[ad_1]

Will the short-term recovery in Bitcoin (BTC) price, reflecting bearish exhaustion, push the price back above $95k?

After a brief recovery over the past 24 hours, Bitcoin’s price has reclaimed the $94,000 level, initiating a V-shaped recovery from a low of $91k.

Will this recovery drive Bitcoin’s price toward the $100,000 mark?

Bitcoin Price Analysis

On the 4-hour chart, the BTC price trend reveals significant demand for Bitcoin at the $90,742 support level, resulting in an early reversal from the 24-hour low of $91,215. This reversal has led to three consecutive bullish candles.

Moreover, the bulls have managed to reverse the large 4-hour bearish engulfing candle, which had caused a 2.45% drop the previous night. However, the ongoing correction has caused the 50 and 200 EMA lines to converge, threatening a potential death cross.

As mentioned in our previous article, the bullish divergence in the RSI line led to a quick reversal rally after trapping the bears below the $92,654 support level. With the rising RSI, momentum is clearly increasing, suggesting that a bottom may be forming in the ongoing correction.

Bitcoin Derivatives Turn Green

Despite the short-term recovery, the 24-hour liquidations in the crypto market have reached $367 million, with bullish players losing $254.53 million.

However, short-term recovery is evident, with $13 million in liquidations occurring over a 4-hour period—$10.48 million of which came from bearish positions.

Bitcoin Derivatives

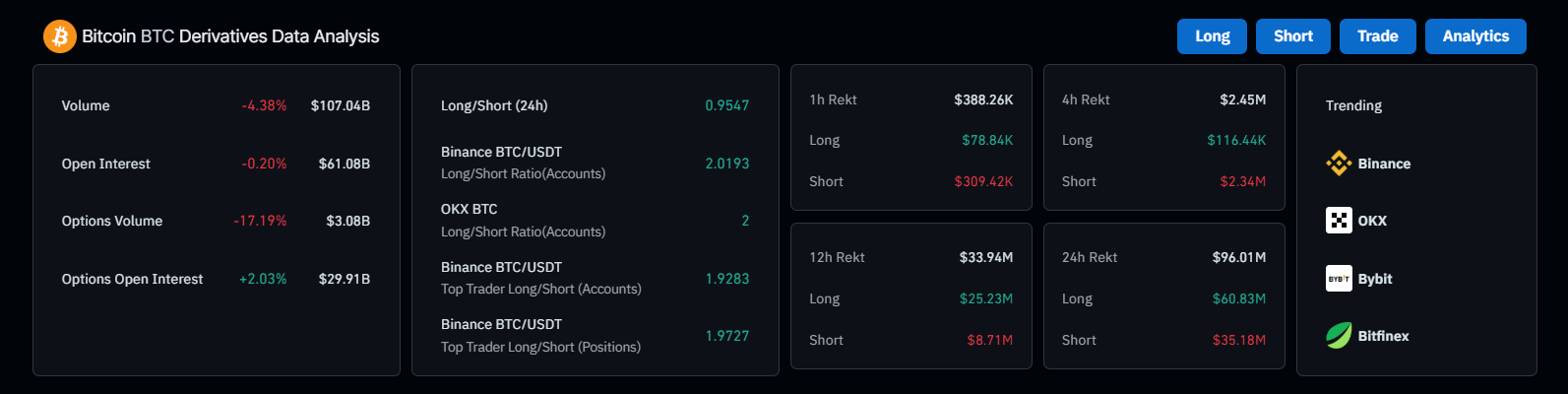

The Bitcoin derivatives data shows that open interest is holding steady above $60 billion, currently at $61.02 billion. The long-to-short ratio has improved slightly to 0.9539. While the ratio is still below 1, it favors shorts.

Additionally, the funding rate is gradually improving, rising from 0.0010% to 0.0044%. This suggests increased demand for long positions as traders grow more optimistic about Bitcoin’s recovery.

BTC Price Target

As the recovery continues, Bitcoin is approaching the $95,190 resistance level, with bulls gradually taking control. Based on BTC price action, a breakout could face resistance at the 200 EMA, which sits at $96,216.

On the other hand, a reversal from the 20 EMA near the $95,119 level could test the $90,742 support level.

[ad_2]