidity without selling their BTC, allowing them to benefit from potential long-term gains.

Additionally, Bitcoin-backed loans act as a hedge against inflation by offering an alternative to the ever-devaluing fiat currencies. A crypto holder in Argentina, for example, would be able to secure themselves against their dwindling national currency and even make extra cash.

According to Bankrate, USD now has an inflation rate of 2.4%, which is notably the lowest it has been since February 2021. Meanwhile, BTC has an inflation rate of just 1.7%.

Bitcoin Annual Inflation. Source: Woobull (Glassnode).

BTC-backed systems also promote financial accessibility. Unlike traditional banks, which require stringent credit checks, Bitcoin-backed credit platforms primarily assess the value of the collateral. This approach opens the door to individuals in regions with limited banking infrastructure, offering a lifeline to the unbanked.

For those who hold true to the ethos of decentralization, global inclusion is the real selling point. Bitcoin-backed credit has the potential to provide financial services to these populations, bridging the gap left by traditional systems. Central banks and global financial institutions remain privy to the whims and shifts of the ever-changing political playground.

In a nation like Lebanon, whose residents primarily transact in USD due to its effectively dead LBP, citizens were barred from withdrawing their own dollars when the central bank faced a dollar shortage crisis. For reference, one USD equals 89,550 LBP. In neighboring Egypt, rumors of impounded USD accounts also began circulating before being denied by central bank officials.

“Bitcoin-backed credit operates on a global, decentralized network, meaning access is not dependent on income, location, or credit history. By using Bitcoin as collateral, anyone holding the asset can access loans without traditional gatekeepers. Early DeFi platforms show increasing adoption in regions with limited banking access, highlighting the potential for financial inclusion,” Charles added.

However, even with all of these advantages, duality is the law of the universe. Bitcoin-backed credit systems are no cure-all solution; they carry significant risks.

The most glaring is Bitcoin’s price volatility. A sudden drop in BTC’s value can trigger margin calls, forcing borrowers to either add collateral or face liquidation. During the crypto market crash in 2022, countless borrowers lost their collateral as prices plummeted. According to Charles, there are ways to mitigate volatility.

“Volatility is managed through over-collateralization and automated liquidations. By requiring more collateral than the loan value, platforms create a buffer against price drops. Additionally, real-time monitoring ensures loans are adjusted to market conditions, maintaining stability even during price crashes,” Charles added.

The Three-Eyed Trojan Horse: Centralization’s Re-emergence

Even so, Bitcoin-backed credit systems have socio-economic implications that warrant examination. The first is that while these platforms democratize access to credit for crypto holders, they risk creating new financial gatekeepers. Wealthy crypto investors, or “crypto whales,” stand to benefit the most, while average users with limited holdings may find themselves excluded.

