[ad_1]

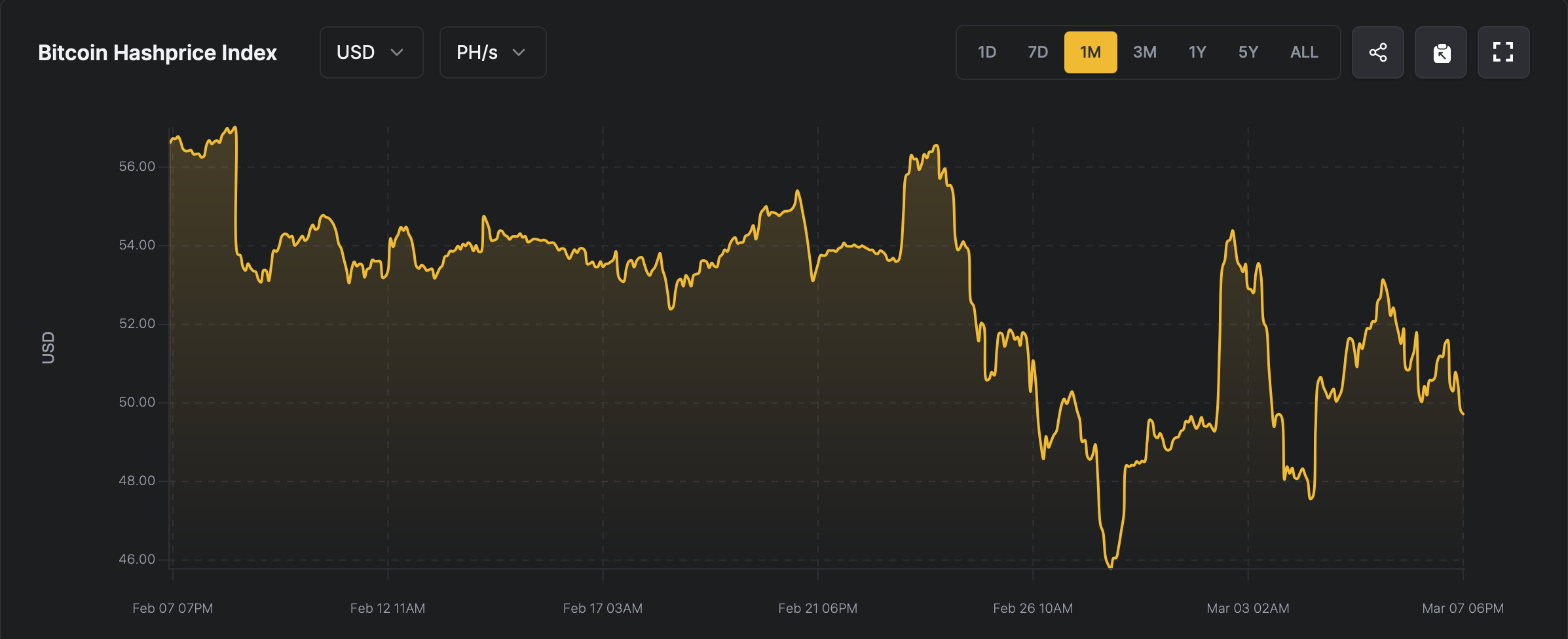

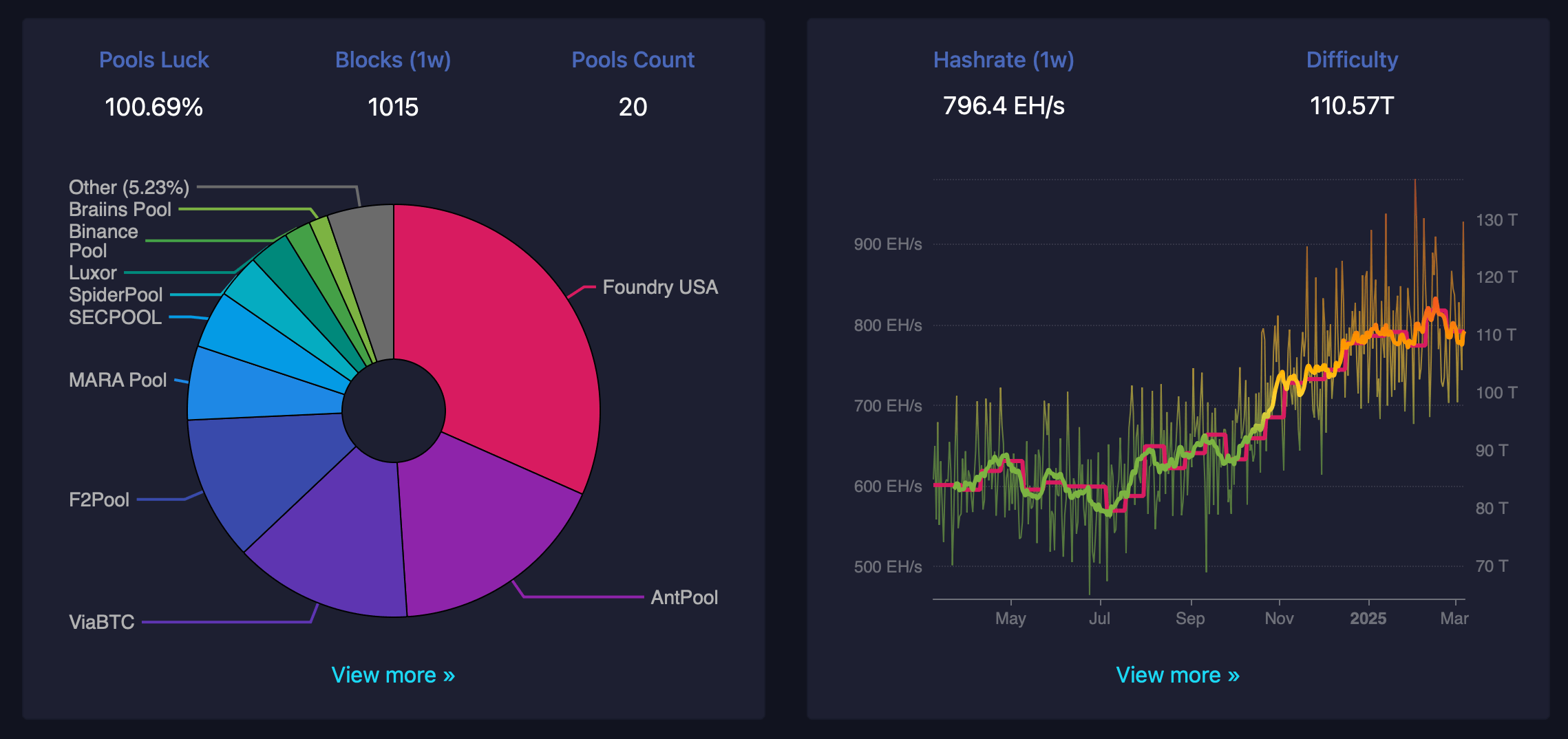

Bitcoin’s hashprice—the estimated earnings generated by operating 1 petahash per second (PH/s) of mining power—has dipped from $53.13 per petahash down to its current value of $49.81 over the past seven days. Meanwhile, Bitcoin’s total hashrate bounced back impressively from its Feb. 25 low, adding over 41 exahash per second (EH/s) to reach the present rate of 794 to 796 EH/s.

March Might Lack Magic for Bitcoin Miners as Profits Slide

In February, bitcoin miners earned $1.24 billion, down from January’s haul of $1.4 billion. This month’s first week alone saw miners pocketing $250.75 million, including $2.97 million derived directly from onchain transaction fees. For comparison, 30 days ago, Bitcoin’s hashprice previously stood at $56.73 per PH/s, significantly above today’s more modest figure of $49.81.

Current indicators suggest March might lack the charm of the preceding two months unless conditions shift favorably. However, there’s good news on the hashrate front, with mining power rising a solid 5.44% from its recent low of 753 EH/s to a healthier 794 EH/s. Within that total, the mining pool giant Foundry dominates with a 31.43% share, while Antpool contributes a substantial 17.44%.

Viabtc comfortably occupies third place, accounting for 13.99%, which together puts these three mining pools in control of 62.86% of Bitcoin’s 794 EH/s total. Currently, the outlook for bitcoin miners isn’t exactly sparkling, as they’re bracing for a potential difficulty increase of around 1.29% on or around March 9.

Right now, blocks are arriving at a snappy pace, averaging about 9 minutes and 52 seconds each. Meanwhile, those eager to expedite transactions via a high-priority transfer, face fees averaging 3 satoshis per virtual byte (sat/vB), translating to roughly $0.36 per transaction. Given the current trajectory, bitcoin miners are likely to navigate tightening margins unless there’s a notable shift in market dynamics or transaction demand.

With pools consolidating control and mining costs inching upward, profitability pressures could prompt strategic adaptations. Ultimately, the industry’s immediate future hinges on balancing rising network difficulty with maintaining efficient mining operations amid fluctuating revenue streams. And keeping fingers crossed that bitcoin’s market value takes a turn for the better.

[ad_2]