[ad_1]

The Chicago-based CME Group has introduced a new suite of cryptocurrency benchmarks designed to provide standardized pricing and volatility data for institutional traders using tools they’re familiar with across traditional asset classes.

Announced Tuesday, the CME CF Cryptocurrency Benchmarks cover a range of digital assets, including Bitcoin (BTC), Ether (ETH), Solana (SOL) and XRP (XRP).

Notably, the launch includes the CME CF Bitcoin Volatility Benchmarks, which track the implied volatility of Bitcoin and Micro Bitcoin Futures options, effectively serving as a crypto-market equivalent of the equity market’s VIX by showing how much price movement traders expect over the next 30 days.

Source: CME Group

Volatility benchmarks have long played a central role in traditional markets, allowing traders to quantify uncertainty. They underpin options pricing, enable protection against sharp market swings, support volatility-based strategies and serve as real-time gauges of market fear.

Based on Tuesday’s release, the CME CF Bitcoin Volatility Index is not a directly tradable contract; instead, it serves as a standardized reference point for pricing and risk management.

Related: CME rekindles ETH ‘super-cycle’ debate as Ether futures volume tops Bitcoin

Crypto options market activity grows

Institutional demand has become a steady force in the cryptocurrency market, driven both by the surge in spot exchange-traded funds (ETFs) and the continued expansion of futures and options trading.

While crypto derivatives long predate ETFs, the space has drawn less attention amid massive inflows into Bitcoin funds.

Still, the third quarter marked a period of rapid growth for institutional derivatives activity on CME, with combined futures and options volume reaching a record high of over $900 billion.

The quarter ended with a record average daily open interest of $31.3 billion across CME’s futures and options contracts. This is an important signal because open interest reflects the amount of capital that remains actively committed to the market, not just short-term trading turnover. Rising open interest typically points to deeper liquidity and greater institutional conviction.

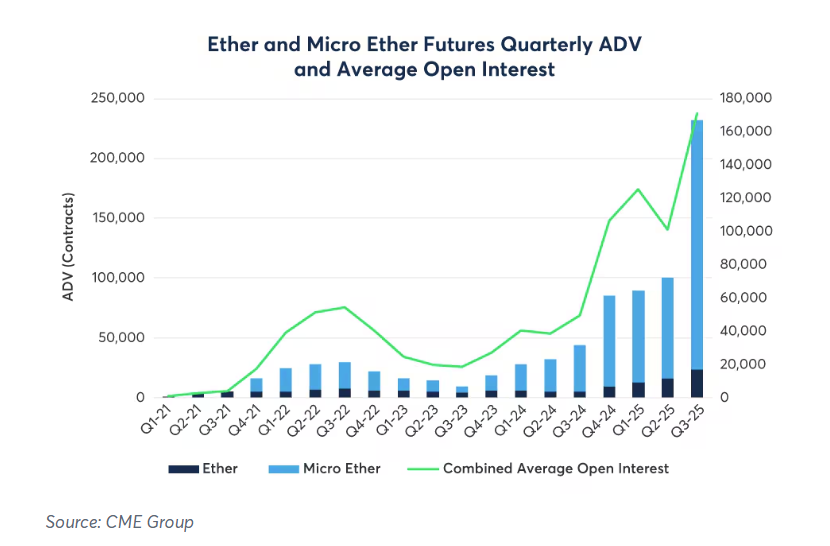

Derivatives activity also broadened beyond Bitcoin to include Ether, Ethereum’s native token, with trading in Ether and Micro Ether futures climbing sharply.

Ether-based crypto derivatives trading activity. Source: CME Group

Magazine: Big Questions: Did a time-traveling AI invent Bitcoin?

[ad_2]