[ad_1]

While the quantity of ethereum held by liquid staking platforms has remained static within a narrow band of 13.6 to 14 million since Q4 2024, Binance’s derivative for staked ether has undergone a dramatic expansion, ballooning 27.27% since mid-November.

Ethereum Liquid Staking Conquest

Rocket Pool, the ether liquid staking protocol, long lingered in the shadow of Lido, the dominant liquid staking derivative network. Today, the narrative pivots: Binance’s derivative offering, wrapped binance beacon ether (wBETH), has eclipsed rivals to secure its rank as the second-largest protocol trailing only Lido.

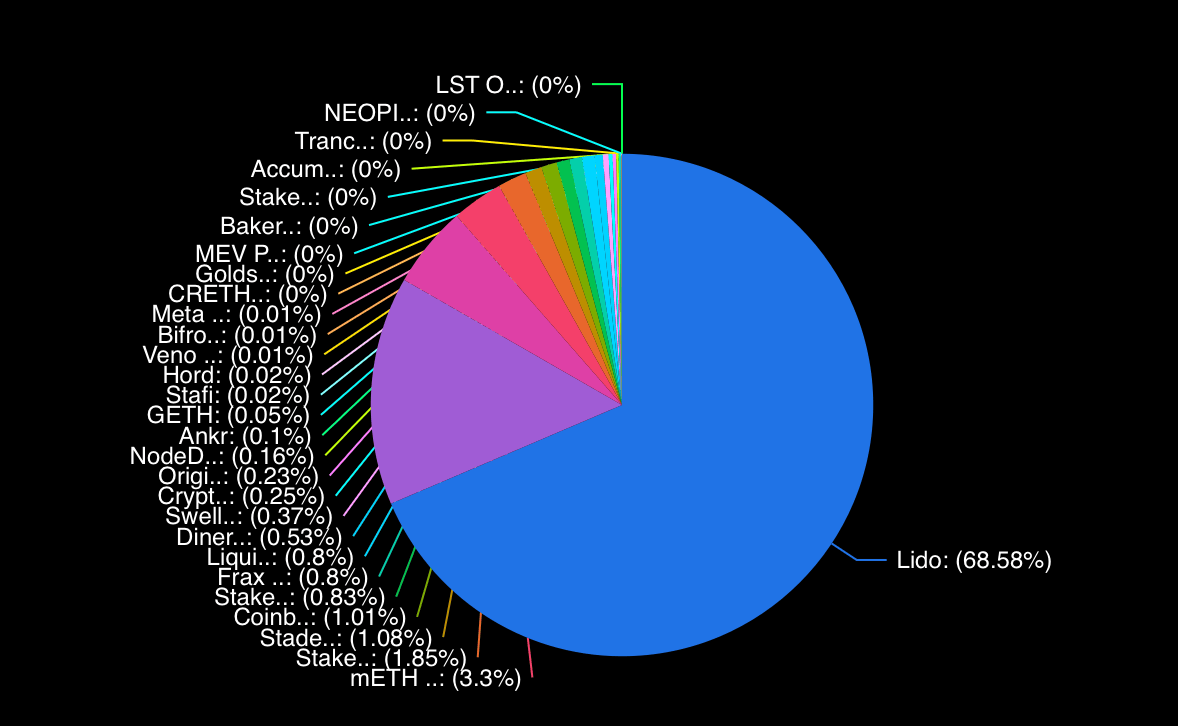

A pie chart of the total value locked ETH (13.68 million) percentages via defillama.com stats.

This shift highlights a quiet yet potent realignment in the sector, defying prior expectations of market inertia. Archived Etherscan records from Nov. 19, 2024, detail the minting of 1.43 million wBETH tokens at inception, distributed across 3,304 addresses managing Binance’s liquid staking derivative.

Three months and sixteen days later, wBETH’s Ethereum-based supply has climbed 27.27% to 1.82 million tokens, while 189,689.74 wBETH circulates on BNB Chain—yielding a combined total of 2,013,541.54. Ownership now spans 4,461 Ethereum addresses and 6,681 BNB Chain wallets, reflecting broadening adoption.

Rocket Pool, once the unchallenged second-place protocol with over one million ETH staked, now circulates 443,596.87 rETH. Despite diminished supply, its holder base has ballooned to 19,391 wallets. Yet its position grows precarious as competition intensifies.

Mantle Network’s mETH looms with 426,121.19 tokens—a hair’s breadth from rivaling rETH—while attracting 9,864 holders. Lido’s stETH maintains ironclad dominance, constituting 68% of the 13.68 million liquid staking derivatives. Ethereum’s blockchain currently hosts 9.39 million stETH, per onchain metrics.

[ad_2]