[ad_1]

The growing popularity of stablecoins has seen the market cap hit a new high with USDT continuing to dominate the stablecoin market.

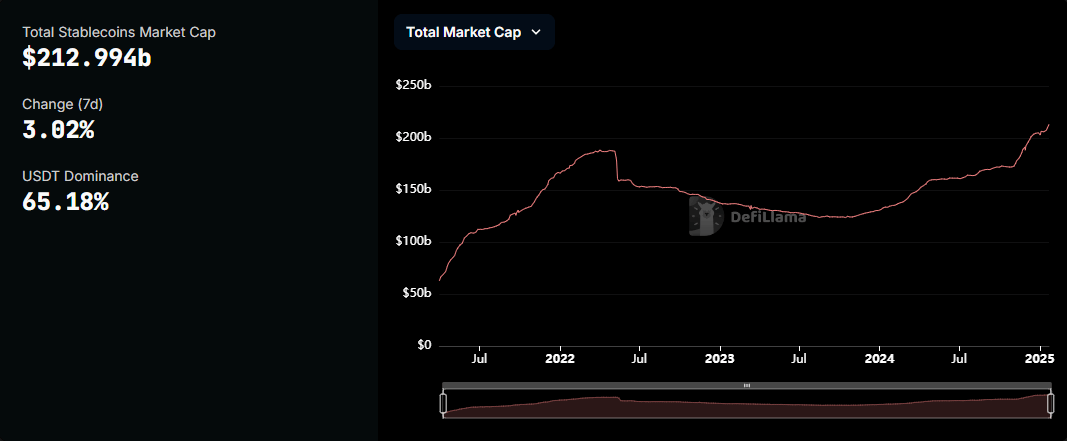

New Market Cap High for Stablecoins

The overall market capitalization of stablecoins across all networks hit $212.99 billion, setting a new record. This is according to data from Defillama, a decentralized finance total value locked (TVL) aggregator.

The market cap of stablecoins grew by 3.02% over the past seven days to hit this historic milestone. Tether‘s USDT with a market cap of $138.83 billion continued its stablecoin market dominance with a 65.18% market share.

Its closest competitor, Circle’s USDC saw its market value increase by 11.23% over the past seven days to bring its market cap to $50.86 billion with a market share of 23.88%.

The other stablecoins in the top five include Ethena’s USDE with a $5.73 billion market cap and a market share of 2.69%, DAI with a $4.65 billion market cap and market share of 2.18%, and Sky Dollar’s USDS with a $2.14 billion market cap and 1.01% market share. Together, the top five stablecoins account for 92% of the total market share.

Recently, Coinbase CEO Brian Armstrong suggested that new U.S. stablecoin legislation may force issuers to fully back their tokens with U.S. Treasury bonds which could impact offshore issuers like Tether’s USDT.

[ad_2]