[ad_1]

Quick Take

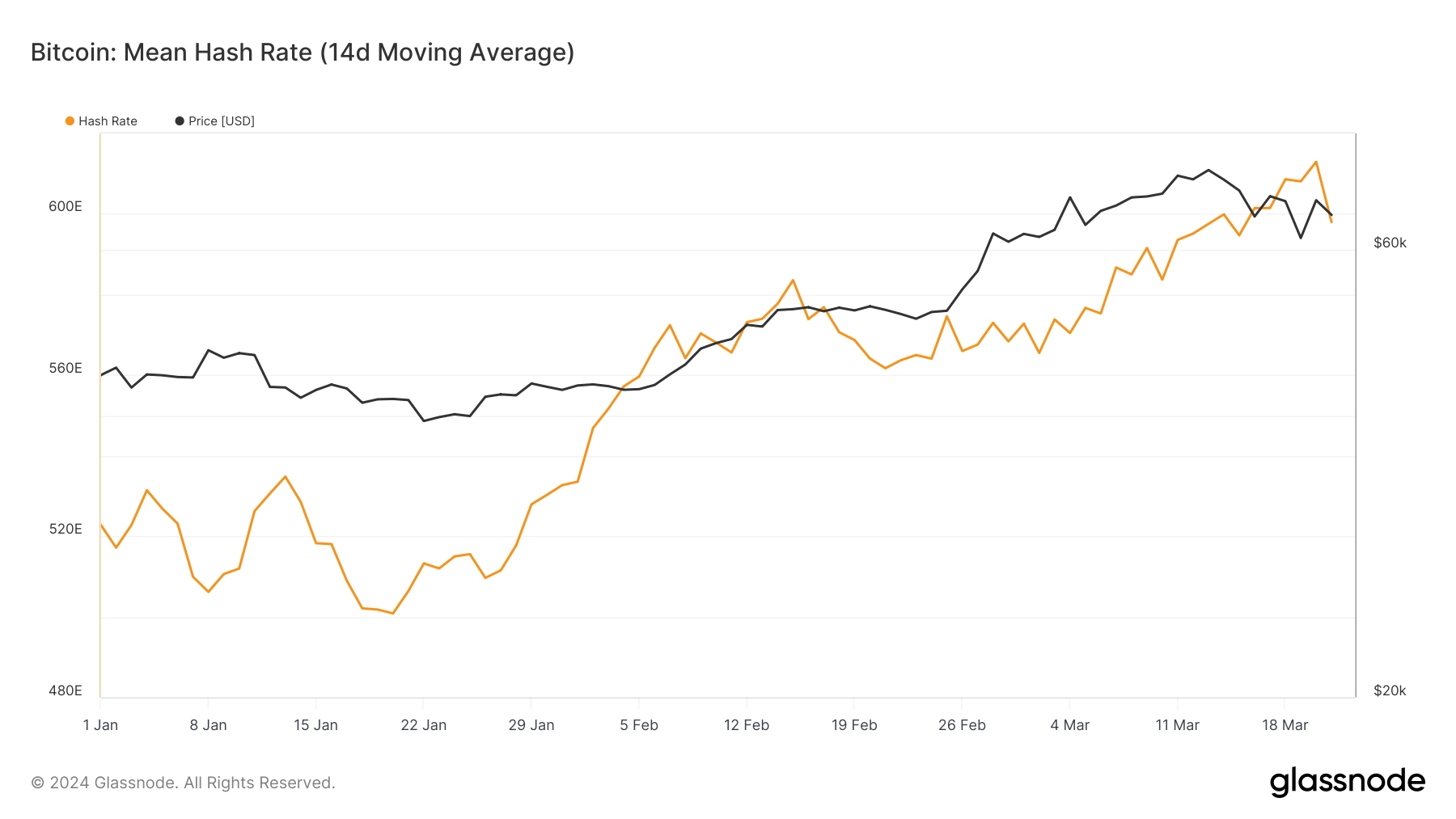

As the Bitcoin halving nears, now just under 4,300 blocks away and slated for April 20, the network has experienced a notable surge in hash rate, registering a 15% increase in 2024. The 14-day moving average hash rate is approaching record levels, currently peaking at approximately 598 eh/s.

This upswing in hash rate suggests that miners are ramping up their operations to optimize earnings before the halving event, a sentiment echoed by Mike Alfred, a board member at IREN Energy. Alfred predicts a notable post-halving correction in the global hash rate, attributing this to the widespread use of older mining equipment struggling to remain profitable.

