[ad_1]

Lido DAO, the decentralized organization behind the largest liquid staking protocol in DeFi, is signaling plans to push beyond its core ETH staking business next year.

The plan, titled “2026 Ecosystem Grant gRequest (EGG): Executing GOOSE-3,” lays out a $60 million budget for new products as Lido seeks to move beyond just a single-product, staking-focused model. According to the proposal, Lido wants to develop new earn products and vault structures designed for different users, including on-chain treasuries and even regulated entities.

“The proposed focus for the Foundations in 2026 shifts towards evolving Lido’s position from a single-product protocol focused on liquid staking to an innovative organization with a product portfolio by expanding the product offering, creating new revenue streams and ensuring long-term protocol resilience,” the proposal reads. Liquid staking protocols let traders keep their staked assets usable while still earning staking rewards.

The plan also calls for work on new products “related to stablecoins and other asset classes to broaden demand and diversify revenue,” but provides little additional detail.

The vote on the new budget proposal runs on Snapshot until Dec. 19, though it has already reached quorum, with all votes in favor so far.

Ethereum Staking Giant

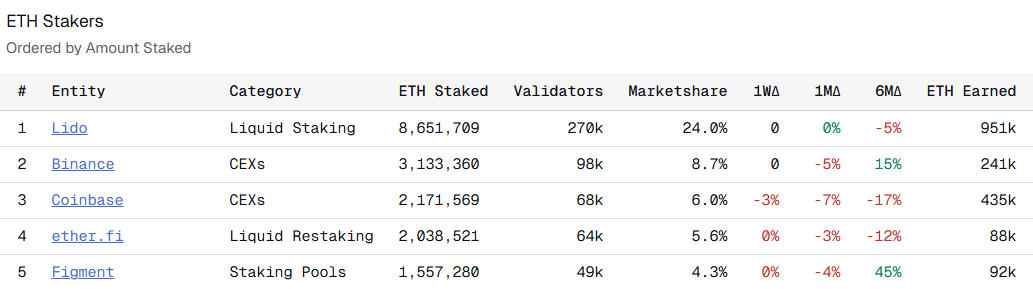

Data from Dune Analytics shows that Lido remains by far the largest Ethereum staking provider, controlling nearly 24% of all ETH staked. The platform holds more than 8.6 million ETH, valued at roughly $24.5 billion at current market prices, followed by Binance and Coinbase with 3.1 million ETH and 2.1 million ETH, respectively, as of press time.

ETH stakers by amount staked. Source: Dune Analytics

Lido is also currently the second-largest protocol across all of DeFi by total value locked, with $25.7 billion, following Aave with $33.2 billion, per DefiLlama data. While most of Lido’s TVL is on Ethereum, it supports several other blockchains.

[ad_2]