[ad_1]

Ethereum’s price is experiencing consolidation following its deep correction over the past month. However, key supports still remain in front of the price, making a bullish retracement stage possible.

Technical Analysis

By Shayan

The Daily Chart

Ethereum has undergone a deep correction over the past few months, eventually reaching the critical $2K support range. This level holds significant importance, as it has acted as a strong support zone since December 2023 and aligns with the crucial Optimal Trade Entry (OTE) levels.

If ETH breaks below this support, a notable downward trend may follow. However, given the historical demand at this level, the market is likely to consolidate, with a potential for short-term bullish retracements.

The 4-Hour Chart

On the lower timeframe, Ethereum’s bearish market structure remains intact. It is characterized by lower lows and lower highs, signaling continued seller dominance. Recently, the asset has seen heightened volatility around the $2K region, leading to large liquidations of leveraged positions.

However, a bullish divergence is emerging between Ethereum’s price and the RSI indicator, suggesting a gradual increase in buying pressure.

Given these factors, further consolidations within the $2K-$2.5K range are likely in the short term, with the possibility of heightened volatility and short-term price rebounds.

Onchain Analysis

By Shayan

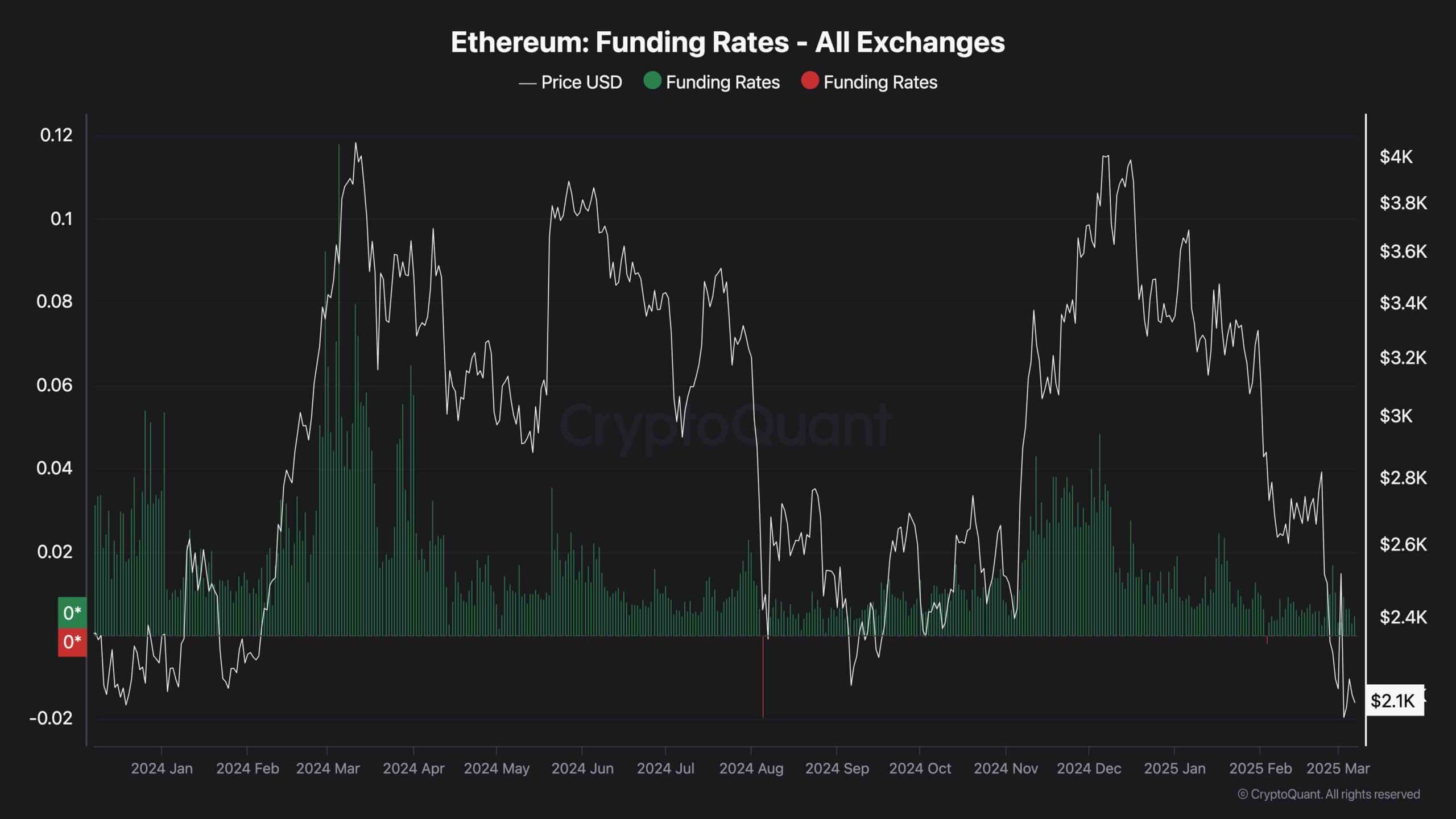

The funding rates metric is a crucial indicator of buyer vs. seller dominance in the Ethereum futures market. Since ETH’s recent peak at $4K, funding rates have been declining, indicating a rise in short positions and overall bearish sentiment. This increases the probability of a continued market correction in the short term.

While negative funding rates typically signal seller dominance, they also raise the chances of a short-squeeze event. If Ethereum experiences even a modest bullish rebound, a wave of liquidations of short positions could trigger a rapid price surge, pushing the market higher.

Ethereum’s ability to hold above the $2K support zone will be critical in determining the next major move. If ETH stabilizes, it could pave the way for a bullish reversal, with $2.5K and $3K as key resistance levels. However, continued selling pressure could drive the price below $2K, signaling a deeper downtrend. The next few days will be crucial in determining Ethereum’s short- to mid-term trajectory.

[ad_2]