[ad_1]

On March 1, 2024, an infamous and vast bitcoin mega whale moved 2,000 vintage bitcoins from 2010 and now, four days later, on March 5—the day bitcoin hit its peak value of $69,210 per coin—the same entity transferred another 1,000 bitcoins from 2010.

2010 Bitcoin Whale Moves Millions as Prices Peak

This prominent whale, known for its substantial bitcoin transactions since first being identified by Bitcoin.com News in March 2020, has executed yet another series of transfers involving 1,000 BTC, valued at approximately $63.29 million, according to current exchange rates. Originally mined during the months of August, September, October, and November of 2010, when a bitcoin’s value was at or below $0.39, these coins stem from block rewards mined during bitcoin’s early days.

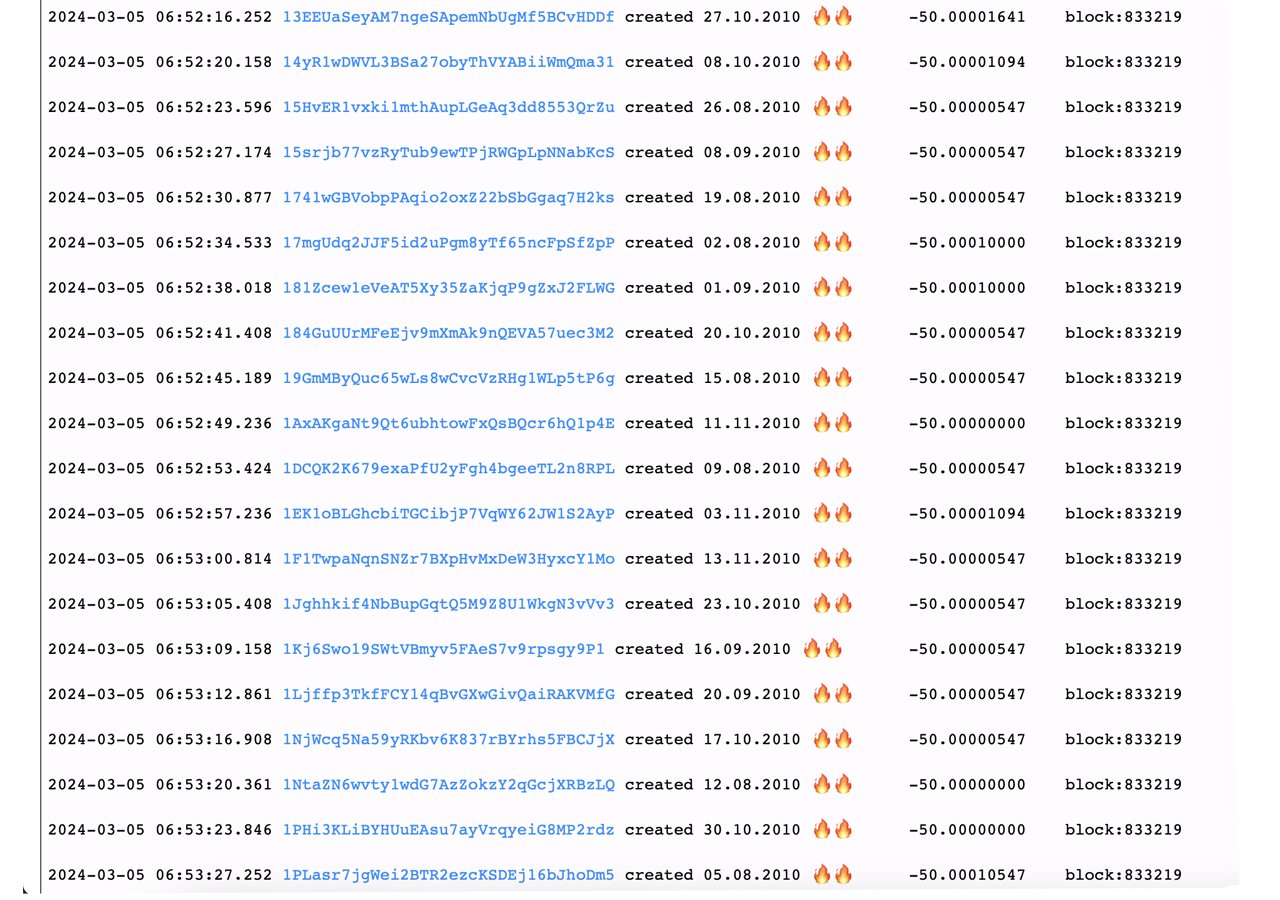

A total of 20 block rewards from 2010 were shifted, with all related transactions appearing in block 833,219. This recent activity mirrors the whale’s historical pattern, noted again in the series of 20 transactions executed on Tuesday. Each of the 20 aged wallets from 2010 utilized Pay-to-Public-Key-Hash (P2PKH) addresses, and the funds were amalgamated into a single Pay-to-Script-Hash (P2SH) address labeled “36i1W.” As of this report, the 1,000 BTC has been shifted from the initial P2SH consolidation address.

