[ad_1]

Securitize, a real-world asset tokenization platform, has unveiled a tokenized fund designed to give investors access to AAA-rated collateralized loan obligations onchain.

The fund is being developed in partnership with global investment bank BNY Mellon. According to Wednesday’s announcement, BNY will safeguard the fund’s underlying assets, while a subsidiary of the bank will manage the fund’s portfolio.

With global collateralized loan obligation issuance topping $1.3 trillion, Securitize and BNY aim to bring AAA-rated floating-rate credit onchain, the company said.

Pending governance approval within the Sky Ecosystem, Grove, an institutional-grade credit protocol, plans to anchor the fund with a $100 million allocation.

Tokenization is the process of converting real-world assets such as stocks, real estate or debt into digital tokens recorded on a blockchain.

Securitize CEO Carlos Domingo said the launch “is a major step in making high-quality credit more accessible, efficient, and transparent through digital infrastructure.”

The announcement follows Domingo’s comments to CNBC on Oct. 28, revealing plans for Securitize to go public via a merger with the blank-check company Cantor Equity Partners II, Inc.

Related: Tokenization platform tZero eyes 2026 IPO amid surge in crypto listings

Tokenization of financial products surges

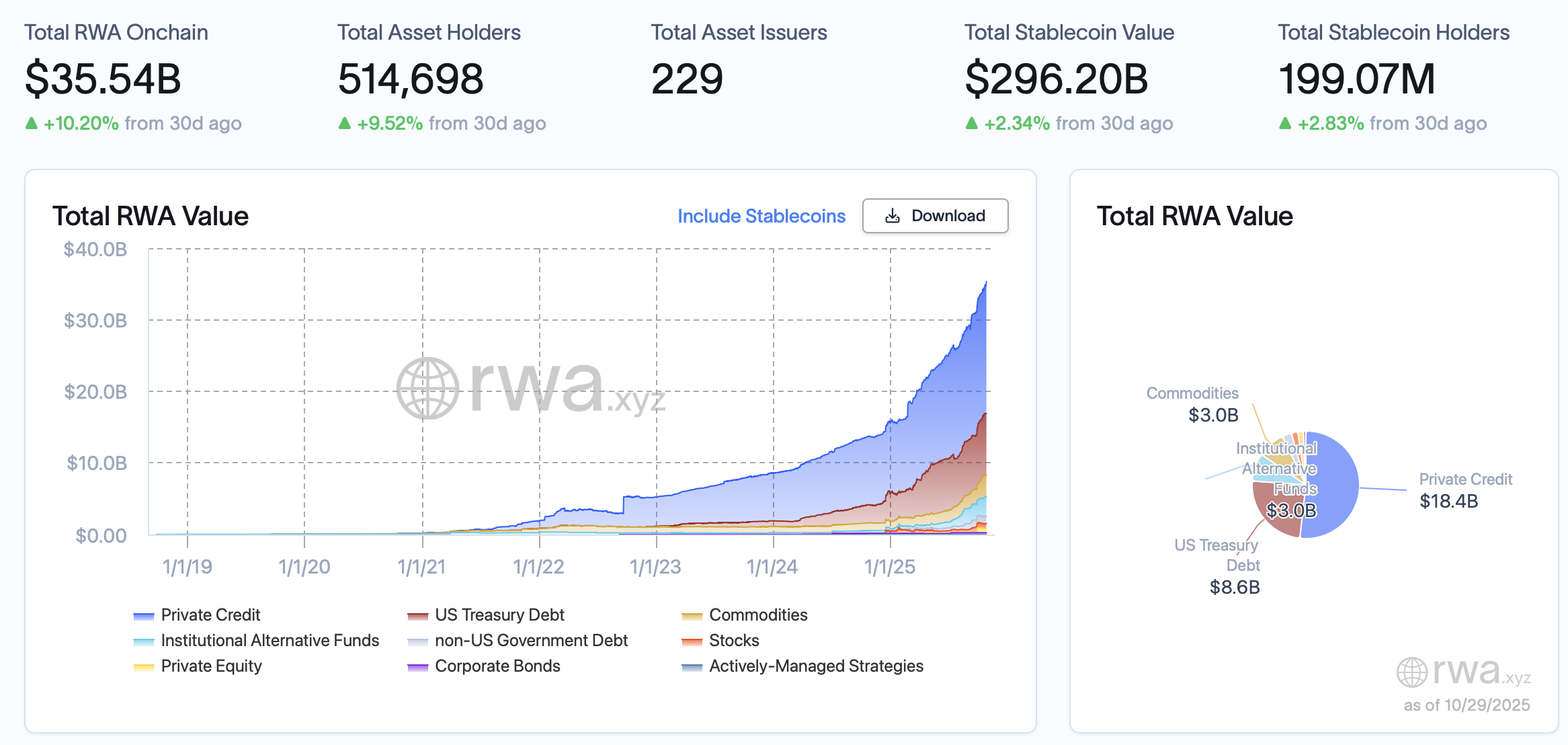

As the tokenization of real-world assets accelerates — with more than $35.5 billion now represented onchain, according to RWA.xyz — the process is rapidly expanding beyond to include a broader range of traditional financial instruments.

Total RWA onchain. Source: RWA.xyz

In January, Ondo Finance announced it would launch a tokenized US Treasury Fund on the XRP Ledger, enabling investors to gain exposure to institutional-grade government bonds with the option to redeem holdings using stablecoins. The fund went live in June.

In July, Grove partnered with Centrifuge, a blockchain infrastructure platform, to launch two Janus Henderson tokenized funds on Avalanche.

The same month, Centrifuge partnered with S&P Dow Jones Indices to tokenize the S&P 500 Index, marking the first time the benchmark was brought onchain.

Magazine: Solana vs Ethereum ETFs, Facebook’s influence on Bitwise: Hunter Horsley

[ad_2]