[ad_1]

Key Takeaways

- Fed’s Bostic says employment risks are now as significant as inflation risks.

- Labor market stability is becoming a concern as the Fed weighs its dual mandate of maximum employment and price stability.

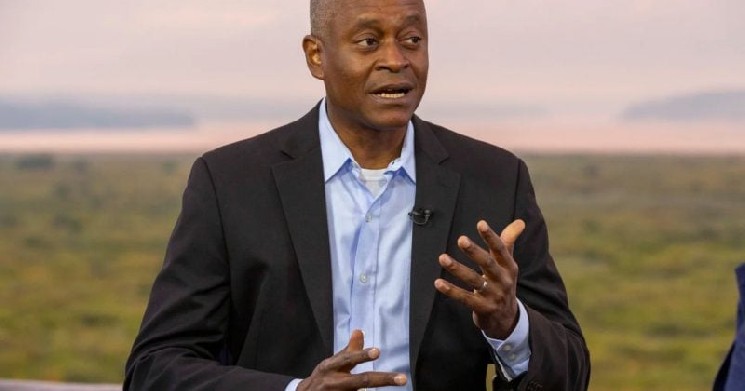

Federal Reserve Bank of Atlanta President Raphael Bostic today signaled that employment risks now pose threats equivalent to inflation pressures.

The statement reflects growing concerns about labor market stability as the Fed navigates between its goals of maximum employment and price stability. Bostic serves as a voting member of the Federal Open Market Committee, which sets national monetary policy.

U.S. core inflation hovers around 3.1% according to Fed projections, while unemployment is expected to reach 4.5% by year-end. This economic backdrop has prompted policymakers to reassess the relative weight of employment versus inflation risks.

The Fed hiked rates aggressively in 2022-2023 to combat inflation that peaked above 9% during the post-pandemic recovery. Officials have since begun modest cuts but remain cautious, with only limited rate reductions projected for 2025.

Recent Fed communications indicate a delicate balancing act as inflation remains above the 2% target. The central bank’s dual mandate from Congress requires promoting both maximum employment and stable prices, often creating policy trade-offs.

[ad_2]