[ad_1]

Bitcoin’s value fell by 6% in April, diverging from traditional safe-haven assets like gold and the US Dollar, which experienced a rally amid the Middle East conflict escalation. According to a report by on-chain analysis firm Kaiko, the halving event and its usual volatility are among the factors influencing this trend.

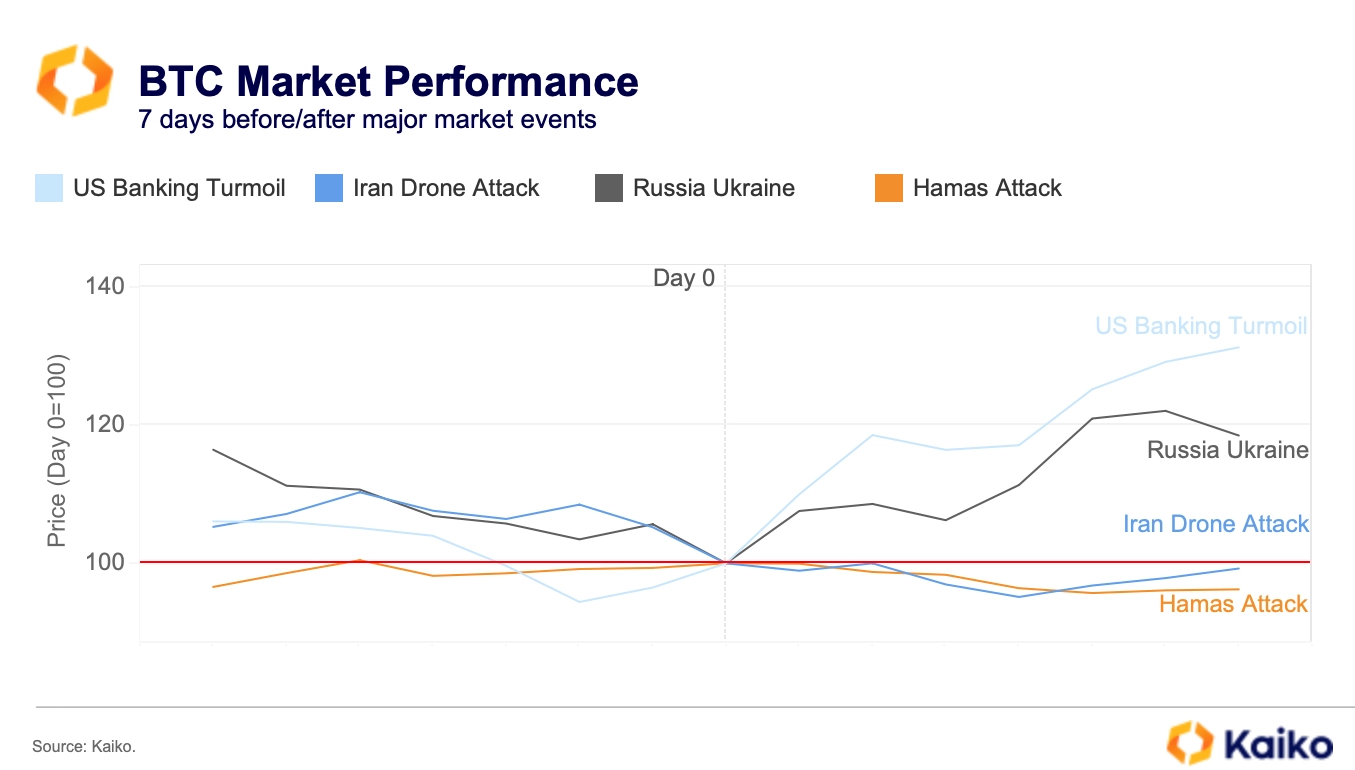

Despite Bitcoin’s previous surges in response to the US banking crisis and Russia’s invasion of Ukraine, its reaction to other significant events such as the Hamas attack on Israel was negligible. Moreover, performance as a safe-haven asset is inconsistent across different fiat currencies, with currency devaluation often prompting increased crypto adoption.

As Kaiko analysts mentioned, this could be tied to the halving. Trader Rekt Capital shared his analysis on the current state of this Bitcoin cycle, concluding that its price is in a post-halving accumulation range. This could be the last chance investors might have to buy BTC between $60,000 and $70,000, adds the trader, as a “parabolic uptrend” will potently start after this period.

Nevertheless, Bitcoin’s derivatives data are still strong. Funding rates for perpetual contracts remained close to neutral despite briefly flipping negative in the lead-up to the halving, which means short sellers are paying longs to maintain their positions. Overall, open interest remains elevated above $10 billion, even though it has retreated from a record high in dollar terms in March.

[ad_2]