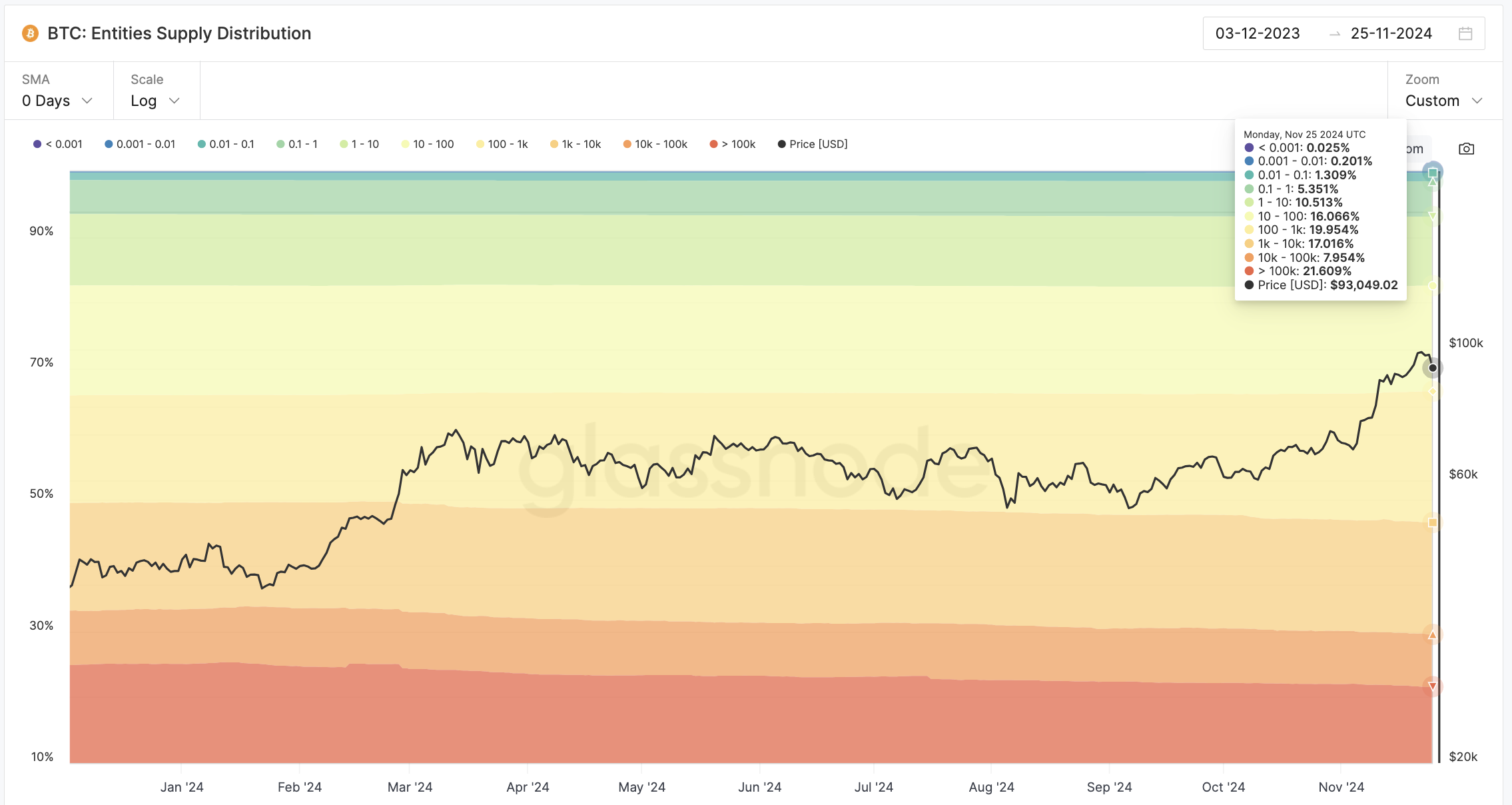

Whales, or addresses holding more than 100,000 BTC, hold 21% of the total Bitcoin supply. This dynamic means perpetuating wealth concentration within the crypto space as well. If that does happen, we can wave goodbye to the promise of inclusion.

BTC Coin Distribution. Source: Glassnode.

The second concern is traditional financial institutions. They are increasingly infiltrating the Bitcoin-backed credit market through acquisitions and regulatory influence.

Banks like Goldman Sachs and JPMorgan have begun exploring crypto-backed lending, signaling a convergence of decentralized and traditional finance. In November, Bloomberg reported that Goldman Sachs is preparing to launch a new company focused on digital assets. While these developments bring legitimacy, they also raise concerns about co-opting Bitcoin’s decentralized ethos.

Then enters the third and final Trojan horse: government oversight. It presents both opportunities and challenges for Bitcoin-backed credit systems.

Regulation can legitimize these platforms, ensuring consumer protection and stability. However, excessive regulation could stifle innovation and compromise decentralization.

For example, the European Union’s MiCA framework has introduced clarity but also imposed stringent compliance requirements, causing friction within the crypto industry. Binance, the world’s largest crypto exchange by trading volume, had to disable copy trading services for its European users in June after MiCA was announced.

Another issue that may impact accessibility is know-your-customer (KYC) standards, which may hinder those who rely on crypto wallets because they lack sufficient personal documentation. Policymakers often argue that platforms without strict KYC oversight risk assisting criminals in money laundering operations. In 2023, Turkiye even rolled out a new set of crypto laws aimed at tightening up KYC standards.

“We’re witnessing a re-centralization of a system designed to be free. The challenge is finding balance without diluting Bitcoin’s core principles,” Charles posed.

Platforms like Aave and Sovryn exemplify decentralized approaches to Bitcoin-backed credit. These systems rely on smart contracts to automate transactions, reducing the need for intermediaries and ensuring transparency. However, decentralization comes with its own challenges, including scalability, security vulnerabilities, and regulatory gray areas.

Still, success stories exist. Borrowers have used Bitcoin-backed loans to fund businesses, pay medical bills, or navigate economic uncertainty without selling their BTC. Conversely, others have faced significant losses due to liquidation during market downturns, highlighting the high stakes of these systems.

In conclusion, Bitcoin-backed credit represents both a financial revolution and a cautionary tale. Its future hinges on its ability to scale, remain accessible and adhere to Bitcoin’s ethos of decentralization.

As traditional finance enters the space and regulatory frameworks evolve, the challenge will be maintaining the balance between innovation and inclusivity. Whether these systems democratize finance or merely shift the gatekeeping remains to be seen.