[ad_1]

Today, over $10 billion worth of Bitcoin (BTC) and Ethereum (ETH) options are due to expire.

Market watchers are particularly attentive to this event due to its potential to influence short-term trends through the volume of contracts and their notional value. Examining the put-to-call ratios and maximum pain points can provide insights into traders’ expectations and possible market directions.

Bitcoin and Ethereum Options Expiring Today

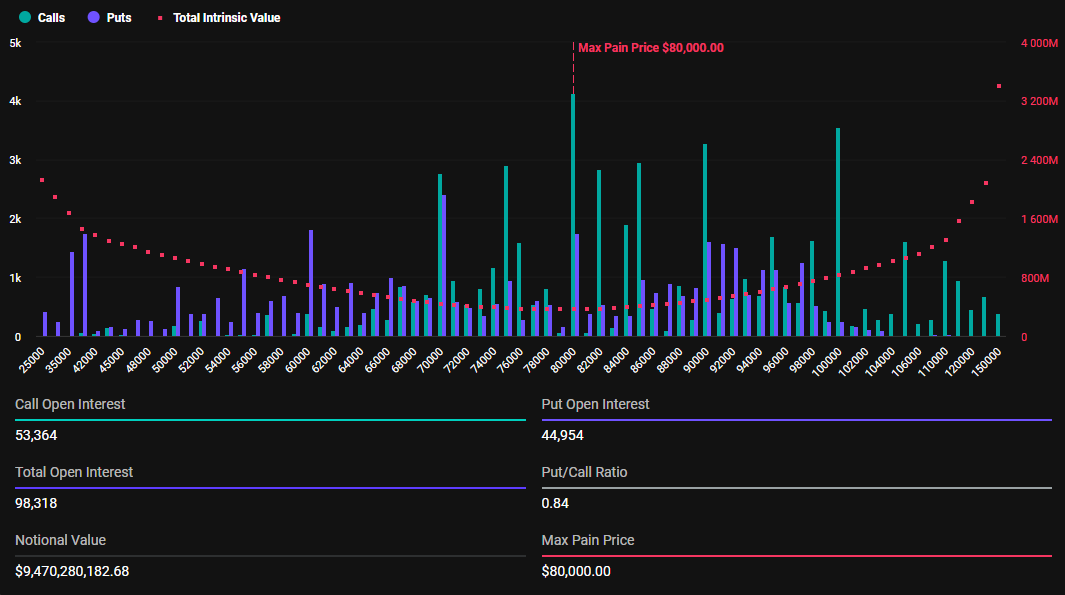

The notional value of today’s expiring BTC options is $9.47 billion. According to Deribit’s data, these 98,309 expiring Bitcoin options have a put-to-call ratio of 0.84. This ratio suggests a prevalence of purchase options (calls) over sales options (puts).

The data also reveals that the maximum pain point for these expiring options is $80,000. In crypto options trading, the maximum pain point is the price at which most contracts expire worthless. Here, the asset will cause the greatest number of holders’ financial losses.

