[ad_1]

Ethereum has started the week with a strong push from support levels, catching short sellers off guard and sparking a fresh round of bullish momentum.

The recent breakout is showing signs of strength, but key resistance levels still lie ahead.

Technical Analysis

By Edris Derakhshi

The Daily Chart

ETH’s daily structure remains bearish overall, with prices still trading well below the 200-day moving average, which is located around the $2,800 mark. However, buyers have stepped in at the critical $1,550–$1,600 support zone, leading to a clean rebound toward the $1,800 level.

This marks a short-term break in the bearish sequence, and if buyers manage to hold this momentum, the next hurdle sits around $1,950–$2,000. A potential breakout above this level will show if this recovery is serious or not.

The 4-Hour Chart

On the 4H chart, ETH broke out of a clear ascending triangle pattern, confirming a bullish breakout above the $1,700 mark. This structure had been forming for the last couple of weeks, and the breakout occurred on strong bullish candles, adding confidence to the move.

The asset quickly extended toward $1,800 after clearing the higher boundary of the pattern. The immediate resistance zone is now between $1,800 and $1,950, where past breakdowns have occurred. If ETH holds above $1,700, any dip may act as a retest and offer long opportunities, but failure to maintain above this level could trap late longs.

Sentiment Analysis

By Edris Derakhshi (TradingRage)

Taker Buy Sell Ratio

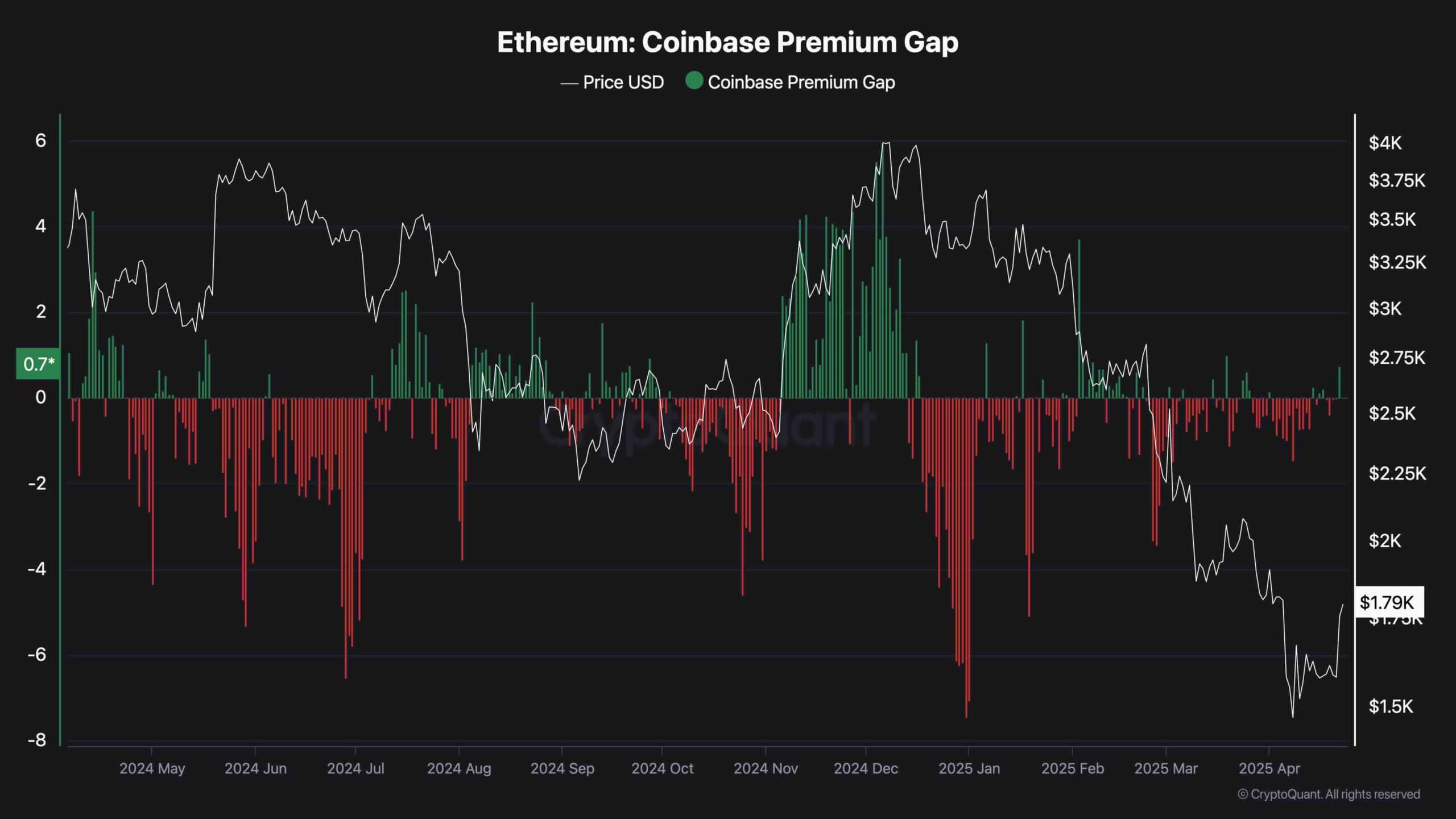

The Coinbase Premium Gap has flipped positive for the first time in weeks, indicating renewed buying interest from U.S.-based institutions. This shift is a subtle but encouraging signal that spot demand is returning. Moreover, the pattern of smaller red bars and the latest green bar spike on the chart shows reduced sell pressure, which aligns with the price rebound.

If this trend continues, it may support higher prices in the near term. However, a sustained premium will be needed to validate institutional interest and support further upside momentum.

[ad_2]