[ad_1]

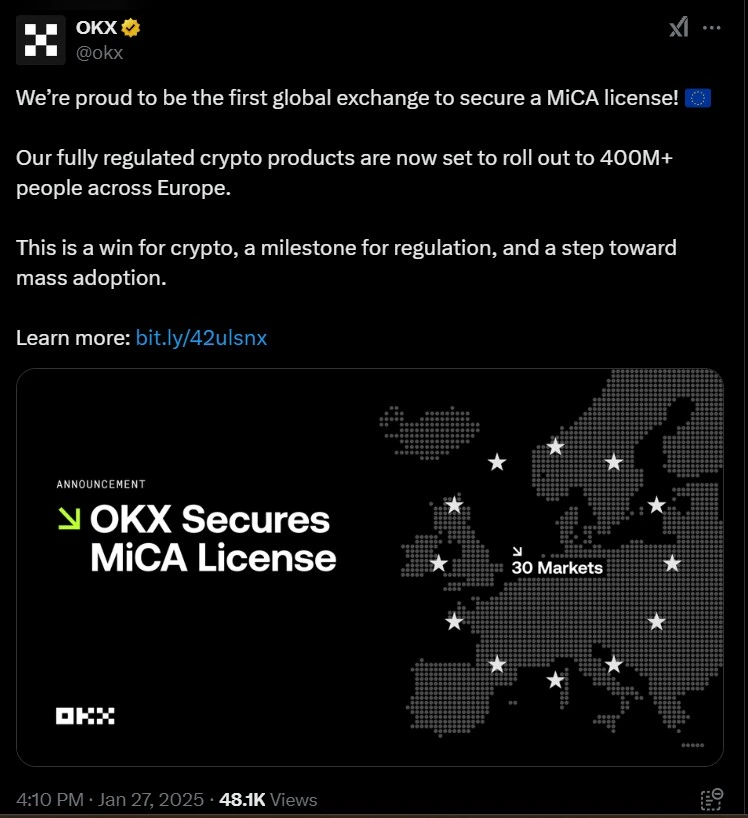

OKX and Bitpanda recently announced on their X accounts that they both have secured their Markets in Crypto-Assets (MiCA) licenses. OKX announced that it is the first global exchange to obtain this license. This will let the exchange offer fully regulated crypto products to over 400 million people across Europe. Similarly, Bitpanda received its license from Germany’s BaFin, one of the top financial supervisory body of Europe.

OKX announces securing MiCA license

Bitpanda announces securing MiCA license

Why MiCA Licenses Matter?

A MiCA license has become this prestigious license to hold in the crypto industry because it has been designed to ensure transparency, security and trust while innovation paves its path within the European region. With this framework it also makes sure that the regulations brought into force are uniform for all crypto companies and protect the investors.

For OKX and Bitpanda, with this license in their hands, both the exchange companies can now easily expand their services across the EU’s 450 million citizens.

Unlocking the European Crypto Market

Europe is currently being viewed as an emerging country for cryptocurrency adoption because of its clear regulations such as MiCA. OKX’s MiCA license paves the way for mass adoption, while Bitpanda emphasizes its readiness to deliver secure and transparent services across the region.

With this license in place, more and more institutional and retail investors are expected to increase in the region which may position Europe as a global hub for innovation in the digital asset space.

This milestone also indicates that there is a great scope for other exchanges to explore such opportunities in the European region that would allow innovation within the industry and position Europe as one of the most sort after country in terms of crypto regulations.

Also Read: Brazil Suspends Crypto Rewards for Biometric Data Collection

[ad_2]