[ad_1]

According to the 2024 report by ChainPlay, a company specialized in the analysis and evaluation of blockchain projects, the GameFi sector is said to be in great difficulty.

Based on the findings, 93% of the projects in this niche have failed, with an average decline of 95% from their all-time highs. A total of 3,200 case studies were analyzed.

Even investments in the sector have not been particularly profitable, putting investors on alert about its future in the GameFi landscape.

All the details below.

ChainPlay studies 3,279 projects in the GameFi sector

ChainPlay, a well-known company in the crypto world, has recently publicly released its report on the current state of the GameFi industry in 2024.

This sector, resulting from a hybrid between the world of gaming and that of decentralized finance, seems to be going through a phase of great crisis.

After leading the rise of cryptocurrencies during the bear market of 2022, attracting billions of dollars in investment, the GameFi landscape now appears significantly worsened.

Before delving into the heart of the topic, we present the methodology undertaken by ChainPlay in its research work.

A total of 3,279 different blockchain game projects have been analyzed, thanks also to the collaboration of the partner company Storible.

The information on the price of the respective project tokens comes from Dune Analytics, while the user data is obtained from DappRadar.

A project is defined as “dead” if the price of the respective token has fallen by more than 90% from its all-time high and/or has fewer than 100 active users per day.

The creation date of a project’s token and the date on which it began to meet the aforementioned criteria determine its duration.

The data relating to the return on investment for venture capital and the annual fundraising data come from an internal database with multiple information sources.

All data were collected in November 2024.

Source: https://chainplay.gg/blog/state-gamefi-2024/

Difficult life for new GameFi projects: 93% fail in a short time

As mentioned in the introduction, the report by ChainPlay highlights the failing nature of the majority of GameFi projects.

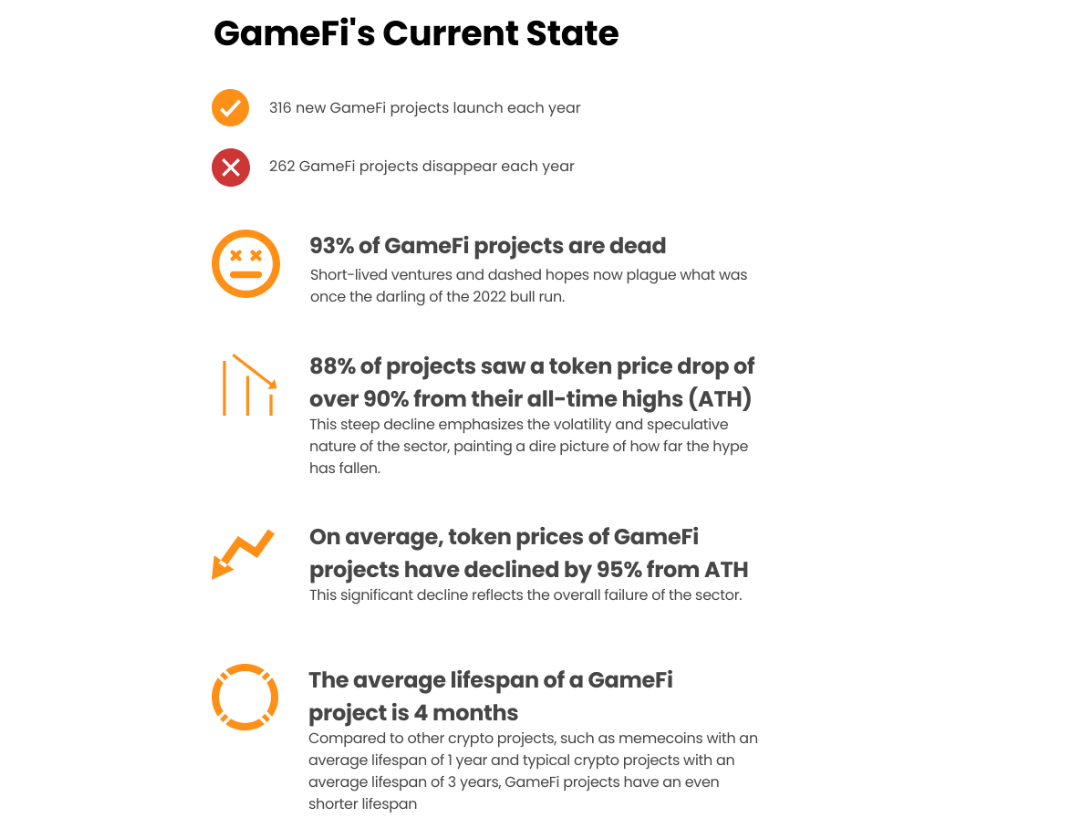

On average, 316 new projects are launched every year, but 262 of these disappear within a few months and are considered “dead”.

While in 2022 the union of gaming with decentralized finance seems like a trend destined to grow, just 2 years later a completely different picture emerges.

88% of the entire GameFi token industry has seen a price drop of over 90% from their respective all-time highs. This situation highlights the poor utility of the digital assets in question, reflecting a mere speculative value tied to the momentary hype.

On average, the prices of these tokens have decreased by 95% from their ATH, highlighting the great disappointment of investors who believed in this narrative.

Consider that the average duration of a GameFi project is only 4 months, significantly lower compared to other sectors in the crypto and blockchain world.

This incredibly short existence highlights the immense difficulties in building sustainable gaming ecosystems over time, capable of attracting traffic organically.

Contributing to this general failure is also the rapid evolution of game logics and the ever-changing challenges of the gaming industry, which constantly vary over time.

All these statistics paint the GameFi world as a transitory place unable to offer long-term experiences to players and investors.

Retail and VC investments in this market niche: questionable performance

The macabre outlook of the GameFi industry is confirmed by ChainPlay data on retail and VC investments, which suffer from unappealing performance.

However, although the high failure rate of GameFi is undeniable, the profitability parameters reveal two distinct realities for retail investors and venture capitalists.

As for the first, the report highlights an average profit of 15% for all those small operators who have invested in decentralized initial offerings (IDO).

We are talking about numbers that are not very significant which, despite the positive appreciation, must be related to the stratospheric growth of the entire crypto industry since 2022.

Furthermore, when retail investors approach the IDOs of GameFi tokens, they often have to comply with dangerous vesting constraints, with resources locked for several months.

Considering the average drop of 95% mentioned earlier, you understand well that an average profit of 15% does not justify the presence of such financial limits.

For many retail investors, the aspiration to achieve financial success with GameFi has turned into a terrifying reality of illiquid assets and falling prices.

For Venture Capitalists (VC) the returns seem more polarized, with one part emerging in profit while the other reflects significant losses.

The average profits are equal to 66%, with 42% of the VCs recording performance between 0.05% and 1950%, while the remaining 58% incurs losses ranging from -2.5% to -98.8%.

The top venture capital investors are Alameda Research with an ROI of 713.15%, Jump Capital with an ROI of 519.11%, and Delphi Digital with an ROI of 490.50%.

Honorable mention also for Binance Labs which records average performances of 338.52% and 3Commas with a return of 267.20%.

On the other hand, the most unproductive funds were Golden Shovel Capital, which lost 97.4% in GameFi, and Infinity Capital with a ROI of 97.1%.

[ad_2]