[ad_1]

Falcon Finance’s overcollateralized synthetic dollar USDf now has a transparency and risk-management framework. Following the market decline on Oct. 10, USDf added over $700 million in new deposits and surpassed $2 billion in supply. The protocol is setting itself up to tackle issues that have long plagued decentralized finance like opaque reserves and complicated risk models.

USDf overcollateralization

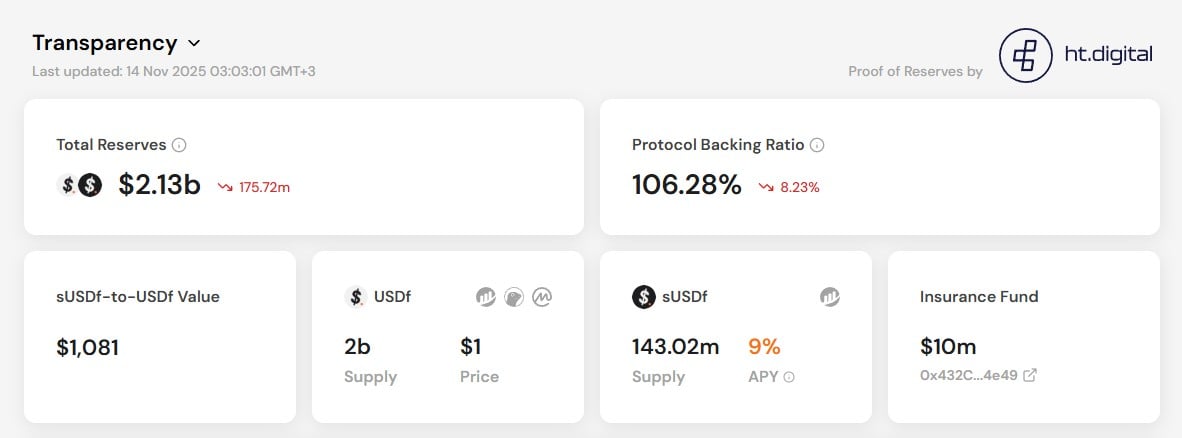

A live Transparency Dashboard that offers real-time insight into USDf’s financial situation serves as the framework’s focal point. The overcollateralization ratio, reserve composition and yield strategies are all visible to users. Tokenized Ethereum, SOL and Bitcoin are examples of collateral assets for stablecoins as well as treasury bills. The dashboard also displays the distribution of collateral between on-chain multisignature wallets and regulated custodians like Fireblocks and Ceffu.

Daily updates are made to reserve and yield data. One component of Falcon’s strategy is HT’s weekly independent reserve attestations, quarterly assurance reports and digital versions. These attestations confirm that there is always complete collateral backing for the USDf supply in circulation. Zellic and Pashov, two external auditors, have examined the smart contracts of the protocol to guarantee structural integrity.

Believing in security

Andrei Garchev, a founding partner at Falcon Finance, believes that users should not have to make assumptions about the security of their assets. He said that in order for USDf to support institutional use cases, transparency and independent validation are essential. Falcon is aiming to attract institutional and individual clients who desire yield without exposure to volatile strategies and leverage.

Arbitrage selling options and staking are all part of its yield model, which is designed with high liquidity to swiftly unwind positions when market conditions shift. In order to enable institutions to tokenize and use liquid assets as on-chain liquidity, Falcon Finance is creating a collateral infrastructure.

A variety of assets, including tokenized real-world instruments and digital currencies, can be used to create USDf. Falcon’s goal is to link traditional and on-chain financial systems so that users can access yield and liquidity without having to sell their collateral. Driven by institutional demands for security and transparency, the rollout represents a shift toward verifiable and controlled risk.

[ad_2]