[ad_1]

Friday has come around again and that means it is Bitcoin options contract expiry day. With the asset topping $50,000 this week, will the billion-dollar-plus notional value expiry push prices higher?

Around 21,150 Bitcoin options contracts will expire on February 16. This week’s expiry event is a little larger than last week’s, which was followed by BTC hitting a major strike price at $50,000.

Bitcoin Options Expiry

The notional value of this week’s big batch of Bitcoin contracts is $1.1 billion, according to Deribit. Moreover, the put/call ratio is 0.90, which means the sellers of long and short contracts are pretty evenly distributed.

The $50,000 strike price remains hugely significant, with 15,766 calls and a notional value of $822 million at this point. Additionally, the put/call ratio here is just 0.24, meaning the bulls vastly outnumber the bears who are shorting at this strike price.

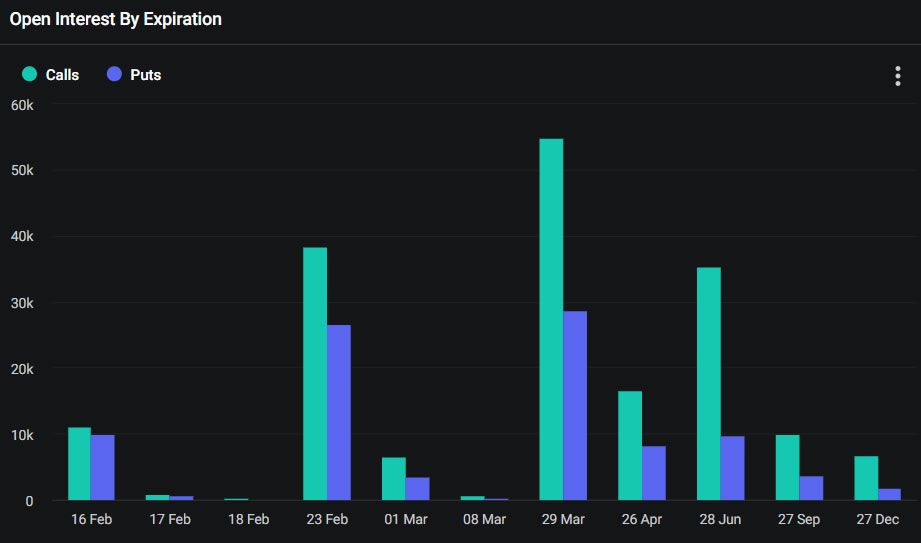

Bitcoin option OI by expiry. Source: Deribit

Interestingly, there is now a lot of open interest at much higher strike prices, namely $60,000, $65,000, and even $75,000. There is almost $2.4 billion in long-contract OI at strike prices between $60,000 and $75,000.

Vetle Lunde, senior analyst at K33 Research, told Bloomberg this week that:

“The options market at large is currently positioning for continued momentum in the coming months.”

Read more: How To Trade Bitcoin Futures and Options Like a Pro

He added that in the last week, flows have largely been directed towards bullish price action,

“With a lot of activity in far out of the money calls.”

Now that spot ETF fever has cooled off, Bitcoin momentum is being driven by the approaching halving and potential rate cuts. Nevertheless, inflows to spot BTC ETFs have reached a record aggregate of $4 billion, which includes the outflows from Grayscale.

Ethereum Contract Expiry

Around 198,700 Ethereum options contracts are also set to expire on February 16. These have a notional value of $565 million and a put/call ratio of 0.62.

Open interest is largest at the $3,000 strike price for ETH at $585 million and 205,000 calls. However, there is also a fair bit at the $2,400 strike price, with OI at $460 million.

Read more: An Introduction to Crypto Options Trading

Bitcoin prices were hovering just over $52,000 at the time of writing. Moreover, the asset hit a two-year high of $52,800 in late trading on February 15.

Ethereum was leading markets today with a 2.5% gain, taking it to $2,860, its highest price since May 2022.

Ethereum (ETH) price chart 1M. Source: BeInCrypto

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

[ad_2]