[ad_1]

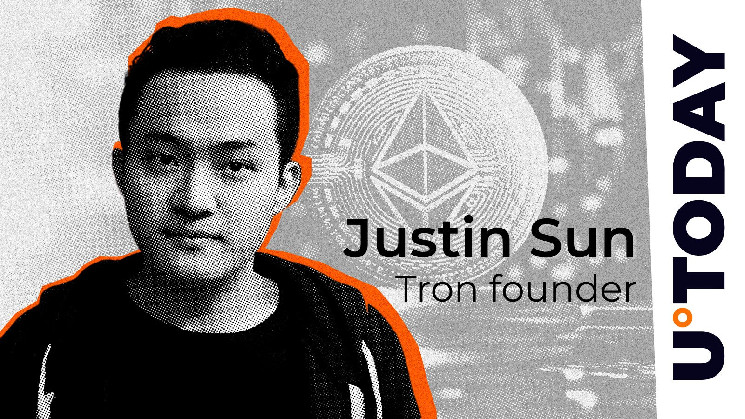

Justin Sun, a crypto billionaire and the creator of the Tron blockchain, has drawn the crypto community’s attention to a major issue on Ethereum that he sees as dangerous for its near future.

Sun addresses Ethereum’s leverage issue

Justin Sun believes that Ethereum is facing a big issue of high leverage used by traders when they conduct operations with ETH both on centralized and decentralized platforms. The Tron founder tweeted that in the short term this problem is likely to implode and “cause losses to protocols and DeFi projects” on the Ethereum network.

Sun urged the Ethereum team to address this issue at an earlier stage and “resolve some of the leverage” rather than wait for the issue to peak and explode, hurting Ethereum DeFi users.

“A negotiated solution is recommended,” he tweeted.

Leverage use on Ethereum expands rapidly

The issue mentioned by Justin Sun refers to the fact that excessive leverage in ETH-based trading has been increasing substantially lately. Particularly that can be seen in derivative markets, such as options and perpetual futures. Many traders have been increasingly using up to 50x (sometimes even 100x) leverage when trading ETH on large platforms. This leads to excessive risks of liquidations when price volatility skyrockets.

Another factor boosting this problem is ETH widely used as collateral in various Ethereum-based DeFi protocols. High leverage here means that a sudden drop in ETH price may cause mass liquidation of loans, which would strengthen bearish pressure on the market.

Also, when leverage becomes too high, this may lead to funding rates surging and in return could drive traders to start shorting ETH. This is likely to cause market corrections.

A commentator responded to Sun’s post, sharing data that as of today, Ethereum’s leverage stands at 5–10x on $50 billion in exposure, which represents roughly11–14% of its $440 billion market cap. This may constitute significant risk since daily liquidation volumes have already risen to $50-$70 million, showing active trading based on leverage.

Ethereum rebounds after 15% crash

Over the past 24 hours, the second largest cryptocurrency Ethereum has crashed by a staggering 15%, dropping to $1,811 earlier today. However, by now, ETH has rebounded by 6%, slightly pairing its losses and is currently trading at $1,920 per coin.

Ethereum here mirrored Bitcoin’s fall below the $80,000 level on Monday and the rise that followed.

[ad_2]