[ad_1]

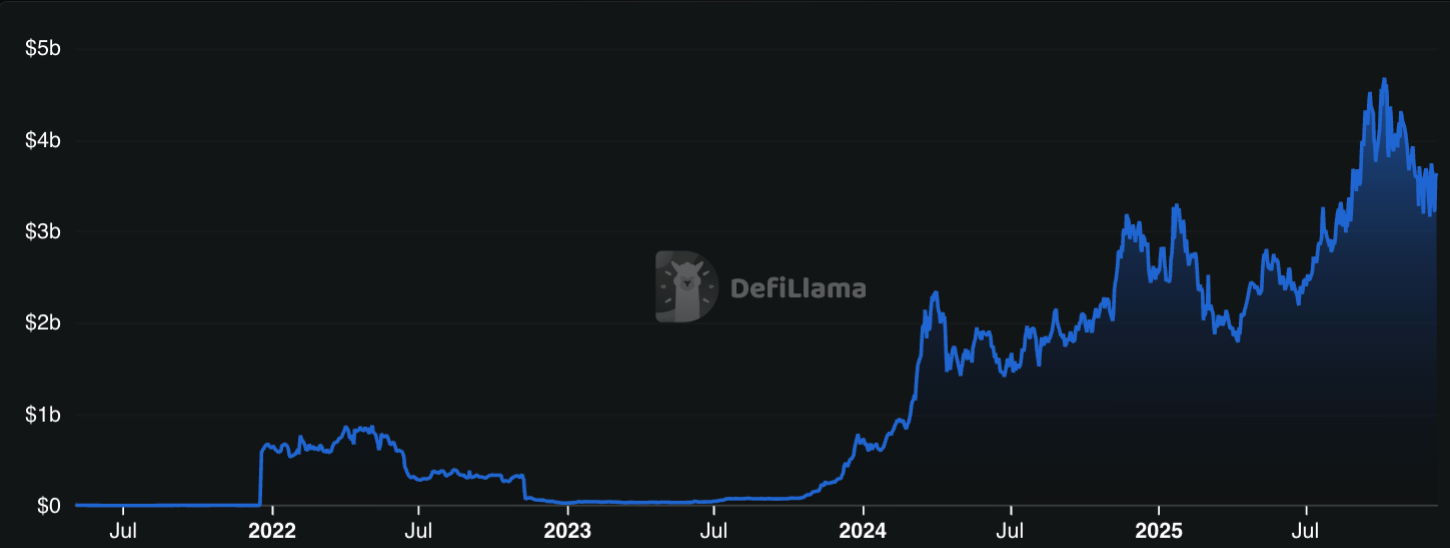

Solana’s lending markets are gaining traction, with their total value locked (TVL) hitting $3.6 billion in December 2025 – up 33% from $2.7 billion a year earlier, according to a new report from Redstone.

Solana DeFi Lending TVL

Redstone, a blockchain oracle and data provider, points to the network’s efficiency as a key driver, citing 400-millisecond transaction finality and a median fee of $0.001. Solana also maintained 100% uptime over the past year and processed a peak daily DEX volume of $35.9 billion.

This growth reflects Solana’s growing influence in decentralized finance (DeFi), fueled by fast, low-cost transactions and a reliable network.

“What makes Solana truly unique is its pragmatic, open approach to building the best onchain environment possible,” the report reads. “If collaborating with competitors leads to better infrastructure, Solana doesn’t hesitate. Status quo barriers don’t matter here.”

Beyond infrastructure, the report says competition across Solana’s lending protocols has intensified as platforms try to attract and retain liquidity. Currently, the three largest lending protocols on Solana are Kamino Lend, Jupiter Lend, and Save.

Moreover, newer protocols are able to reach the top of their respective markets within around six months of launching, which is much faster than on most other blockchains.

The report says that DeFi strategies on Solana are also becoming more advanced. It pointed specifically to Gauntlet, a risk-management firm that now oversees about $140 million across several Solana protocols. Gauntlet manages strategies like delta-neutral positions, which are built to mitigate price risk. According to the report, this level of risk management is similar to what large financial institutions employ.

At the same time, the user experience is becoming easier, Redstone said, citing the CASH vault on Kamino as one example. The strategy, designed by Gauntlet, gives users access to higher yields with just a few clicks, even though the risk controls that underpin it are complex. This mix of easy interfaces and strong risk management is helping more everyday users participate in Solana’s DeFi markets.

[ad_2]