[ad_1]

XStocks are becoming the tokenized shares of choice, after reaching $10B in total trading volumes. Solana is also the main carrier for actively traded RWA tokens.

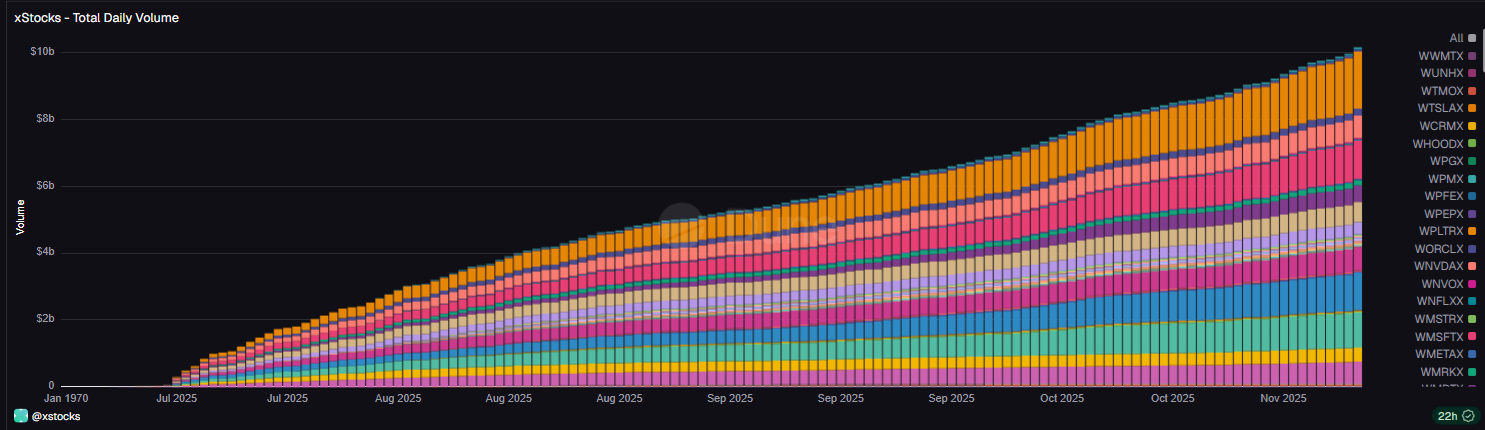

XStocks has shown ongoing expansion in trading activity since the launch of the new tokenized share standard. The XStocks market broke above $10B in total volumes for the first time, on a mix of activity inflows from Kraken and, more recently, Hyperliquid.

Most of the trading volumes are concentrated on centralized markets, with around $341M cumulative volumes on DEXs.

XStocks volumes expanded continuously, boosted by activity on the Kraken centralized exchange. | Source: Dune Analytics

As of November, Solana has also become the main hub for tokenized equities, the smallest and still-growing asset class in RWA tokenization. Over 90% of tokenized equities are minted on Solana, with 77% of transfer volumes using the chain.

XStocks was also added to BNB Chain, Ethereum, as well as Arbitrum, with multiple avenues for transfers. Despite this, Solana remains the preferred network. XStocks are making their way into DeFi, becoming a new collateral class to mint stablecoins. Recently, Falcon Finance added XStocks as collateral for USDf.

Kamino Lend, Solana’s most widely used lending protocol, has also added XStocks as collateral.

XStocks turns into the leading brand for tokenized equities

The launch of XStocks in July created a high-profile brand for tokenized equities. Until recently, tokenized shares were informally created, and the markets were fragmented.

Public equity is still the smallest addition to general tokenization. However, a unified stock standard may bring more crypto natives to trading, especially with the addition of convenient markets.

XStocks caters to a mix of large-scale traders and retail. Most of the volumes are concentrated on a handful of assets, with Tesla (TSLA) and Nvidia (NVDA) at the top. XStocks still lag behind the RWA secured by Ondo and Securitize, but are one of the few stock-based tokens to launch for the European market.

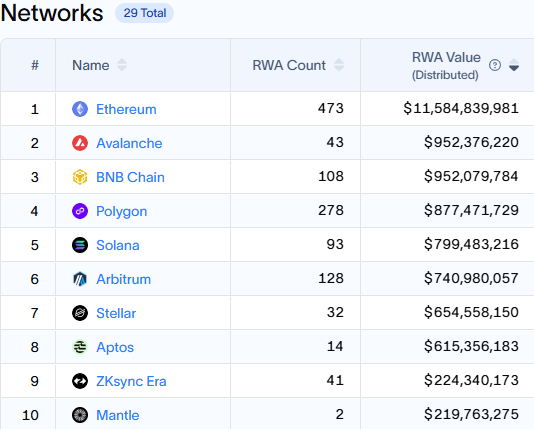

Solana becomes a top 5 network for RWA tokenization

XStocks are becoming the most intuitive type of RWA tokens, bringing Solana into the top 5 of networks for RWA tokenization. XStocks are still growing, with just under $100M in total value locked.

Solana is among the top 5 networks for RWA tokenization, as XStocks became a widely traded asset class. | Source: RWA.xyz

Solana is still lagging behind Ethereum, which got a boost from tokenized money markets. Ondo is the most direct competitor, as the chain also has its own prominent brand of tokenized shares.

While Solana still has a more limited selection of tokenized RWA, the active trading of XStocks is a breakthrough, as other tokens have lower trading activity. Solana also reported 101K holders of its tokenized shares, showing greater potential for mainstream adoption.

[ad_2]