Supporting this observation, CryptoSlate previously highlighted the trend of increasing hash rate as a halving event nears, noting that such growth is typical in the 4-6 months leading up to a halving.

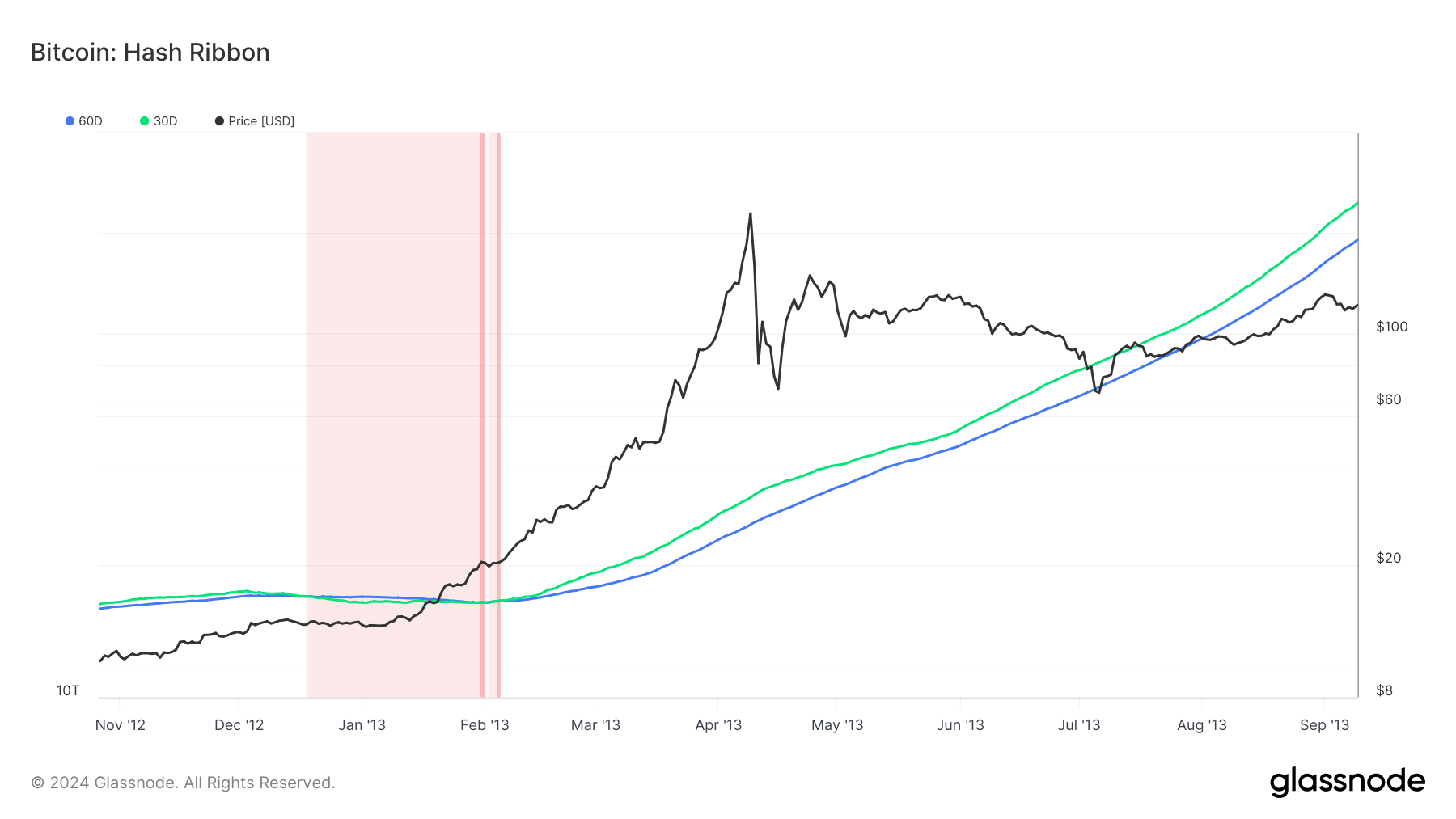

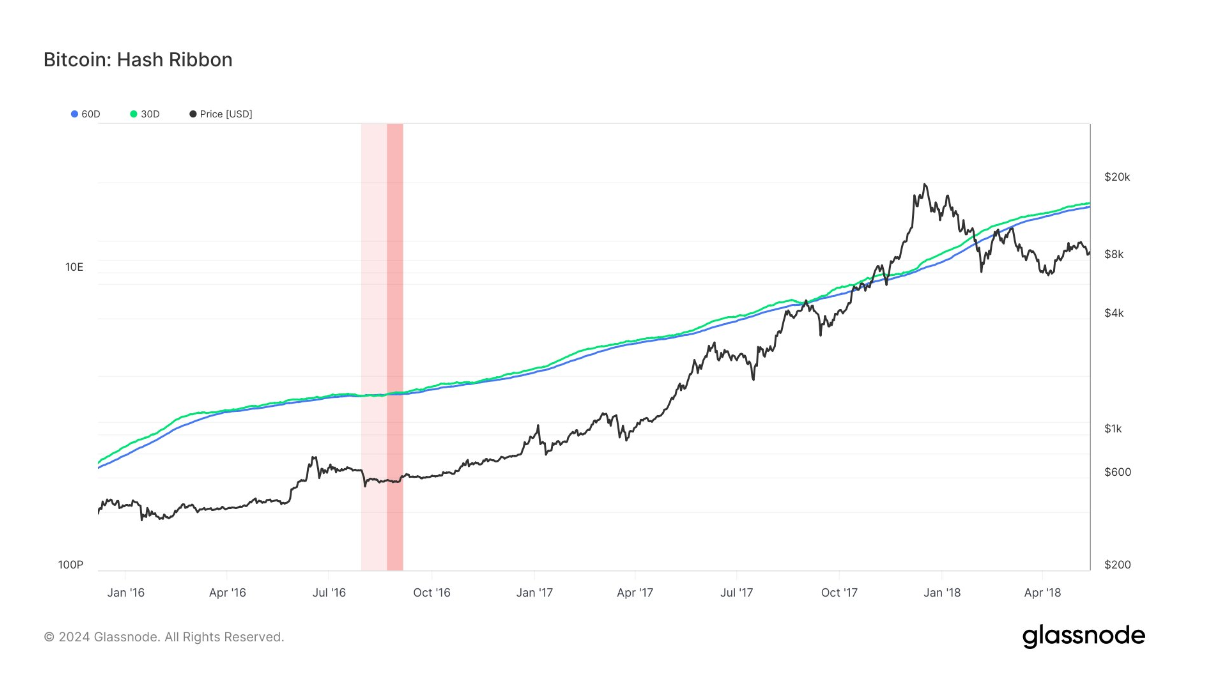

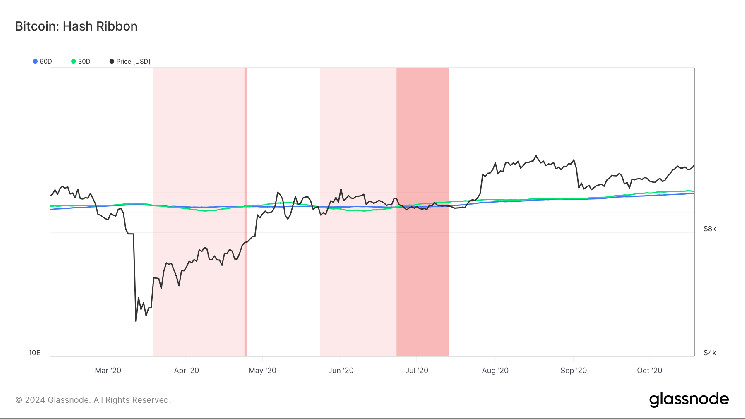

Historical analysis shows a consistent pattern of miner capitulation post-halving, with significant drops in hash rate: 39% in December 2012, 11% in August 2016, and 26% in May 2020. Considering these precedents, a similar downturn, approximately 25% based on the average of past events, is a reasonable expectation following the next halving.

The Hash Ribbon analysis, a notable market indicator for predicting Bitcoin’s price bottoms linked to miner capitulation, further illuminates the anticipated trend. This indicator identifies shifts from negative to positive price momentum when the 30-day moving average (MA) of the hash rate crosses above the 60-day MA. Such a crossover signals the conclusion of the most intense phase of miner capitulation.

Examining three distinct instances, it’s observed that miner capitulation typically begins when the 30-day MA falls below the 60-day MA, a pattern often seen post-halving. Approximately a month following this crossover, the 30-day MA tends to rise above the 60-day MA. An appreciation of Bitcoin’s value usually accompanies this transition.

[ad_2]