20 BTC block rewards caught by btcparser.com on March 5, 2024.

The maneuver on Tuesday was once again detected by btcparser.com, a blockchain analysis tool that tracks thousands of so-called ‘sleeping bitcoin’ addresses dating from 2009 to 2017. The corresponding bitcoin cash (BCH) associated with the 20 BTC coinbase rewards from 2010 was also moved. This marks the 16th observation of this particular whale’s activity. To this point, the enigmatic entity from 2010 has relocated a staggering 17,000 BTC from inactive addresses. This whale often selects pivotal moments for its movements, coinciding with significant price milestones and other notable dates in bitcoin’s history, such as its Jan. 3rd anniversary in 2021.

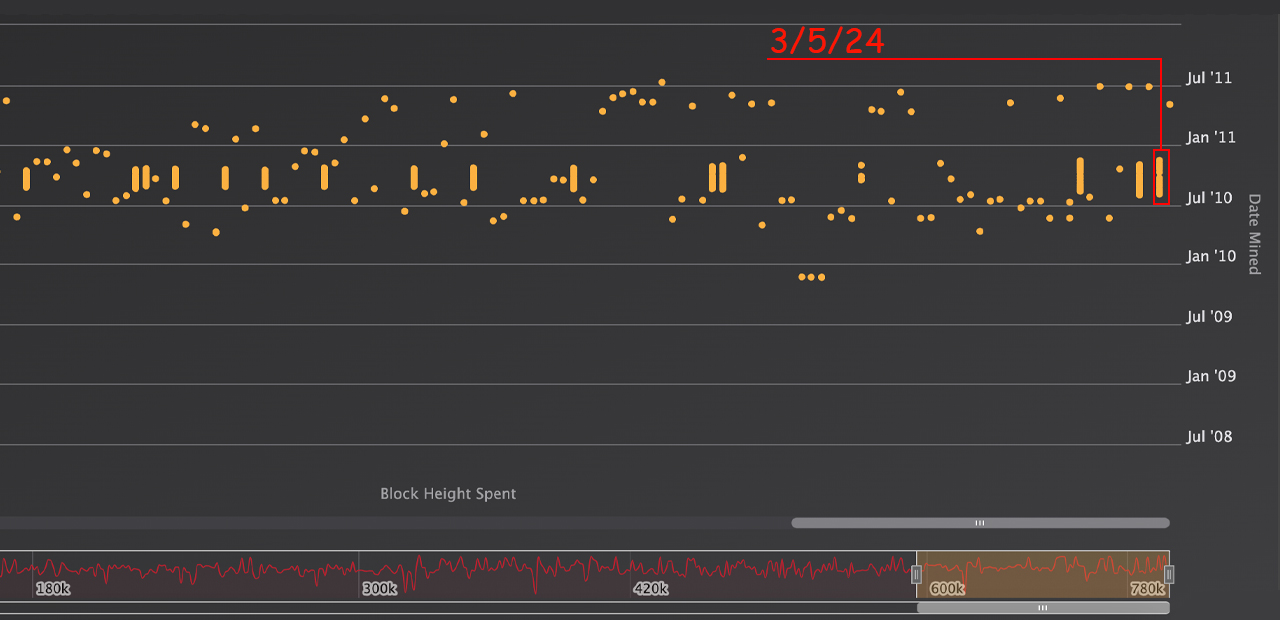

From a visual standpoint, the 2,000 BTC transaction was highlighted by theholyroger.com. Bitcoin.com News has documented this particular whale’s activities on 15 distinct occasions starting from 2020, with sightings on Mar. 11, 2020; Oct. 11, 2020; Nov. 7, 2020; Nov. 8, 2020; Dec. 27, 2020; Jan. 3, 2021; Jan. 10, 2021; Jan. 25, 2021; Feb. 28, 2021; Mar. 23, 2021; June 9, 2021; Nov. 10, 2021; Nov. 12, 2021; Dec. 4, 2023; Mar. 1, 2024; and most recently, Mar. 5, 2024.

The whale’s first appearance was noted on March 11, 2020, with BTC prices oscillating between $7,953 and just below $4,000 within that 24-hour frame. Following the March 2020 activity, the whale lay dormant until October, resuming monthly movements through March 2021, including two separate occasions in November 2020 and three in January 2021. After a brief hiatus, the whale resurfaced on June 9, 2021, and then again for two episodes in November 2021, one aligning with BTC’s peak price for that year.

The whale remained unseen until the close of 2023, reemerging on Dec. 4, and then again earlier this week on March 1, coinciding once more with BTC reaching its highest price point of $69,210 per coin. The intriguing movements of this bitcoin mega whale underscore a cryptic yet fascinating aspect of the cryptocurrency world, where significant transactions by unknown entities can influence market perceptions and highlight the enduring allure of bitcoin’s early mined coins.

Such activities not only reflect on bitcoin’s storied past but also provoke speculation about its future impact and the identity of the whale behind these colossal transfers. It appears this whale has been disbursing sequences of 2010 block rewards following the same pattern, even prior to Bitcoin.com News’ initial observations in 2020.

What do you think about the 2010 mining entity that has spent 20 block rewards with 1,000 bitcoins in a single string? Let us know what you think about this subject in the comments section below.

[ad_2]