[ad_1]

Ethereum has recently sharply declined, dropping to the critical $2K support level. In the broader outlook, the price will likely consolidate within the $2K- $2.5K range until a breakout signals the next major move.

Technical Analysis

By Shayan

The Daily Chart

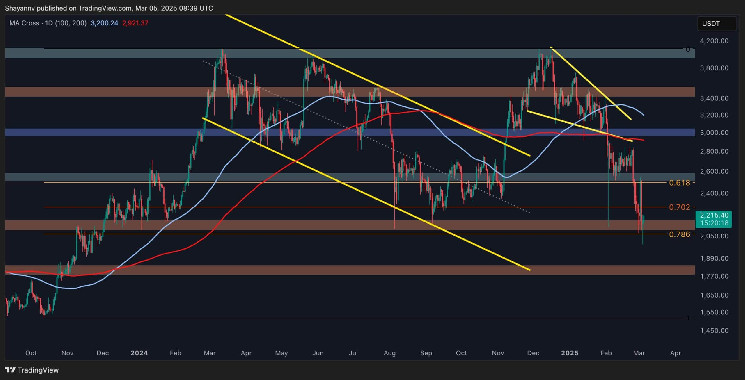

Ethereum has recently faced a sharp decline, plunging nearly 30% to reach the critical $2K support level. This drop followed a rejection at the 200-day moving average near $2.9K and was aggravated by market uncertainty triggered by President Trump’s tariff war announcement. The fear-driven sell-off has left Ethereum in a volatile state, but the $2K region has provided significant support, aligning with key ICT OTE levels.

For now, consolidation between the $2K and $2.5K range is expected as market participants wait for a breakout to dictate the next major move. If buyers fail to defend the $2K level in the coming weeks, further declines toward the $1.5K mark could become likely.

The 4-Hour Chart

On the lower timeframe, ETH recently attempted a bullish retracement but encountered strong selling pressure at the 0.5-0.618 Fibonacci retracement zone, leading to another sharp downturn. Upon revisiting the $2K support, which aligns with a critical sell-side liquidity zone, a temporary bounce occurred due to significant buying interest.

However, this rebound was short-lived, and Ethereum once again faced a wave of sell-offs, pushing it back toward the $2K level. This turbulent price action suggests heightened trading activity and notable liquidations in the perpetual markets, with nearly $980 billion being flushed out within 24 hours.

Given these conditions, Ethereum is expected to remain volatile, consolidating within the $2K-$2.5K range in the mid-term, with further liquidations potentially shaping the market’s next major move.

Sentiment Analysis

By Shayan

Ethereum recently experienced a sharp market downturn, triggering the largest liquidation cascade in years. This wave of liquidations wiped out numerous leveraged positions, as seen in the chart, leading to heightened volatility. Despite the severe drop, Ethereum found strong support at the critical $2K level, signaling potential stabilization.

With leverage significantly reduced, the perpetual markets have cooled down, creating an opportunity for a market reset. This shift could allow for fresh supply and demand dynamics as cautious traders re-enter at key price levels.

If Ethereum sustains its position above $2K and begins to build momentum, the current consolidation phase may evolve into a new bullish wave. Key resistance levels to watch are $2.5K and $3K. While short-term consolidation is expected, a sustained uptrend will depend on increased spot market demand, driving prices higher.

[ad_2]