Global investors have parked a record $7.4 trillion in money market funds, marking an all-time high. While this defensive positioning highlights caution across risk assets, such cash piles rarely stay idle for long.

With the Federal Reserve poised to decide on rate cuts next week, even a modest shift of this capital could have a huge impact on markets. Some analysts believe crypto could be a surprising beneficiary once cash begins rotating out of ‘safe’ instruments.

Why Money Market Funds Matter for Risk Assets

Money market funds are low-risk investment vehicles that pool investors’ money into short-term, high-quality debt instruments like Treasury bills, certificates of deposit, and commercial paper. They aim to provide stability, liquidity, and modest returns.

This makes them a popular option for preserving capital while offering better yields than regular savings accounts. Often used as a parking spot during uncertainty, these funds swell when investors prefer security over riskier assets.

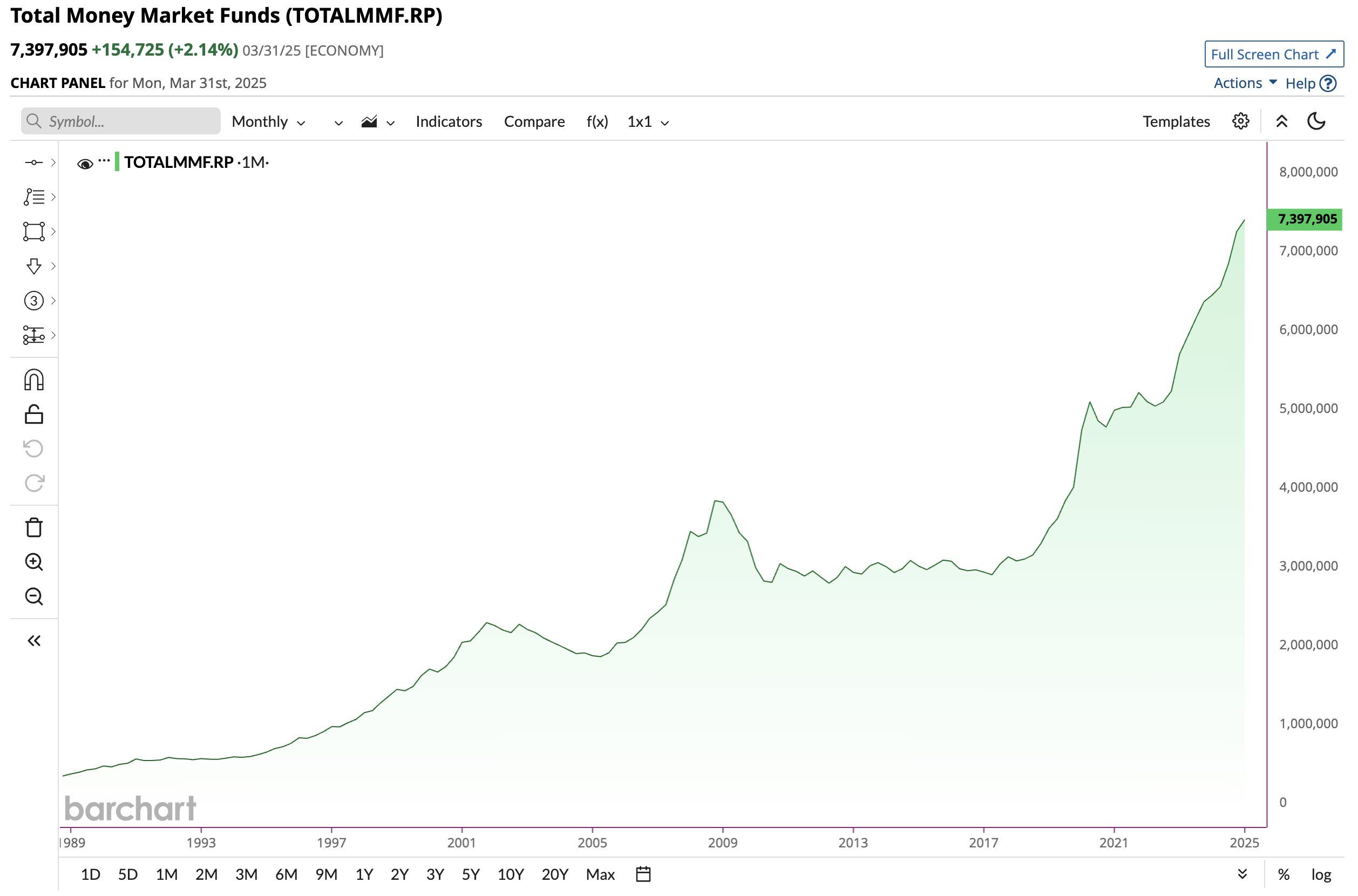

According to Barchart data, a record $7.4 trillion now sits in money market funds.

Money Market Funds Record High. Source: X/Barchart

In a post on X (formerly Twitter), a macro analyst highlighted that with yields holding above 5%, holding cash has become an appealing option for investors.

“We only see buildups like this when investors want yield but don’t want to take on duration or equity risk. It happened after the dot com bust, again after the GFC, and in 2020–21 when rates were floored and money waited on the sidelines,” the post read.

What Happens If The Fed Cuts Interest Rates

However, the analyst cautioned that this trend will unlikely persist if the Federal Reserve moves to cut rates. A reduction of 25 or 50 basis points on September 17 would lower yields on money funds, savings accounts, and short-term Treasuries. While not sparking an immediate exit, it could gradually weaken the appeal of holding cash.

“History shows that once the yield edge fades, these big cash piles rotate, first into Treasuries for safety and liquidity, and then into risk assets when confidence in the easing cycle grows. That’s what we saw in 2001, 2008, and 2019, where cash moved into government bonds first, then broadened into equities, credit, and other assets once the Fed cut deeper,” the analyst added.