Expiring Bitcoin Options. Source: Deribit

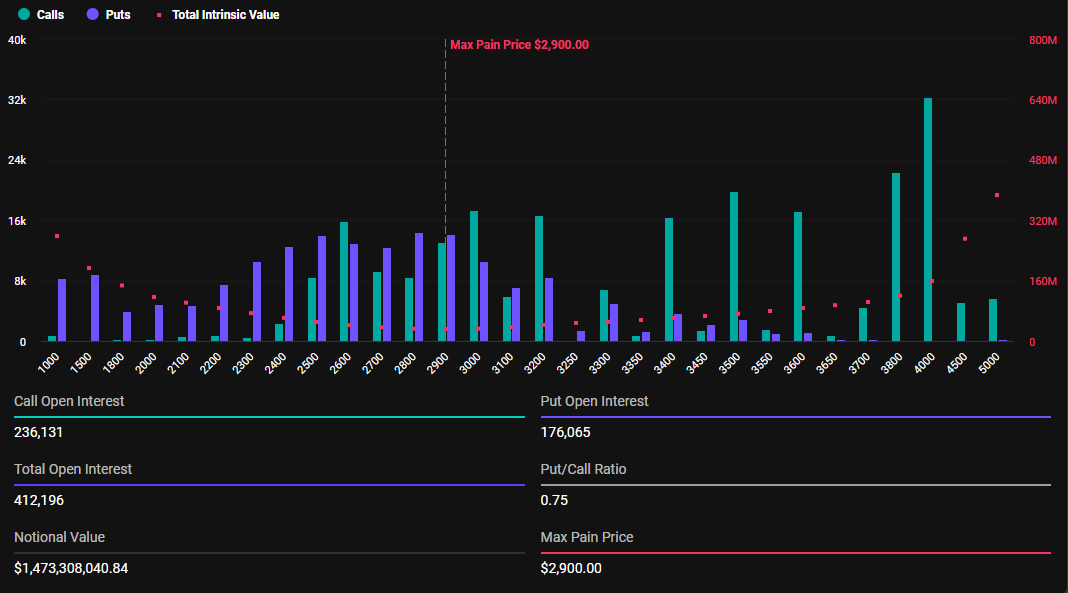

In addition to Bitcoin options, 412,116 Ethereum options contracts are set to expire today. These expiring options have a notional value of $1.47 billion and a put-to-call ratio of 0.75. The maximum pain point is $2,900.

Expiring Ethereum Options. Source: Deribit

The current market prices for Bitcoin and Ethereum are above their respective maximum pain points. BTC is trading at $96,353 while ETH sits at $3,573. This suggests that if the options were to expire at these levels, it would generally signify losses for options holders.

The outcome for options traders can vary significantly depending on the specific strike prices and positions they hold. To assess potential gains or losses at expiration accurately, traders must consider their entire options position, along with current market conditions.

Insights on Today’s Expiring BTC and ETH Options

Analysts at options trading tool provider Greeks.live reveal an interesting investor outlook that shows comprehensive evaluation is essential before drawing conclusions.

“We got an 11% pullback on BTC and people are saying the end is imminent. It was less than 10 days ago when the same people were asking for a pullback to buy,” they wrote.

Jeff Liang, CEO and co-founder of Greeks.live expresses optimism, saying that he is prepared to hold until the options expire at 8:00 UTC, Friday.

“Although the spread is significant, the offer implied volatility is on par with recent 1-month historical volatility, so it’s not overpriced. A 5% spot price increase can offset the spread. I’m prepared to hold until expiration. I bought a batch of call options last night, and the market has made some moves this morning,” Liang said.

Meanwhile, crypto markets remain subtly optimistic. In a statement shared with BeInCrypto, Bybit said the optimism could be attributed to hopeful investors’ expectation of a more crypto-friendly SEC Chair after Gary Gensler’s resignation.

Against this backdrop, Bybit also commented on the current market outlook, citing a correction in Bitcoin price and that expiring ETH options signal moderated bullish sentiment.

“BTC’s ebbing from the $100,000 mark has flattened the ATM volatility term structure, with short-tenor options dipping below 60%. This mirrors a pattern observed since the US election. Lower realized volatility explains the drop. While open interest in calls and puts remains unchanged, demands for short-term options this week have stagnated. ETH options show slightly more bullish sentiment than BTC options. Markets have recalibrated after the post-election high, but call options remain in the lead in both trading volumes and open interests,” Bybit added.

ATM IV refers to the implied volatility of an option contract whose strike price is equal to the current market price of the underlying asset. Analysts and traders often use this specific type of IV (implied volatility) to gauge market sentiment and volatility expectations for the underlying security.

Traders are therefore advised to remain cautious, as historically, options expiration often leads to short-term instability in the market. The weekend will also be crucial as it is often characterized by high volatility due to low trading volumes.

[ad_2]