[ad_1]

A recent Ethereum transaction caught widespread attention after a user paid 58.76 ETH, valued at $129,139, as a fee to transfer 285.85 WETH.

This unusually high fee, which occurred on March 4, has sparked discussions within the community about Ethereum’s transaction costs. Many users expressed frustration with the network, particularly in light of fluctuating gas fees, which had recently hit a five-year low before seeing an increase.

High Fee Sparks Community Reactions

Users on social media reacted strongly to the high transaction fee, questioning Ethereum’s efficiency and cost structure. Some users cited the network’s slow transaction speeds and high costs as major drawbacks, arguing that security alone is insufficient if fees remain unpredictable.

Meanwhile, the fee anomaly occurred just as Ethereum gas fees dropped to their lowest level in five years. The average transaction fee is currently at an average of 0.642 gwei. This significant decline followed years of fluctuating costs, with gas fees peaking at 709.7 gwei, or approximately $196 per transaction, in 2020 due to increased DeFi activity and NFT adoption.

Ethereum’s Fee Trends Show Volatility

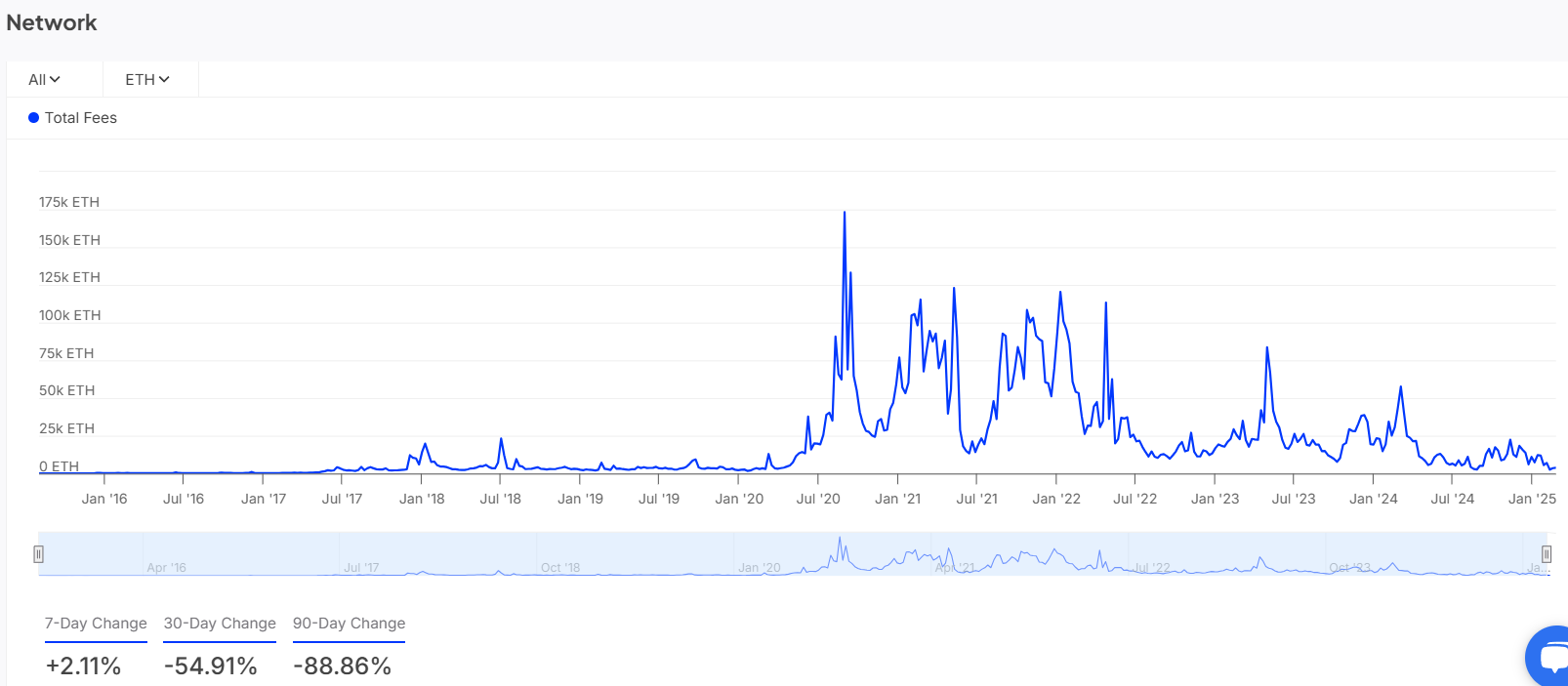

A historical analysis of Ethereum’s total fees suggests fluctuating costs over time. According to IntoTheBlock data, the seven-day change in total fees remained positive at +2.11%, indicating a recent increase.

Ethereums Total Fees

However, the 30-day and 90-day changes stood at -54.91% and -88.86%, respectively, signaling a longer-term decline in fees.

Ethereum’s gas fees have long been a subject of comparison, especially against Solana, which offers lower transaction costs and higher throughput. While Ethereum’s fee reduction was notable, recent data suggests shifts in transaction costs across different blockchains.

Solana’s Fees and Market Comparison

Solana’s network activity has continued to rise, influencing its transaction fee structure. In February, on-chain data from Glassnode showed that Solana’s seven-day average transaction fees had consistently outpaced Ethereum’s since January 9, 2025.

Although Solana’s fee dominance weakened in February, the weekly difference remained above $3 million.

[ad_2]