[ad_1]

Tokenization platform and DeFi protocol Ondo Finance’s total value locked (TVL) broke over the $2 billion mark this week, marking a record high, according to DefiLlama data. The figure is more than double its TVL from early March of last year.

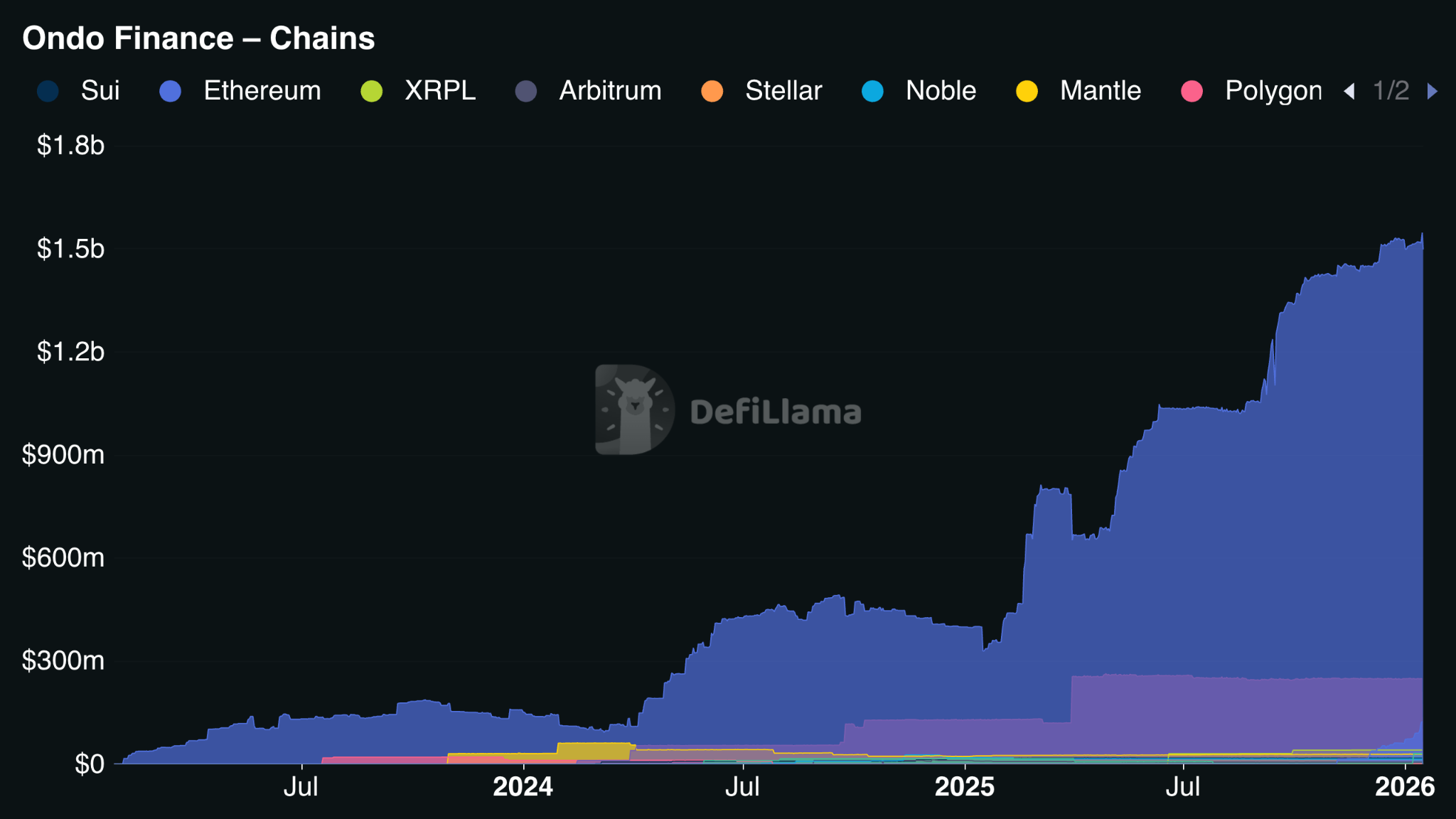

Ondo Finance’s TVL. Source: DefiLlama

The move highlights the rapid growth of real-world assets (RWAs) on-chain, particularly tokenized securities and U.S. Treasuries. As The Defiant reported previously, 2025 was a breakout year for the tokenized RWA sector, and analysts estimate that the total value of RWAs on blockchains could reach about $2 trillion by 2030 under base-case scenarios.

Ethereum remains the dominant network for Ondo’s tokenized assets, with roughly $1.5 billion in value on the chain as of press time. Solana follows with about $248 million, while BNB Smart Chain accounts for around $123 million.

Ondo TVL by chain. Source: DefiLlama

As TVL has expanded, Ondo Finance’s flagship OUSG product — a fund holding tokenized short-term U.S. Treasury bills — has also grown, now holding more than $820 million in T-bills, according to data from RWAxyz.

Ondo Finance’s top tokenized products by market cap. Source: RWAxyz

Ondo’s Big Year

Ondo’s rapid rise builds on momentum from early 2025, when its TVL first crossed $1 billion following the launch of Ondo Nexus, a product that was designed to improve liquidity for tokenized assets by allowing third-party issuers to connect their assets directly to Ondo.

Ondo Finance also gained an additional reputational win in December, when the U.S. Securities and Exchange Commission (SEC) closed a multi-year investigation into the platform without bringing any charges.

Just today, Ondo announced a partnership with Hyperliquid-based DeFi protocol Felix to offer on-chain trading of tokenized spot U.S. equities.

[ad_2]