[ad_1]

Trump-based politiFi tokens rallied ahead of the United States election with some posting gains over 120% in the past 24 hours.

MAGA Hat (MAGA), MAGA (TRUMP), Doland Tremp (TREMP), Super Trump (STRUMP), TrumpCoin (DJT) and other meme coins themed around former U.S. president Donald Trump saw significant gains as the overall market cap of PolitFi coins rose 5.4% bringing it to over $685 million in valuation.

Meanwhile, Kamabla (KAMABLA) was the only meme coin spun around Vice President Kamala Harris to see a positive day. KAMABLA surged 32.7% over the past day with an intra-day high and low of $0.00078 and $0.00049 respectively.

Political meme coins gained traction as the hype around these tokens peaked with the Presidential elections set for Nov. 5, an event expected to shape the future of the crypto sector in the U.S. and globally.

Trump tokens took the lead despite narrowing odds of the former President winning across prediction platforms. Polymarket data shows Trump’s chances of winning have dropped from 66.9% seen on Oct. 30 to 56% when writing.

Meanwhile, Harris saw her chances rise from 33.5% to 44% reflecting a shifting market sentiment, as investors leaned towards the idea of an unpredictable outcome based on historical inaccuracies of polls during past election years.

You might also like: Trump’s lead over Harris on Polymarket weakens, as Bitcoin drops to $68,000

Earlier on Nov. 3, the majority of Trump-themed meme coins faced a downturn following some agitated remarks made by Trump during the republican candidate’s Milwaukee rally. However, most of the tokens have since recovered and offset the past day’s losses.

Yet, based on the recent price action of these tokens it seems investors remain slightly biased towards Trump’s chances of returning to the white house.

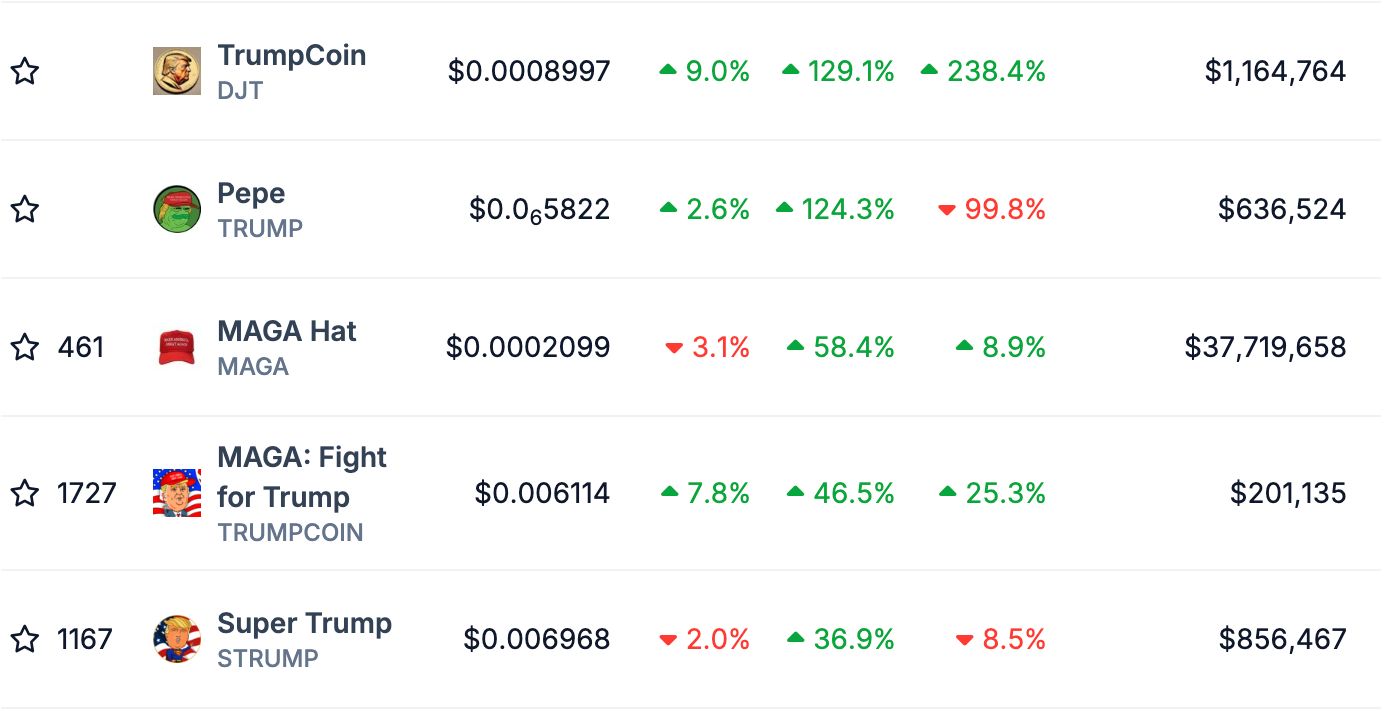

DJT was up 129.1%, placing it as the leading gainer while Pepe (TRUMP) saw gains of over 124.3% over the past day. Other popular meme coins MAGA, TRUMPCOIN, STRUMP, MAGA Pepe (MAPE) and TREMP posted gains of 58.4%, 46.5%, 36.9%, 28.2% and 14.3% respectively.

Source: CoinGecko

Trump has widely been regarded as a crypto-friendly president in recent years. He has pledged to launch a Bitcoin reserve for the U.S. aimed to curb the $35 trillion U.S. debt over the years ahead. He has also committed to making the U.S. ‘crypto capital of the planet.’

Price rallies around these cryptocurrencies are primarily driven by the hype surrounding elections and other political events, leading traders to classify them as ‘event coins.’ Tokens themed around each candidate are likely to surge based on election outcomes but are expected to pull back once the initial excitement fades.

However, some experts suggest that if these tokens develop tangible utility, they could eventually shed their meme coin status and gain a more stable footing in the market.

Read more: Donald Trump celebrates Satoshi’s whitepaper anniversary

[ad_2]