[ad_1]

Indonesia’s Financial Services Authority (OJK) has published a whitelist of 29 licensed crypto platforms, officially spelling out which exchanges are legally allowed to operate in the country.

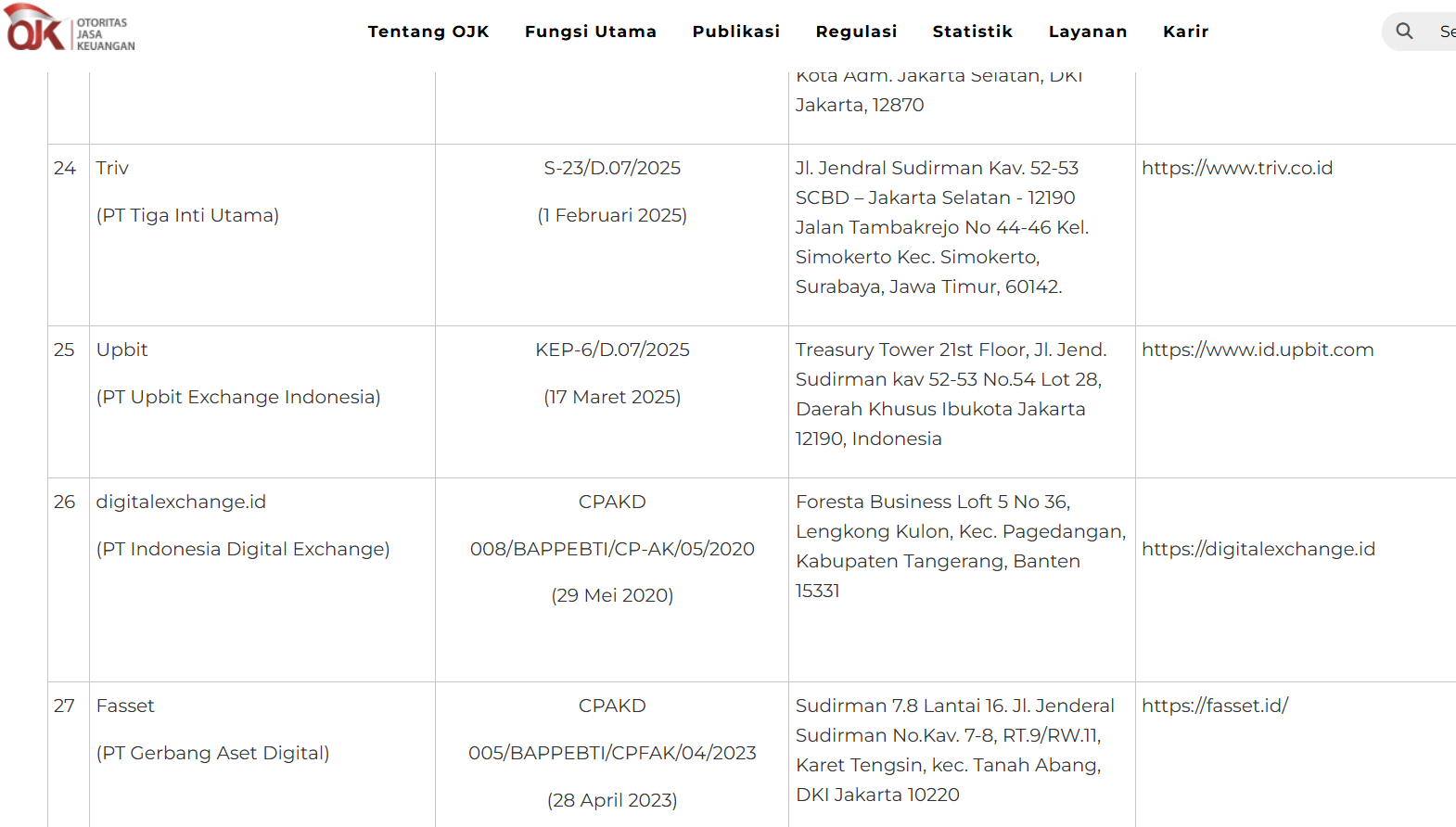

The list, which includes names of entities and their apps or platforms, is meant to serve as an official reference for users to verify whether a provider is properly licensed before trading.

OJK has urged the public to transact only with entities on the list and to treat unlisted platforms as unlicensed operators.

South Korea’s largest exchange, Upbit, is included among licensed exchanges. Source: OJK

Global crypto players eyeing Indonesia

The clarification of who can legally offer crypto services lands as global players move to lock in Indonesian footholds.

Robinhood signed deals earlier this month to acquire Indonesian brokerage Buana Capital and licensed digital asset trader PT Pedagang Aset Kripto, a move that gives it entry to a market with more than 19 million capital‑market investors and about 17 million crypto traders.

Related: Indonesia’s digital rupiah CBDC to get ‘stablecoin’ companion backed by government bonds

Hong Kong–based OSL Group completed its acquisition of licensed local exchange Koinsayang in September, securing regulatory approval to offer spot and derivatives trading.

Related: Survey finds 6 in 10 of Asia’s rich plan to ramp up crypto buying

Tightening oversight of digital assets

The whitelist follows OJK Regulation No. 23/2025, which tightens oversight of digital financial assets, including crypto and related derivatives. The rule bars exchanges from facilitating trades in assets that are not registered or approved by a licensed digital asset exchange, and it introduces a framework for digital asset derivatives that requires prior OJK approval at the exchange level.

Platforms must implement margin mechanisms via segregated funds or digital assets, and consumers have to pass a knowledge test before accessing derivatives. These are measures the regulator said were designed to align with international supervisory standards and strengthen investor protection.

Related: Ripple’s big Singapore win: What the expanded license allows now

Among fastest-growing markets worldwide

Indonesia’s tightening grip on licensing comes as the country cements its place as a major crypto market. Robinhood and industry data providers describe Indonesia as one of Southeast Asia’s fastest‑growing crypto economies, with tens of millions of investors across capital markets and digital assets.

Chainalysis’ 2025 Global Crypto Adoption Index places Indonesia in the global top 10 for crypto adoption and notes that the country has been among the most dynamic markets worldwide, highlighting its growing presence in global digital asset activity.

[ad_2]