[ad_1]

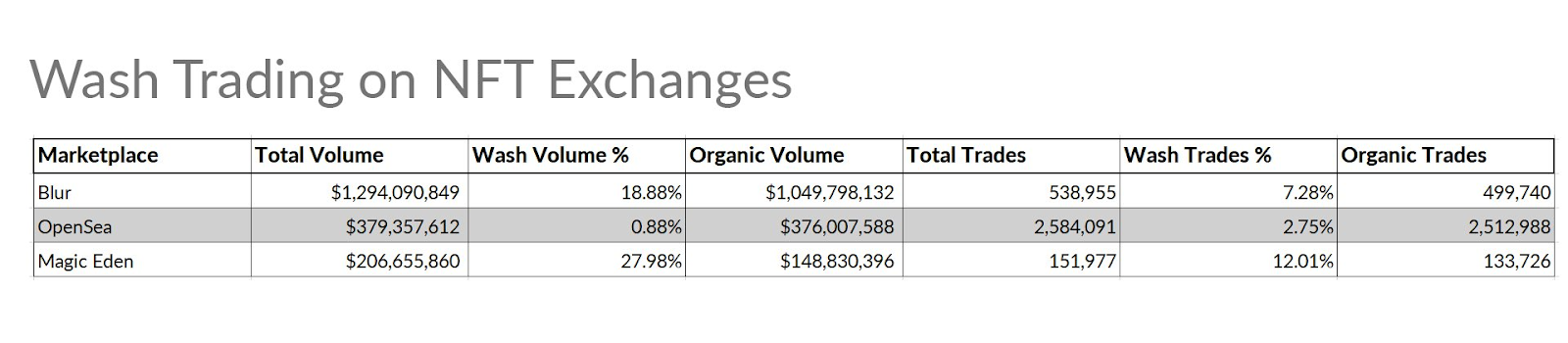

The NFT market has seen significant levels of wash trading, where traders engage in artificial trades to inflate trading volume. Data from Blur, OpenSea, and Magic Eden highlight this trend. Blur leads in wash trading volume with 18.88%, followed by Magic Eden at 27.98%. OpenSea has the lowest at 0.88%.

Among the collections, Blur and Magic Eden have high wash-trading levels. Blur’s total volume is $1.29 billion, with 18.88% attributed to wash trading, resulting in an organic volume of $1.05 billion. Magic Eden’s total volume is $206.66 million, with 27.98% wash trading, leaving an organic volume of $148.83 million.

OpenSea, the leading marketplace, has the least wash trading volume at $379 million, with only 0.88% wash trading, maintaining a healthy organic trading volume of $376 million.

NFT Wash Trading Volume (180 Days):

The more prominent the nft, the more volume from wash trading there could be

This is a crypto feature, not a bug

Anyone looking to learn more about NFTs or becoming a greater participant should recognize the signs

These are some of them:… https://t.co/lqyw1bbRoF pic.twitter.com/3JdhcIVI78

— Andrew Forte (@TheAndrewForte) June 3, 2024

Renowned NFT collections also have varying wash trading volumes. Bored Ape Yacht Club (BAYC) has the highest actual volume of $249.81 million, with $24.62 million attributed to wash trading. Mutant Ape Yacht Club (MAYC) follows with a volume of $127.58 million, including $12.08 million from wash trading. Collections like Azuki, Milady, and Ethlizards have lower wash trading volumes, suggesting different trading patterns across collections.

Source: Forte’s X account

Understanding wash trading and its patterns is crucial for traders. Common indicators include:

-Stable prices with no regard to the highly priced buy.

-Low social media interaction with high trading activities.

-Multiple trades involving the same buyer in a short period of time.

-A single address engaging in high-frequency trading of a specific NFT.

Wash trading is prevalent in the NFT market. Investors need to be well aware of this so they can identify red flags and the market dynamics to make informed investment decisions.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

[ad_2]