He pointed out that the massive $7.4 trillion parked in money funds could reshape markets if they begin to move. A shift of just 10% would inject hundreds of billions in fresh capital into any sector it enters.

“A cautious 25 bps move lets money funds bleed down gradually, while a 50 bps cut could accelerate the shift, pushing cash into Treasuries first and then risk assets as the yield advantage disappears. With $7.4 trillion waiting, the scale of the rotation matters as much as the direction,” he noted.

From Safe Havens to Crypto: Where $7.4 Trillion of Cash May Flow

Previously, analyst Cas Abbé highlighted that most of the capital in money market funds is tied up in US Treasury bills. If interest rates fall, yields on these securities will decline, making them less appealing.

At that point, this substantial liquidity will begin shifting toward risk assets such as stocks and crypto.

“So don’t listen to permabears as we’re going up only,” Abbé said.

Furthermore, Axel Bitblaze added that this cycle differs from previous ones due to the rise of institutional access. Spot Bitcoin and Ethereum exchange-traded funds (ETFs) now provide pension funds and asset managers with a direct entry point, while altcoin ETF approvals are expected ahead.

“On top of that, there’s $7.2 trillion sitting in money-market funds which will experience outflows once T-bills yield start to go down. Imagine just 1% of this amount flowing into crypto; it would be enough to send BTC and alts to new highs,” Bitblaze remarked.

Meanwhile, Crypto Raven forecast that if even $1 trillion or less were to flow into the crypto market, Bitcoin could potentially climb to the $150,000–$160,000 range.

“I’m very bullish for Q4,” he commented.

Market participants will now closely monitor the impact as the Fed prepares to decide. The direction of this unprecedented cash hoard will likely shape the trajectory of risk assets. The coming weeks will be critical in determining whether this capital ignites a crypto rally or signals deeper economic jitters.

The post $7.4 Trillion Sits on Sidelines as Fed Rate Cut Looms: Will Crypto Benefit? appeared first on BeInCrypto.