[ad_1]

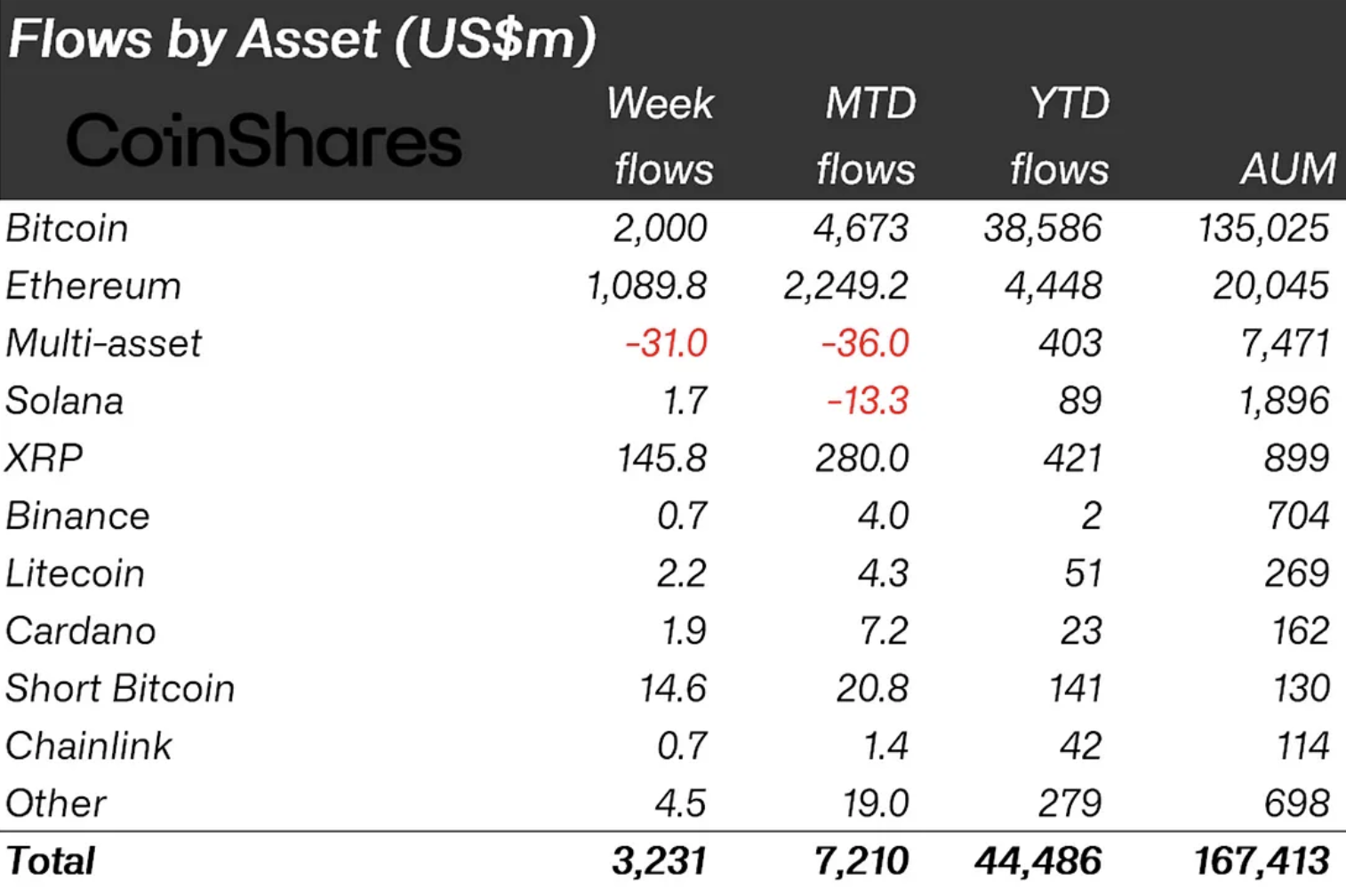

As more and more people look to the digital asset investment products field, Cardano (ADA) made a name for itself in last week’s inflows, standing out from the crowd in a very competitive landscape. According to CoinShares, funds flowing into digital asset ETFs reached $3.23 billion, marking its 10th consecutive week of growth. This brings the 2024 total to an impressive $44.5 billion — a number that is unmatched by previous years.

While Bitcoin was the big winner with $2 billion in inflows, Ethereum kept up its steady pace. Ethereum-linked products brought in $1 billion for the seventh consecutive week, bringing the total for the period to $3.7 billion. Other altcoins saw less dramatic but still notable inflows, with XRP attracting $145 million amid optimism around a potential ETF.

In this crowded field, Cardano is worth mentioning for its performance. ADA-linked ETPs saw inflows of $1.9 million last week. While these gains are modest compared to the market leaders, they show that interest in the asset is steady and growing.

Since the beginning of the year, $23 million have flowed into Cardano investment products, with a third of that coming in December alone. There is no doubt that the momentum is real, bringing the total assets under management in Cardano ETPs to $162 million.

The numbers show that it is holding its own. Cardano may not be as big as Bitcoin or as hyped as Ethereum, but its inclusion among cryptocurrencies with dedicated ETPs is still a big deal. It is pretty rare for a digital asset to get this kind of institutional recognition, and even rarer for it to maintain it over time.

The broader market also saw inflows for Polkadot and Litecoin, with $3.7 million and $2.2 million, respectively. But Cardano’s steady growth and consistent demand show that it is relevant among an expanding array of altcoin investment options.

[ad_2]