[ad_1]

Despite recent price struggles, Ethereum (ETH) appears to be facing significantly low selling pressure at the moment.

Ethereum has been the subject of ongoing jokes among crypto as it has grossly underperformed its contemporaries in recent years. Its price struggles have only been magnified with the crypto market going through a rough patch in the past two months.

While Bitcoin has been up 25% in the past year and XRP has been up nearly 300%, ETH has been down over 40%. But it may not be all doom and gloom for the asset.

Ethereum Selling Pressure Almost Non-Existent?

Despite recent price struggles, Ethereum seems to be experiencing exceptionally low selling pressure at the moment.

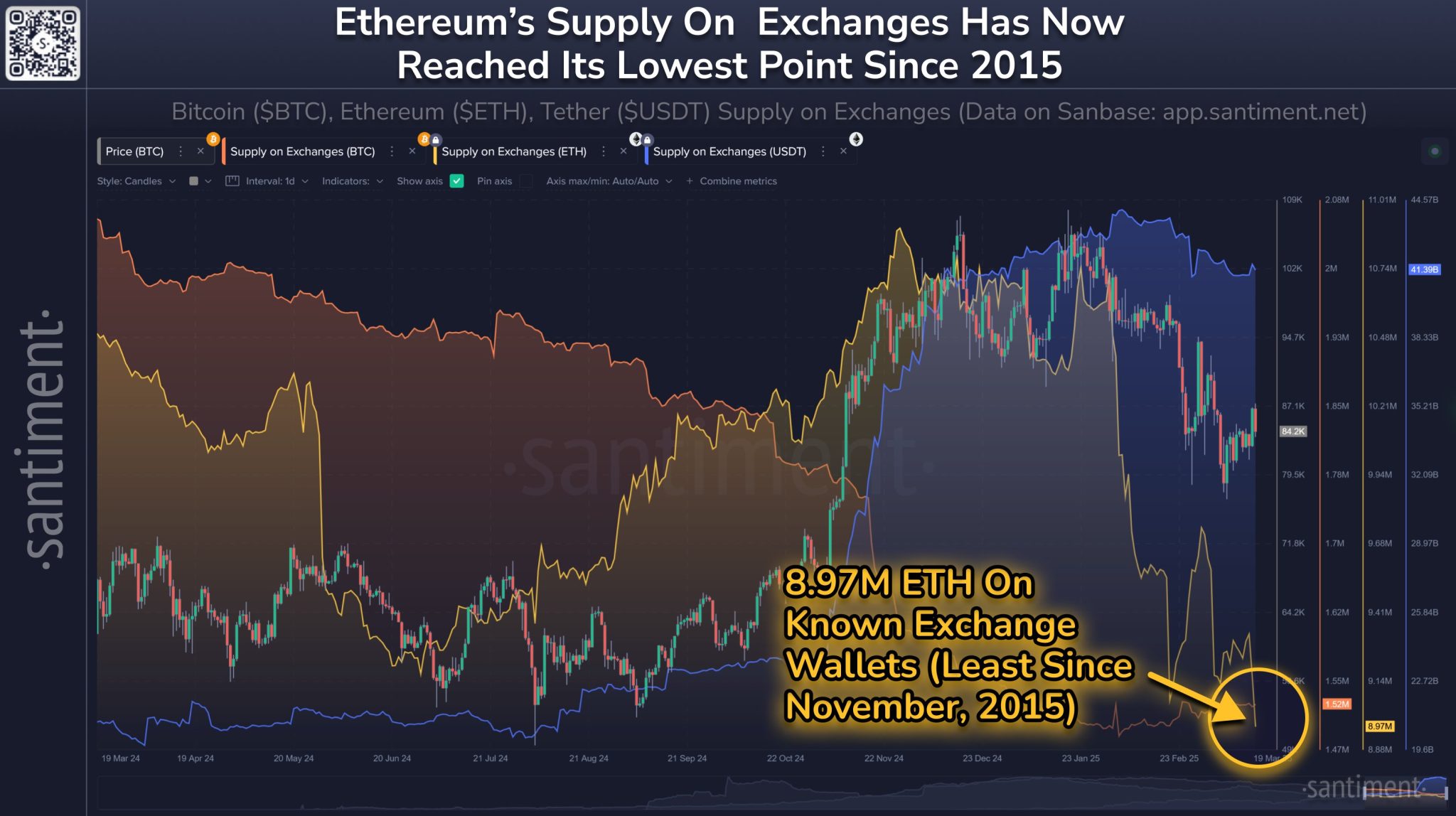

Specifically, Ethereum supply on exchanges is at ten-year lows, according to crypto analytics provider Santiment Feed.

In an X post on Thursday, March 20, Santiment disclosed that following a 16.4% drop in the past seven weeks, only 8.97 million ETH was on centralized exchanges, the lowest since November 2015

Ethereum supply on exchanges at lowest point since November 2015 Source Santiment Feed

This drop in Ethereum exchange supply can be seen as significantly bullish as it suggests only 7.4% of the nearly 121 million ETH supply is available for sale.

Why ETH Exchange Supply Dropping

Santiment noted that the recent decline in Ethereum supply on exchanges is the result of holders engaging in DeFi and staking activities. Amid declining market prices, these strategies could help holders mitigate some losses through yield-generating opportunities.

At the time of writing, ETH is trading at $1,971.66, down 2% on the day, as macroeconomic concerns continue to subdue risk markets.

Until these conditions clear up and demand for risk assets picks up, ETH is unlikely to feel the impact of any exchange supply shortages.

[ad_2]