[ad_1]

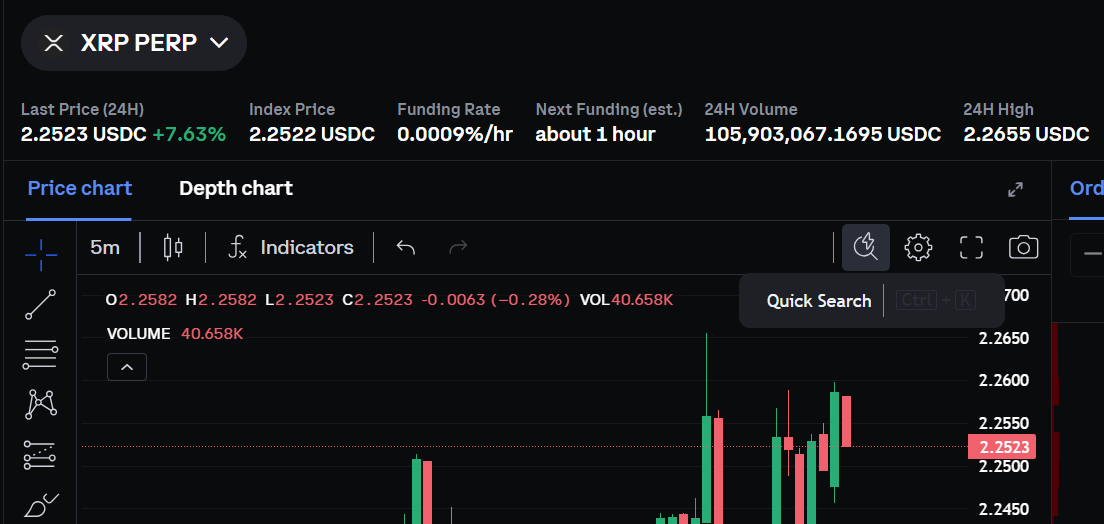

Coinbase officially launched XRP futures contracts on its U.S. Derivatives Exchange on April 21. The XRP futures saw strong performance, with daily trading volume already surpassing 100 million USDC. The strong start shows the increasing demand and interest from both retail and institutional traders.

The futures include two types of contracts, Standard Contracts representing 10,000 XRP, aimed at large institutions and active traders, and retail-oriented “nano” contracts representing 500 XRP each, or approximately $1,000 as of April 21, for retail traders and smaller institutions, as per the filings.

Coinbase expanded its offering adding to its 20+ existing contracts on assets like Bitcoin, Ether, Dogecoin, and Solana. The launch also follows recent additions of CFTC-regulated Cardano and Natural Gas futures.

Major exchanges like Coinbase, Robinhood and CME have been expanding their crypto futures offerings to cater to the rising demands. Coinbase now lists derivatives for over 92 assets globally and around 24 in the US. Derivatives trading on the exchange soared over 10,000% last year. The exchange is also reportedly eyeing Deribit acquisition to expand its presence.

Oregon Files Lawsuit Against Coinbase

Just days before Coinbase launched XRP futures, the Oregon Attorney General filed a lawsuit against the exchange claiming that the 31 tokens including XRP, UNI, LINK, AAVE, and MKR, are unregistered securities sold on Coinbase.

Paul Grewal, Coinbase CLO also condemned Oregon’s Attorney General for filing the lawsuit and warned that this lawsuit could not just harm Coinbase, but the entire crypto industry. He claimed the lawsuit lacked credibility and was motivated by political and financial interests.

[ad_2]